-Shekhar Tripathi

September 27, 2024

Introduction

With the U.S. Federal Reserve’s recent decision to cut interest rates by 50 basis points last week, lowering the federal funds rate to a range of 4.75% to 5%, investors are now considering the effects this policy shift will have on Real Estate Investment Trusts (REITs)(1). This marked the first rate cut in over four years, signaling that the central bank sees a need to reduce borrowing costs to support economic activity amid cooling inflation and potential labor market risks. For REIT investors, this change offers both opportunities and challenges. In this article, we will explore how interest rates, particularly the recent cuts, influence REIT performance, and provide strategies for navigating this evolving environment.

Source: Primior

Understanding the Relationship Between Interest Rates and REIT Performance

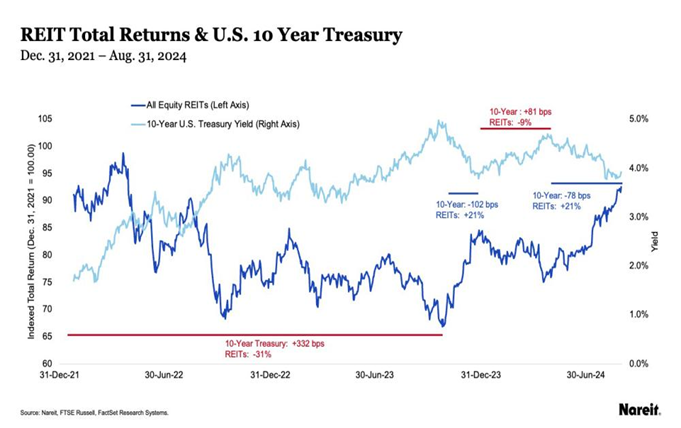

Interest rates are a significant driver of REIT performance. They impact REITs in two primary ways, borrowing costs and dividend attractiveness relative to other income-generating investments.

1. Borrowing Costs

REITs typically rely heavily on debt to finance their property acquisitions, developments, and operations. As interest rates fall, borrowing becomes cheaper, allowing REITs to expand more aggressively and refinance existing debt at more favorable terms. The recent 50-basis-point rate cut is expected to reduce financing costs for REITs, giving them greater flexibility in managing their portfolios.

For example, REITs that had previously issued debt during periods of higher interest rates may now look to refinance at lower rates, reducing their overall cost of capital. Lower borrowing costs could also encourage new property acquisitions and development projects, increasing potential returns for shareholders. However, it’s important to note that REITs with significant exposure to fixed-rate debt may not immediately benefit from rate cuts, as their debt is already locked in at higher rates(1).

2. Dividend Yield vs. Bond Yields

REITs are known for their reliable dividend payouts, making them attractive to income-seeking investors. In a high-interest-rate environment, bond yields rise, making fixed-income securities more appealing relative to REIT dividends. However, with the Fed’s recent rate cut, bond yields are expected to decline, making REIT dividends relatively more attractive by comparison(2). This dynamic may lead to increased demand for REIT stocks, driving up share prices and benefiting investors.

The Impact of Rising Interest Rates on REITs

While falling interest rates are generally positive for REITs, rising rates can present challenges. Over the past several years, REITs faced rising interest rates, which increased their borrowing costs and put pressure on their profitability.

● Residential and Mortgage REITs

Mortgage REITs (mREITs), which invest in mortgage-backed securities, are particularly sensitive to rising rates. These REITs borrow short-term funds at lower rates and invest in longer-term mortgages with higher yields. When interest rates rise, the cost of short-term borrowing increases faster than the returns on long-term mortgages, compressing profit margins(2).

Residential REITs, which focus on rental properties, are more resilient in rising rate environments, especially in high-demand areas where rents can be increased to offset higher borrowing costs. For instance, residential REITs in urban centers like New York and San Francisco have historically managed to pass on higher costs to tenants through rent increases, which helps stabilize cash flows(1).

● Commercial and Industrial REITs

Commercial REITs, such as those in retail, office, and industrial spaces, face a mixed impact from rising rates. Higher borrowing costs make it more expensive to finance new acquisitions and developments, but many commercial REITs are protected by long-term leases with tenants that include rent escalations tied to inflation. In sectors like industrial REITs, which benefit from the continued growth of e-commerce, the demand for warehouse and logistics spaces remains high, providing stability even during periods of rising rates(3).

REIT Performance in Falling Interest Rate Environments

Falling interest rates, like the recent Federal Reserve rate cut, generally have a positive impact on REIT performance. Lower rates reduce the cost of borrowing for REITs, which makes it easier for them to refinance debt, expand their portfolios, and undertake new developments. The recent cut, which lowered the federal funds rate to a range of 4.75% to 5%, is expected to ease capital costs and spur growth for REITs across various sectors(1)(4).

Opportunities from the Recent Fed Rate Cut

This rate cut is particularly important for REIT investors as it signals the beginning of a more accommodative monetary policy. The Fed’s decision was driven by declining inflation and concerns over potential slowdowns in hiring(1). With further rate cuts expected, REITs stand to benefit from lower interest expenses, which improves profitability and potentially boosts share prices.

- Commercial REITs: Commercial and industrial REITs, which are heavily dependent on debt financing for growth, will likely experience a resurgence as borrowing becomes more affordable. This creates opportunities for REITs to acquire properties or refinance existing loans at lower interest rates, improving their balance sheets and increasing their capacity for expansion(6).

