-Shekhar Tripathi

September 13, 2024

Introduction

The global focus on sustainability has triggered a profound transformation across various industries, and real estate is no exception. Environmental, Social, and Governance (ESG) principles have emerged as powerful drivers of change within Real Estate Investment Trusts (REITs), influencing how they operate, invest, and create value. Investors are increasingly recognizing ESG’s role not just as a risk management tool but as a mechanism for long-term value creation. This article delves into how ESG practices are reshaping the REIT landscape, focusing on the benefits, challenges, and future potential of ESG integration in real estate investment.

Source: US LED Blog

The Growing Influence of ESG in Real Estate

The demand for ESG considerations in real estate has been driven by a combination of regulatory pressures, investor preferences, and tenant expectations. Real estate is responsible for approximately 40% of global carbon emissions(1), making it a prime target for sustainability initiatives. Investors and asset managers are now prioritizing ESG compliance to mitigate climate risks and address social and governance issues.

● Environmental Factors

REITs are increasingly focusing on reducing their environmental impact by adopting energy-efficient technologies, renewable energy sources, and sustainable building materials. The global trend towards decarbonization has seen REITs integrate renewable energy into their portfolios, with many striving to achieve net-zero emissions by 2050(2). For instance, major REITs like Kilroy Realty Corporation are leading the charge by incorporating solar energy and energy-efficient infrastructure into their properties, reducing their carbon footprints and enhancing asset values(3).

● Social Responsibility

Social considerations in ESG include enhancing tenant well-being, promoting diversity and inclusion, and engaging with local communities. REITs are increasingly investing in wellness-focused properties that prioritize tenant health through improved air quality, access to green spaces, and wellness amenities. For example, WELL and Fitwel certifications have been growing in popularity as they ensure that properties meet health and wellness standards(4). Additionally, affordable housing initiatives have become central to many REITs’ social strategies, helping address critical housing shortages in urban areas.

● Governance

Good governance remains a key pillar of ESG, ensuring transparency, accountability, and ethical business practices. REITs with robust governance frameworks tend to outperform their peers by attracting long-term investors who value ethical management and board diversity(5). REITs that publish comprehensive ESG reports, disclosing their environmental and social initiatives, also demonstrate a commitment to transparency, a factor that is increasingly important for institutional investors.

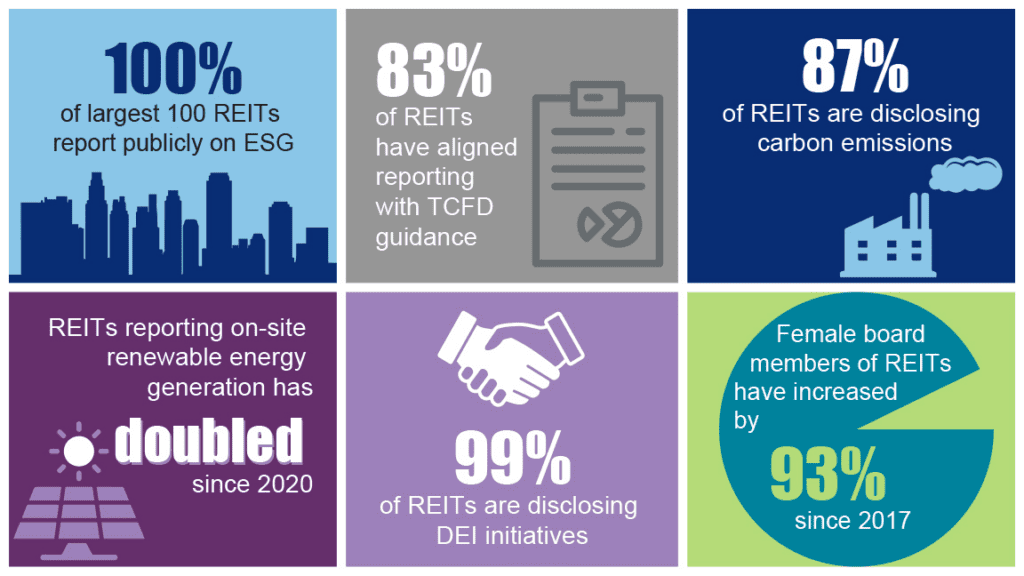

Source: NAREIT

ESG as a Value Driver for REIT Investors

For investors, ESG is no longer a niche concern but a key factor that enhances both risk mitigation and long-term returns. Studies have shown that companies, including REITs, with strong ESG scores tend to outperform those that lag behind. Deloitte’s 2024 report indicates that green-certified properties command higher rents and have lower vacancy rates than non-certified counterparts(6). Green buildings, such as those certified under LEED or BREEAM, are not only more attractive to tenants but also reduce operational costs through lower energy consumption and maintenance requirements.

● Sustainable Construction and Green Buildings

REITs are increasingly integrating sustainable building materials into their portfolios to reduce the environmental impact of their developments. Sustainable timber, green steel, and low-carbon concrete are becoming more common in commercial real estate as developers look to reduce the carbon footprint of construction(6). Green buildings also generate higher returns for REITs, with properties that meet high environmental standards often commanding higher rents and offering better tenant retention rates (74).

