-Shekhar Tripathi

September 5, 2024

Introduction

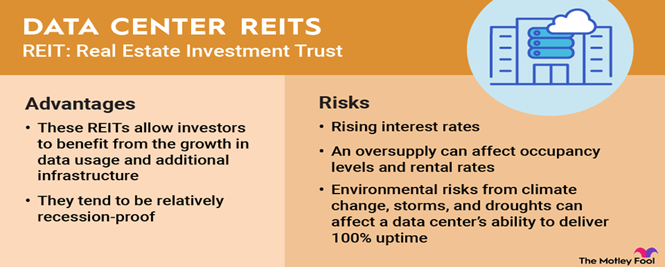

The explosion of digital data is reshaping industries worldwide, and the backbone of this transformation is the humble yet essential data center. Data centers are critical infrastructure for storing, processing, and managing the vast amounts of data generated by our increasingly connected world. As more businesses and consumers rely on digital services—from e-commerce and cloud computing to artificial intelligence and 5G technology—the demand for data centers is skyrocketing. This is where Real Estate Investment Trusts (REITs) specializing in data centers come into play.

Data center REITs offer a unique opportunity for investors looking to capitalize on the rapid growth in digital infrastructure. Unlike traditional real estate sectors, data centers present a combination of long-term leases, high barriers to entry, and stable cash flows, making them particularly appealing in today’s market. With data center usage expected to increase exponentially, driven by technological advancements and shifts in global business operations, REITs in this space are poised for continued expansion. This article explores the key drivers behind the booming data center market, how REITs are leveraging this growth, and the opportunities available for investors in this high-potential sector.

Source: The Motley Fool

Understanding the Data Center Boom: What’s Driving Demand?

Data centers are physical facilities that house servers, networking equipment, and other infrastructure essential for cloud computing, storage, and data management. The global shift toward digital operations has led to skyrocketing demand for data centers, which are becoming indispensable for businesses across sectors. Below are some of the major drivers contributing to this growth.

● Rise of Cloud Computing and Big Data

Cloud computing services provided by companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are leading the charge in digital transformation. Cloud computing allows businesses to store data remotely and scale operations without investing in their own infrastructure. According to a report from Grand View Research, the global cloud computing market is projected to grow at a compound annual growth rate (CAGR) of 14.1% from 2021 to 2028, reaching $1.25 trillion(1). As more businesses shift to cloud-based platforms, the demand for data centers—both large centralized ones and smaller edge data centers—is growing exponentially.

Big Data analytics is another major factor driving data center demand. With businesses collecting vast amounts of information for predictive analytics, customer insights, and operational optimization, the need for data storage and processing capabilities is increasing. Data centers provide the secure, scalable environments required for processing these large datasets.

● 5G Networks and the Internet of Things (IoT)

The rollout of 5G networks is expected to further boost data center demand. 5G technology allows for faster data transmission and lower latency, which is crucial for applications like autonomous vehicles, smart cities, and IoT devices. As more IoT devices come online—ranging from smart home appliances to industrial sensors—there will be a need for more local, distributed data centers that can handle the increased data traffic.

The IoT market is set to expand dramatically, with forecasts predicting that there will be over 25 billion connected devices by 2030(2). These devices will generate massive amounts of data that need to be processed in real-time, further driving demand for data center infrastructure.

● Shift Toward Remote Work and Digital Services

The COVID-19 pandemic has accelerated the adoption of remote work and digital services, from e-commerce to telehealth. This shift has placed additional strain on the digital infrastructure, as businesses scramble to accommodate distributed workforces and meet rising consumer demand for online services. Video conferencing platforms like Zoom and Microsoft Teams, as well as entertainment services like Netflix and YouTube, are heavily reliant on data centers to ensure smooth, uninterrupted service.

A report by Synergy Research Group found that global spending on cloud infrastructure services grew by 35% in 2020 alone(3). As businesses adjust to the “new normal,” data centers will continue to play a crucial role in maintaining the backbone of these digital operations.

How Data Center REITs Capitalize on This Demand

Data center REITs have emerged as key players in meeting the growing demand for digital infrastructure. These REITs own and operate data center facilities that they lease to companies in need of secure and scalable data storage and processing solutions. By investing in data center REITs, investors can gain exposure to this high-growth sector without directly managing physical assets.

● Leading Data Center REITs

Some of the most prominent data center REITs in the market include:

- Equinix: One of the largest data center REITs globally, Equinix operates more than 220 data centers across 26 countries. The company focuses on providing interconnection services, which enable businesses to securely exchange data across different networks and cloud providers.

