– Vatsal Rai

July 15, 2024

Introduction

Commercial real estate, a diverse and ever-evolving sector that includes office buildings, warehouses, and retail spaces, hinges on a complex interplay of risk and reward. Central to this balance are interest rates, which significantly impact investment decisions and the broader market dynamics. Lowering interest rates can set off a chain reaction, enhancing the appeal of commercial real estate to investors. By understanding how these lower rates create opportunities, we can gain insights into the potential benefits and strategies within the commercial real estate market.

Interest rate cuts are more than just financial adjustments; they are catalysts that can transform the investment landscape. When borrowing costs decrease, financing becomes more accessible and affordable, encouraging more investments in commercial properties. This influx of capital can stimulate market activity, drive property values, and create a favorable environment for growth. In the following sections, we will explore the specifics of how reduced interest rates can open new doors for investors and shape the future of the commercial real estate industry.

CRE Industry Outlook

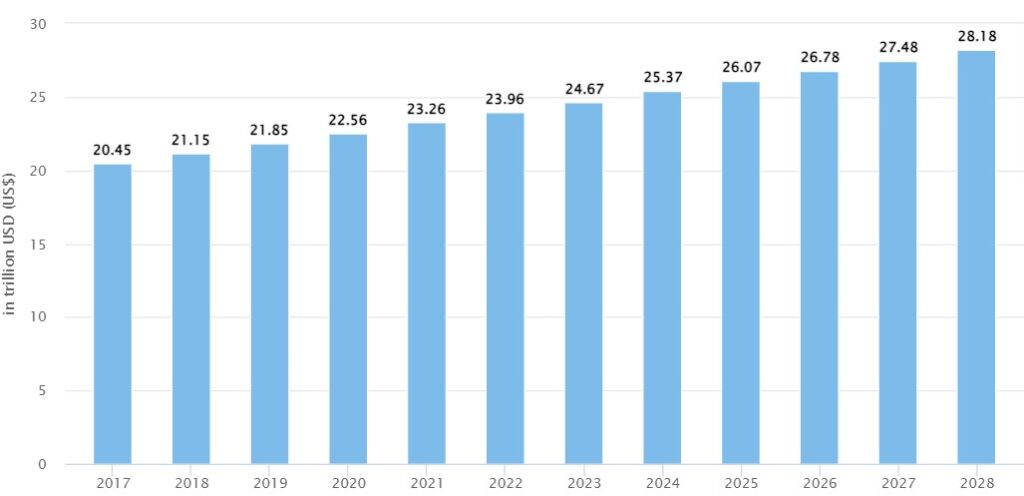

The U.S. commercial real estate market is projected to soar to $25.37 trillion by 2024. With an annual growth rate (CAGR 2024-2028) of 2.66%, the market is expected to reach $28.18 trillion by 2028.[4] Compared to other countries, the U.S. is set to lead the global real estate sector with this valuation. The demand for flexible office spaces is increasing, driven by the rise of remote work and the need for adaptable environments. The U.S. commercial real estate market is shaped by local factors like population growth and urbanization. As individuals migrate to cities for employment, the need for urban commercial properties rises. Furthermore, the diverse American economy, with its various industries, creates region-specific demand for commercial real estate. For instance, tech companies boost the need for office spaces in San Francisco and Seattle, whereas the healthcare sector increases the demand for medical offices in New York and Boston

Fig. 1 – Size of the US CRE market[4]

In 2023, the commercial real estate sector experienced a significant decline, with property values plummeting by $590 billion. Projections for 2024 remain grim, with Capital Economics forecasting an additional $480 billion drop.[5]

Reports from firms such as EY and CBRE concur that the primary driver behind this downturn is the rise in interest rates. This increase is attributed to both tighter regulatory measures and more stringent credit standards. Despite this, there is a silver lining. The expectation of decreasing interest rates offers a glimmer of hope for the commercial real estate market’s recovery.

Likelihood of cutting interest rates

Traders are now completely convinced that the Federal Reserve will cut interest rates by September. According to the CME FedWatch tool, there’s a 93.3% chance that the Fed’s target range for the federal funds rate will drop by a quarter percentage point to 5% to 5.25% in September, down from the current 5.25% to 5.50%.[2] Additionally, there’s a 6.7% chance the rate could be reduced by half a percentage point, suggesting that some traders expect the central bank to cut rates both at the end of July and again in September. This leads to a total certainty of 100%. The catalyst for this shift in expectations was the consumer price index update for June, which revealed a 0.1% decrease from the previous month, bringing the annual inflation rate to 3%, the lowest in three years. A month ago, the odds of a rate cut in September were about 70%.[3]