- Mortgage REITs: Mortgage REITs, which saw profitability squeezed during periods of rising rates, stand to benefit greatly from lower interest rates. A lower cost of borrowing allows them to maintain better profit margins on their mortgage investments, and the possibility of further rate cuts may improve conditions in the housing and lending markets(6).

- Residential REITs: Residential REITs, which have a robust presence in major urban centers, are also well-positioned to benefit. As mortgage rates fall, homebuyers who were previously priced out of the market may re-enter, which can stabilize the demand for rental properties, a key component of residential REITs’ revenue streams.

How Investors Can Navigate Changing Interest Rates

Investing in REITs during periods of fluctuating interest rates requires a nuanced approach. By understanding how interest rate changes impact different types of REITs, investors can make informed decisions about where to allocate their resources.

● Focus on Debt Structure

REITs that maintain a higher proportion of long-term, fixed-rate debt are generally more insulated from rising interest rates. These REITs benefit from predictable interest expenses and are less exposed to fluctuations in short-term borrowing costs. According to Cohen & Steers, fixed-rate debt has been a key factor in protecting certain REITs from the negative effects of rising rates in previous cycles(4).

Conversely, REITs that rely heavily on floating-rate debt are more vulnerable to rate increases. Investors should scrutinize a REIT’s debt profile before making decisions, focusing on its proportion of fixed versus variable debt.

● Diversify Across Sectors

Different REIT sectors are impacted differently by interest rate changes. For example, industrial REITs, which are bolstered by e-commerce and the need for warehouse space, tend to perform well regardless of interest rate movements due to the consistent demand for logistics facilities. Meanwhile, retail REITs, particularly those in traditional brick-and-mortar retail spaces, may face greater challenges in an environment of rising rates(4).

● Stay Informed About Macroeconomic Trends

The recent Fed rate cut signals a shift in monetary policy, and investors need to remain alert to macroeconomic indicators such as inflation, GDP growth, and employment rates. For instance, although lower rates tend to benefit REITs by reducing borrowing costs, they can also be a sign of economic slowdown, which might negatively affect property values and rental incomes(3). Balancing exposure across different types of REITs—residential, commercial, industrial, and mortgage—can help mitigate these risks.

The impact of interest rates on REITs is multifaceted and varies depending on the type of REIT, its debt structure, and broader economic conditions. While rising interest rates present challenges by increasing borrowing costs and making REIT dividends less attractive, falling rates like the recent 50-basis-point cut by the Fed can provide a significant boost to REIT performance by lowering capital costs and making their dividend yields more appealing to income-seeking investors. By understanding these dynamics and carefully selecting REITs with strong fundamentals, investors can successfully navigate interest rate fluctuations and enhance their portfolios.

Sortis REIT: The Sortis Advantage

One compelling option for Private REIT investors is the Sortis REIT (S-REIT). Sortis REIT stands out for several key reasons. It’s tailored for Accredited Investors, requiring a minimum investment of $25,000. Investors enjoy quarterly distributions, providing a steady income stream. Redemption is possible after 6 months, with caps of 2% quarterly and 5% annually, subject to fund availability and advisor discretion. The REIT’s impressive maximum offering is set at $1 billion, showcasing its scale and potential. Management charges are transparent at 1.25% of Net Asset Value (NAV), with a profit-sharing mechanism ensuring further transparency.

Sortis REIT focuses on acquiring stabilized or readily stabilized real estate assets, prioritizing off-market transactions. Deal sizes range from $2 million to $20 million to stay competitive. Supported by Sortis Holdings, Inc., they enhance acquisitions through curated retail experiences. Asset classes include multifamily, hotel, retail, office, light industrial, and life science properties.

The REIT’s approach, led by individuals with proven investment management expertise, identifies opportunities for strong risk-adjusted returns. Focused on the Western States, they capitalize on localized expertise. As a boutique-sized fund, Sortis REIT maintains flexibility in the market, avoiding forced investments. Their diverse relationships facilitate unique access to deals, and staff members’ personal investments align their interests with investors. Learn more about Sortis REIT here.

References:

- Fox Business. (2024). Federal Reserve cuts interest rates for the first time in 4 years.

https://www.jchs.harvard.edu/americas-rental-housing-2024 - Seeking Alpha. (2024). Fed Meeting September 2024: Interest Rates Cut By 50 Basis Points

https://seekingalpha.com/article/4722008-fed-meeting-september-2024-interest-rates-cut-by-50-basis-points - Investopedia. (2024). How Federal Reserve Interest Rate Cuts Affect Consumers.

https://www.investopedia.com/articles/economics/08/interest-rate-affecting-consumers.asp - Morningstar. (2024). Following Two Years of Rising Interest Rates, We Believe REITs Are Trading at Significant Discounts

https://www.morningstar.com/company-reports/1215047-following-two-years-of-rising-interest-rates-we-believe-reits-are-trading-at-significant-discounts - Trading Economics. (2024). United States Fed Funds Interest Rate

https://tradingeconomics.com/united-states/interest-rate - NAREIT. (2024). Fed Rate Cut Bodes Well for REITs

https://www.reit.com/news/articles/fed-rate-cut-bodes-well-for-reits