- Digital Realty Trust: With a portfolio of over 290 data centers in North America, Europe, Asia, and Australia, Digital Realty is a leading global provider of data center solutions. The company is focused on expanding its presence in strategic markets to capitalize on growing data needs.

- CyrusOne: Specializing in colocation and interconnection services, CyrusOne operates more than 50 data centers worldwide, serving over 1,000 customers, including many Fortune 1000 companies.

These REITs offer investors an opportunity to participate in the rapid expansion of data centers while benefiting from the stability of long-term leases and high occupancy rates.

● Investment Appeal of Data Center REITs

Data center REITs present several advantages for investors:

- Long-term Leases with Reliable Cash Flows: Most data center leases are long-term agreements with large corporations or cloud service providers. This provides REITs with stable, predictable cash flows. Additionally, data centers typically have high occupancy rates due to the critical nature of their services.

- High Barriers to Entry: Developing and maintaining data centers requires substantial capital investment, technical expertise, and regulatory compliance. These barriers to entry help protect existing data center operators from new competition, creating a favorable environment for established REITs.

- Scalability and Growth Potential: As demand for data storage and processing grows, data center REITs are well-positioned to expand their portfolios by acquiring new assets or developing additional facilities. For example, Digital Realty Trust’s acquisition of Interxion for $8.4 billion in 2020 significantly expanded its reach in Europe, one of the fastest-growing data center markets(4).

● Edge Data Centers: A New Frontier

Edge computing is a relatively new trend that involves processing data closer to its source to reduce latency and improve performance. As IoT devices and autonomous systems generate vast amounts of real-time data, the demand for edge data centers—smaller facilities located near population centers—is increasing. Data center REITs are beginning to invest in these edge facilities to capture the growing need for low-latency data processing.

This trend offers significant growth potential for data center REITs, as businesses increasingly require distributed infrastructure to support real-time applications such as smart cities, autonomous vehicles, and industrial automation.

● The Role of Sustainability in Data Centers

Data centers are notoriously energy-intensive, consuming vast amounts of electricity to power servers and maintain optimal temperatures. As environmental concerns grow, data center REITs are under increasing pressure to reduce their carbon footprints. This has led to a significant focus on sustainability within the sector, with many REITs adopting renewable energy sources and energy-efficient technologies to address these challenges.

For example, Digital Realty Trust has pledged to achieve 100% renewable energy across all its data centers by 2030, part of its broader sustainability strategy(5). Likewise, Equinix has committed to reaching climate neutrality through the use of green energy and the implementation of energy-efficient technologies in its facilities(6).

Sustainability is not just a regulatory or reputational issue; it also makes economic sense. By reducing energy consumption, data center REITs can lower operating costs and pass those savings on to tenants. Moreover, sustainability initiatives appeal to environmentally conscious investors, making data center REITs an attractive option for those prioritizing ESG (Environmental, Social, and Governance) considerations in their portfolios.

● Geographic Diversification and Global Expansion

The demand for data centers is not confined to any one region. As digital transformation spreads worldwide, data center REITs are increasingly expanding their footprints beyond the U.S. market to capitalize on international growth opportunities.

Regions such as Europe, the Asia-Pacific, and Latin America are seeing significant investments in digital infrastructure. For instance, the European data center market is projected to grow at a CAGR of 5% between 2021 and 2026, fueled by increasing demand for cloud services, 5G adoption, and IoT expansion(7). Recognizing this opportunity, Digital Realty Trust expanded its portfolio by acquiring Interxion, a leading European data center operator, for $8.4 billion. This acquisition positioned Digital Realty to tap into the high-growth European market, which has been fueled by strong demand from cloud service providers and enterprise customers(8).

In the Asia-Pacific region, data center growth is being driven by the expansion of tech hubs in cities such as Singapore, Hong Kong, and Tokyo. Equinix and CyrusOne have both invested heavily in these markets, focusing on building or acquiring data centers in strategic locations to serve regional and global customers.

For investors, the global diversification of data center REITs provides exposure to multiple growth markets, reducing reliance on any single region. This geographic spread also helps REITs mitigate risks associated with local economic downturns or regulatory changes, making them a resilient investment choice.

Investment Risks and Considerations for Data Center REITs

While data center REITs offer considerable growth potential, investors should be mindful of certain risks and challenges associated with this asset class.

● Technological Advancements and Market Evolution

The rapid pace of technological change can both benefit and challenge data center REITs. While demand for data centers is expected to grow, advancements such as quantum computing or new data storage technologies could potentially disrupt the market. For instance, technologies that allow for more efficient data compression or processing could reduce the need for large-scale data centers, affecting occupancy rates and rental income.