The CME FedWatch Tool calculates these probabilities based on trading in fed funds futures contracts at the exchange, reflecting where traders are placing their bets. While the actual probability of rates remaining unchanged in September isn’t zero, it indicates that no traders are willing to bet on it. Recent comments from Fed Chairman Jerome Powell have reinforced traders’ belief in a rate cut by September. Powell stated that the Fed wouldn’t wait for inflation to reach its 2% target before cutting rates, due to the lag effects of tightening. The Fed is seeking “greater confidence” that inflation will return to the 2% level, he said, adding that recent positive inflation data is bolstering this confidence.[2]

The Power of Leverage: Lower Borrowing Costs

One of the major benefits of interest rate cuts for commercial real estate is in the area of financing. Reduced interest rates lead to lower borrowing costs, enabling investors to obtain loans for purchasing or developing properties at more favorable rates. This significantly decreases the ongoing costs associated with servicing debt. As a result, the net operating income (NOI) of commercial properties, which is crucial for their financial health, sees an improvement.

To illustrate, imagine an investor planning to buy an office building. In a high-interest rate environment, a large portion of the rental income would be consumed by monthly loan payments. However, when interest rates drop, these payments decrease, allowing the investor to retain a larger share of the rental income as profit. This enhanced profitability makes the investment more attractive and stimulates more activity in the commercial real estate market.

From this, we can infer that lower interest rates not only improve individual investment profitability but also have a broader positive impact on market dynamics by encouraging increased investment and development activities. This cycle can lead to more robust growth in the commercial real estate sector, as more investors are able to enter the market and existing investors can expand their portfolios more easily.

Enhanced Cash Flow and Return on Investment (ROI)

Lower interest rates lead to decreased borrowing costs, which not only enhance a property’s Net Operating Income (NOI) but also boost the return on investment (ROI) for investors. Capitalization rates (cap rates) measure the rate of return on a commercial property investment, calculated by dividing the property’s NOI by its current market value. With lower interest rates, cap rates tend to decrease. This means the property yields a higher ROI at a reduced market value, making it more appealing to investors looking for substantial returns. Additionally, lower interest rates drive up commercial property values. Cheaper financing increases the pool of potential buyers, heightening demand for properties. As demand rises, so do property prices, enhancing investor returns upon sale.

Lower borrowing costs and compressed cap rates make properties more attractive, encouraging more investments in the market. Increased demand due to accessible financing can create a competitive market, driving up property values. Investors benefit not only from improved ROI during the holding period but also from significant capital appreciation when they sell the property. This further helps in the following:

Enhanced Investor Appeal: The reduction in borrowing costs makes it easier for investors to finance purchases, making real estate investments more attractive. This encourages a higher volume of investments in the market, fostering growth and competition.

Market Dynamics: As financing becomes more accessible due to lower interest rates, a larger number of potential buyers enter the market. This increased demand can lead to a more competitive market, with properties selling faster and at higher prices.

Long-Term Gains: Investors not only benefit from an improved ROI while holding the property but also stand to gain significantly from capital appreciation upon sale. This dual advantage makes real estate a highly lucrative investment during periods of low interest rates.

Economic Impacts: The increase in property values can have broader economic implications. As property prices rise, local tax revenues can increase, providing more funds for community services and infrastructure. Additionally, higher property values can lead to greater equity for property owners, contributing to overall economic stability and growth.

Investment Strategy Adjustments: Investors may adjust their strategies in response to lower interest rates, seeking to capitalize on the favorable conditions. This could include acquiring more properties, investing in higher-value properties, or diversifying their portfolios to include different types of real estate assets.

Affect on CRE Financial Performance

One advantage of investing in commercial real estate is leveraging positive differences. For instance, if you purchase a property with a 6% capitalization rate and finance it at 3.5%, the spread between these rates results in a 2.5% yield. Consider a property valued at $1 million with a net operating income (NOI) of $60,000, giving it a cap rate of 6% ($60,000 NOI / $1 million market value). If the annual financing cost is $35,000, the net cash flow (NCF) would be $25,000, resulting in a 2.5% yield ($25,000 NCF / $1 million market value).[1]

Additional benefits of real estate investment, not captured by this 2.5% yield, include property depreciation and potential market value appreciation. Even excluding these factors, the 2.5% yield surpasses the current 10-year Treasury yield of 1.5%.[1]

Strategic Acquisitions and Development Opportunities

Lower interest rates offer a strategic opportunity for experienced investors to seize potential acquisitions and development projects. Here are the key ways they can benefit:

Discounted Property Acquisitions: When interest rates decline, commercial property values may temporarily drop. Astute investors can take advantage of this situation by purchasing properties at reduced prices, which can pave the way for substantial long-term returns. This period of lower interest rates can thus be a prime time for acquiring valuable assets at a bargain.