● Green Financing

The growing trend of green bonds and sustainability-linked loans has made it easier for REITs to access favorable financing terms. REITs that focus on ESG are able to attract more capital from institutional investors who prioritize sustainable investments. For instance, REITs with higher ESG scores are often seen as less risky, allowing them to secure financing at lower interest rates and improve their credit ratings(3).

ESG Trends Shaping the Future of Real Estate

As ESG becomes more mainstream, several key trends are shaping the real estate landscape:

● The Rise of Green Leases

Green leases, which include provisions for tenants and landlords to work together on reducing energy usage and improving environmental performance, are becoming increasingly popular. These leases ensure that both parties are aligned in their sustainability goals, driving greater collaboration on energy efficiency, waste management, and water conservation(6).

● Focus on Retrofitting Existing Buildings

Retrofitting existing properties to meet ESG standards is becoming a critical focus for REITs. Most of the buildings we see today will still be standing in 2050, but many are not compliant with modern energy-efficiency standards(6). Retrofitting these structures to meet ESG goals offers significant opportunities for REITs to add value while also meeting regulatory requirements.

● ESG Data and Benchmarking

Accurate and transparent ESG reporting is essential for investors who are increasingly demanding access to ESG performance data. REITs are using benchmarks like GRESB (Global Real Estate Sustainability Benchmark) to measure their performance and improve transparency(5). Additionally, tenants are seeking data on building energy use, carbon emissions, and sustainability practices, pushing REITs to be more accountable and data-driven in their ESG strategies.

● Technological Innovation

Technology is playing a crucial role in advancing ESG goals within real estate. The rise of smart building technologies, such as IoT-enabled devices for energy management and predictive maintenance, is helping REITs reduce their environmental impact while also lowering operational costs. These technologies allow for real-time monitoring of energy consumption and carbon emissions, ensuring that buildings operate at peak efficiency(7).

Challenges and Risks Associated with ESG in Real Estate

Despite the numerous benefits, there are challenges and risks associated with ESG integration. One significant challenge is the upfront cost of retrofitting older buildings to meet modern ESG standards. These projects require significant capital investments, which can strain REITs’ budgets. However, the long-term benefits in terms of reduced operating costs and increased asset values often outweigh the initial expenses(6).

Additionally, as the demand for ESG reporting grows, some REITs face difficulties in collecting and verifying accurate data, especially from older properties or smaller assets that may not have advanced monitoring systems in place. Moreover, as the regulatory environment becomes more stringent, REITs that fail to comply with evolving ESG standards may face financial penalties or reputational risks(7).

The Future of ESG in Real Estate

Looking ahead, ESG will continue to be a significant driver of change within the real estate sector. Investors are expected to increasingly prioritize sustainable assets, and REITs that fail to adapt may struggle to attract capital. The next decade will likely see further innovation in green technologies, as well as more stringent regulations that push the real estate industry to meet ambitious carbon-reduction targets.

The real estate industry is also likely to see the continued rise of impact investing, where investors seek measurable social and environmental outcomes in addition to financial returns. REITs that align themselves with ESG goals will not only create long-term value for their investors but also contribute to a more sustainable and equitable future.

Sortis REIT: The Sortis Advantage

One compelling option for Private REIT investors is the Sortis REIT (S-REIT). Sortis REIT stands out for several key reasons. It’s tailored for Accredited Investors, requiring a minimum investment of $25,000. Investors enjoy quarterly distributions, providing a steady income stream. Redemption is possible after 6 months, with caps of 2% quarterly and 5% annually, subject to fund availability and advisor discretion. The REIT’s impressive maximum offering is set at $1 billion, showcasing its scale and potential. Management charges are transparent at 1.25% of Net Asset Value (NAV), with a profit-sharing mechanism ensuring further transparency.

Sortis REIT focuses on acquiring stabilized or readily stabilized real estate assets, prioritizing off-market transactions. Deal sizes range from $2 million to $20 million to stay competitive. Supported by Sortis Holdings, Inc., they enhance acquisitions through curated retail experiences. Asset classes include multifamily, hotel, retail, office, light industrial, and life science properties.

The REIT’s approach, led by individuals with proven investment management expertise, identifies opportunities for strong risk-adjusted returns. Focused on the Western States, they capitalize on localized expertise. As a boutique-sized fund, Sortis REIT maintains flexibility in the market, avoiding forced investments. Their diverse relationships facilitate unique access to deals, and staff members’ personal investments align their interests with investors. Learn more about Sortis REIT here.

References:

[1] United Nations Environment Programme. (2022). 40% of Emissions Come From Real Estate.

[2] Gowling WLG. (2024). Top 10 ESG trends impacting real estate in 2024.

[3] Kilroy Reality. (2024). 2023 Sustainability Report.

[4] Nareit. (2022). Fitwel Adds a New Element to the Building Certification Landscape

https://www.reit.com/news/reit-magazine/september-october-2022/fitwel-adds-new-element-building-certification-landscape

[5] The Journal of Real Estate Finance and Economics. (2022). Does Investing in ESG Pay Off? Evidence from REITs.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4147749

[6] Deloitte Global. (2024). 2024 ESG in Real Estate Insights.

https://www.deloitte.com/global/en/Industries/real-estate/research/esg-real-estate-insights.html

[7] Grant Thornton. (2021). ESG goes mainstream for real estate.

https://www.grantthornton.com/insights/articles/real-estate/2021/esg-goes-mainstream-for-real-estate