To mitigate this risk, leading data center REITs are continually upgrading their facilities to accommodate the latest technologies and ensure they remain competitive. Digital Realty, for example, is investing heavily in advanced cooling systems and energy-efficient equipment to stay ahead of the curve(9). However, investors must remain vigilant, monitoring the technological landscape for potential disruptors that could impact the long-term viability of the sector.

● Regulatory and Cybersecurity Risks

Data centers handle vast amounts of sensitive information, making them prime targets for cyberattacks. Regulatory bodies worldwide are tightening data protection laws, with frameworks such as the General Data Protection Regulation (GDPR) in Europe imposing strict guidelines on data security. Non-compliance with these regulations can result in significant fines and reputational damage for data center operators.

Additionally, geopolitical risks, such as government-imposed data localization laws, could require companies to store data within specific geographic regions, impacting how and where data centers are built and operated.

Data center REITs must invest heavily in cybersecurity measures to protect their infrastructure and comply with international regulations. For investors, it’s crucial to assess a REIT’s cybersecurity strategy and its ability to navigate complex regulatory environments.

● The Competitive Landscape

As the demand for data centers grows, so too does competition within the sector. Tech giants such as Google, Amazon, and Microsoft are investing in their own proprietary data centers, bypassing REITs and posing a competitive threat. This vertical integration could limit the market share available to data center REITs, particularly in regions where cloud service providers are dominant.

To remain competitive, data center REITs must differentiate themselves by offering services beyond basic colocation. This includes value-added services such as interconnection, cloud migration support, and tailored data center solutions for enterprise customers.

Conclusion: Data Center REITs in a Digital World

The digital transformation of the global economy is far from over, and data center REITs are poised to play a critical role in supporting this evolution. With strong demand drivers such as cloud computing, 5G, and IoT, data center REITs offer a compelling growth opportunity for investors seeking stable cash flows, high barriers to entry, and geographic diversification.

However, as with any investment, it’s important to weigh the potential risks, including technological disruption, regulatory challenges, and competition from tech giants. Investors who stay informed and choose REITs with strong growth strategies, robust cybersecurity measures, and sustainable practices will be well-positioned to benefit from the continued expansion of the data center market.

By capitalizing on global trends and adapting to emerging technologies, data center REITs will remain a key asset class for the foreseeable future, offering long-term value to savvy investors.

Sortis REIT: The Sortis Advantage

One compelling option for Private REIT investors is the Sortis REIT (S-REIT). Sortis REIT stands out for several key reasons. It’s tailored for Accredited Investors, requiring a minimum investment of $25,000. Investors enjoy quarterly distributions, providing a steady income stream. Redemption is possible after 6 months, with caps of 2% quarterly and 5% annually, subject to fund availability and advisor discretion. The REIT’s impressive maximum offering is set at $1 billion, showcasing its scale and potential. Management charges are transparent at 1.25% of Net Asset Value (NAV), with a profit-sharing mechanism ensuring further transparency.

Sortis REIT focuses on acquiring stabilized or readily stabilized real estate assets, prioritizing off-market transactions. Deal sizes range from $2 million to $20 million to stay competitive. Supported by Sortis Holdings, Inc., they enhance acquisitions through curated retail experiences. Asset classes include multifamily, hotel, retail, office, light industrial, and life science properties.

The REIT’s approach, led by individuals with proven investment management expertise, identifies opportunities for strong risk-adjusted returns. Focused on the Western States, they capitalize on localized expertise. As a boutique-sized fund, Sortis REIT maintains flexibility in the market, avoiding forced investments. Their diverse relationships facilitate unique access to deals, and staff members’ personal investments align their interests with investors. Learn more about Sortis REIT here.

References:

[1] Grand View Research. (2021). Cloud Computing Market Size, Share & Trends Analysis Report.

https://www.grandviewresearch.com/

[2] IoT Analytics. (2021). Global IoT Market Overview.

https://www.iot-analytics.com/

[3] Synergy Research Group. (2020). 2020 Cloud Infrastructure Spending Report.

[4] Digital Realty Trust. (2020). Acquisition of Interxion.

https://www.digitalrealty.com/

[5] Equinix. (2024). Sustainability and Climate Neutrality Efforts.

[6] Digital Realty Trust. (2024). 100% Renewable Energy Pledge by 2030.

https://www.digitalrealty.com/

[7] Data Center Knowledge. (2021). European Data Center Market Forecast 2021-2026.

https://www.datacenterknowledge.com/

[8] Nareit. (2024). The Future of Data Centers and REITs.

https://www.reit.com/what-reit/reit-sectors/data-center

[9] Digital Realty Trust. (2024). Investor Relations Report.