Financing Development Projects: Reduced borrowing costs enhance the feasibility of financing new construction projects. This is particularly advantageous for developing property types that are in high demand, such as warehouses in e-commerce centers. As a result, lower interest rates can lead to an uptick in development activity, meeting market needs and potentially offering lucrative returns on investment.

Increased Market Activity: With the prospect of discounted acquisitions and cheaper financing, there is likely to be a surge in market transactions. Investors might act quickly to secure properties before rates rise again, leading to a more dynamic and competitive market environment.

Long-term Strategic Positioning: Acquiring properties at lower costs during periods of reduced interest rates allows investors to enhance their portfolios and strategically position themselves for future market appreciations. This approach can provide a buffer against market volatility and ensure steady income streams.

Economic Growth Stimulation: An increase in development projects spurred by lower borrowing costs can contribute to broader economic growth. As new constructions rise, they create jobs, boost local economies, and meet increasing consumer demands, particularly in high-demand sectors like e-commerce.

Diversification Opportunities: Investors might also see this as a chance to diversify their portfolios. By acquiring different types of properties or embarking on varied development projects, they can spread risk and potentially increase overall returns.

Timing and Market Cycles: Understanding the timing of interest rate changes and market cycles becomes crucial. Investors who can accurately predict or respond to these fluctuations stand to gain the most, highlighting the importance of market analysis and strategic planning in investment decisions.

Conclusion

The potential for interest rate cuts in the commercial real estate (CRE) sector presents a landscape rich with opportunities for investors and developers alike. As the Federal Reserve signals a high likelihood of rate cuts in the near future, the CRE market stands poised for significant transformation and growth.

Lower interest rates are set to catalyze a chain of positive effects throughout the industry. Primarily, they will lead to reduced borrowing costs, making property acquisitions and development projects more financially viable. This increased affordability is likely to stimulate market activity, attracting a broader pool of investors and potentially driving up property values. The enhanced cash flow and improved return on investment (ROI) resulting from lower debt servicing costs will make CRE investments increasingly attractive, particularly when compared to other investment vehicles like Treasury bonds.

Moreover, the timing of these potential rate cuts coincides with a period of recovery for the CRE market. Following a significant downturn in recent years, where property values experienced substantial declines, the prospect of lower interest rates offers a much-needed boost to the sector. This environment creates strategic opportunities for experienced investors to acquire properties at discounted prices and initiate development projects in high-demand areas, positioning themselves advantageously for future market appreciation.

However, it’s crucial to note that while lower interest rates present numerous opportunities, they also bring challenges and potential risks. Increased competition in the market may lead to inflated property prices, and there’s always the possibility of over-leveraging in a low-interest-rate environment. Therefore, investors and developers must approach these opportunities with careful analysis and strategic planning.

Looking ahead, the CRE market is projected to grow steadily over the coming years. This growth, coupled with evolving trends such as the demand for flexible office spaces and region-specific property needs, suggests a dynamic and evolving CRE landscape. As interest rates potentially decrease, those who can navigate this changing environment with insight and agility stand to benefit significantly from the opportunities that arise.

In conclusion, while challenges remain, the prospect of interest rate cuts heralds a period of potential growth and transformation for the commercial real estate sector, offering a wealth of opportunities for those prepared to capitalize on them.

References

[1] “How Interest Rate Drops Could Affect Commercial Real Estate Investing.” 2022. RealtyMogul. July 8, 2022. https://www.realtymogul.com/knowledge-center/article/how-interest-rate-drops-affect-commercial-real-estate-investing.

[2] Melloy, John. 2024. “Traders See the Odds of a Fed Rate Cut by September at 100%.” CNBC. July 16, 2024. https://www.cnbc.com/2024/07/16/traders-see-the-odds-of-a-fed-rate-cut-by-september-at-100percent.html.

[3] “Traders Pricing in 100% Chance Fed Will Cut Interest Rates in September.” n.d. Investopedia. Accessed July 17, 2024. https://www.investopedia.com/traders-expect-fed-interest-rate-cut-september-8678517.

[4] “Commercial Real Estate – US | Statista Market Forecast.” n.d. Statista. Accessed July 17, 2024. https://www.statista.com/outlook/fmo/real-estate/commercial-real-estate/united-states#analyst-opinion.

[5] “What Will Commercial Real Estate Look like in 2030?” n.d. Www.netguru.com. https://www.netguru.com/blog/commercial-real-estate-in-2030.