– Vatsal Rai

March 10, 2024

Introduction

In the ever-evolving landscape of investments, traditional asset classes such as stocks, bonds, and cash equivalents have long been the cornerstone of portfolio construction. However, as financial markets become increasdingly complex and interconnected, the case for diversifying into alternative assets grows stronger. These non-traditional investments offer unique characteristics that can provide valuable diversification benefits, potentially enhance returns, and mitigate overall portfolio risk.

What are Alternative Assets

Alternative assets encompass a broad range of investment opportunities that fall outside the realm of traditional asset classes. These include, but are not limited to, real estate, private equity, venture capital, hedge funds, commodities, and various derivative instruments. Each alternative asset class possesses distinct risk-return profiles, liquidity characteristics, and correlation patterns with traditional asset classes. As per a recent study conducted by Bain and Company, institutional capital allocated to alternative asset investments will grow 8% annually over the next decade. Individual wealth invested in alternative assets, meanwhile, is expected to grow 12% annually over that period, albeit from a much smaller base.[3] Taken together, these sources would support 9% annual growth in AUM through 2032.[3] Furthermore, in 2022, according to Cerulli Associates based in Boston, 44% of institutional investors express a desire to boost their allocations towards alternative investments.[9] This points towards the serious outlook that alternative assets provide to investors with its benefits as discussed below.

The Case for Alternatives: Diversification and Potential Upsides

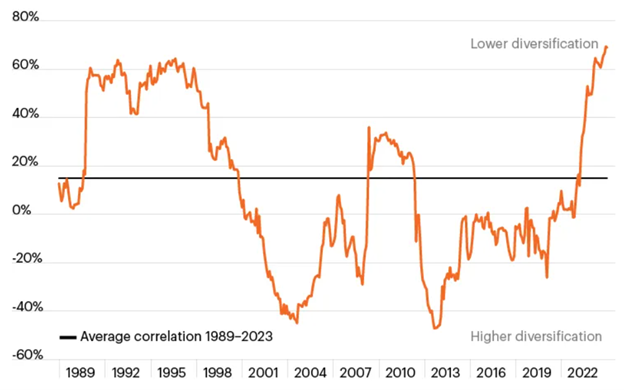

Traditional asset classes, particularly stocks and bonds, tend to exhibit a high degree of correlation. This implies that their price movements often follow similar patterns. When the stock market experiences a downturn, bonds typically follow suit, potentially amplifying portfolio losses. The below figure illustrates a rolling 3-year correlation between stocks and bonds since 1989. More recently, the rolling three-year correlation between stocks and bonds spiked, hit a high of 0.68, and the S&P/Agg correlation reached a 40-year high and marked a stark change from the diversification benefits core fixed income has provided for the bulk of the last 20-plus years.[1]

Fig 1 – Rolling 2 year correlation between stocks and bonds[1]

Alternative investments, on the other hand, often exhibit low correlation with traditional assets.[2] This means their value fluctuations are less influenced by the whims of the broader market. This characteristic makes them valuable tools for portfolio diversification.

For example, commodities, such as precious metals and energy resources, have historically exhibited low correlations with stocks and bonds.[4] This characteristic can provide a cushion against market fluctuations, as commodity prices are influenced by different economic factors than those that drive equity and fixed-income markets.

Similarly, hedge funds employ a variety of investment strategies, ranging from long-short equity to global macro, that can generate returns with low correlations to traditional asset classes. This diversification can help smooth out portfolio returns and potentially reduce overall risk.

By incorporating a strategic allocation to alternatives, investors can potentially:

(i.) Reduce portfolio volatility: During market downturns, the lower correlation of alternatives can help mitigate the overall portfolio decline, offering a buffer against significant losses.

(ii.) Enhance risk-adjusted returns: While not without risk, certain alternatives have the potential to deliver higher returns compared to traditional assets. Private equity, for instance, has historically offered attractive returns exceeding those of the public markets as it has had a return of 14% globally over the past 25 years vs. 7% for the MSCI World Index.[3]

A Spectrum of Alternatives: Exploring Different Asset Classes

The alternative investment universe is huge, with over 18,000 private investment funds and more than 9,000 hedge funds presently included[17], and encompasses a diverse range of asset classes, each with unique characteristics and risk profiles. Some prominent examples include:

Private Equity: Private equity is an alternative investment class that invests in or acquires private companies that are not listed on a public stock exchange. According to Dealogic, a company specializing in monitoring acquisitions, the worldwide value of private equity buyouts exceeding $1 billion surged from $28 billion in 2000 to $502 billion in 2006[5] and around $2.8 trillion globally as of mid-2018.[6] Hence, this is a very lucrative alternative investment vehicle, and offers high growth potential but come with illiquidity (difficulty in selling quickly) and requires a longer investment horizon.

Hedge Funds: These are actively managed funds employing various strategies to generate returns, often independent of market movements. Hedge funds can be complex and come with high fees, however usually are associated with high amounts of returns. For example, TCI, the top ranking fund, recorded investor profits of $12.9 billion and ended last year up 33%, beating the S&P 500′s 24% gain.[8] Citadel, which ranked second in 2023, made $8.1 billion in profits after bringing in a record-breaking $16 billion in 2022, and had gains of $74 billion.[8]

Hedge funds offer diversified sources of return and varied risk profiles for your portfolio, accessing unconventional asset classes through techniques like shorting, increased employment of derivatives, and leverage. Certain hedge fund approaches aim to generate positive returns across various market conditions, often referred to as ‘absolute return’ strategies.[7] While these strategies entail elevated risks, they typically seek to optimize returns to offset these risks as efficiently as feasible.

Art: The worldwide arts sector expanded from $441.02 billion in 2022 to $579.52 billion in 2023, achieving a compound annual growth rate (CAGR) of 31.4%.[9] In the last two decades, the Mei Moses World All Art Index has shown a compounded annual growth rate of 5.3 percent, while the S&P 500 Total Return Index has recorded 8.3 percent. However, over a span of 50 years, this difference diminishes: the All Art Index achieved a return of 7.9 percent compared to the S&P Index’s 9.7 percent.[10] Contemporary art, on the other hand, has yielded much better returns of 7.5%, surpassing the overall art market’s 5.3% average.[11] Conversely, investment grade bonds from developed nations saw a return of 6.5%, while global high yield bonds averaged 8.1% during the same period.[11] However, with rising demand and limited supply, prices are trending upward, a trend that persists even during economic downturns. Fractional ownership offers a means to reduce both the expense and the investment risk associated with art.

Real Estate: Direct ownership of physical property or investment in real estate investment trusts (REITs) that offer potential rental income and capital appreciation. In the U.S. market, real estate typically yields a median annual return of 8.6% as per the S&P 500.[12] The strategies employed for investment significantly influence these returns, with various property types appealing to investors pursuing different approaches. On average, residential properties yield 10.6% annually, commercial properties yield 9.5%, and REITs yield 11.8%.[12] The S&P 500 Index’s average annual return over the past two decades is approximately 10%.[13] Hence, Regardless of the yardstick used, the real estate industry has performed comparably to the broader market, despite enduring a drastic crisis in housing prices during both the 2008 financial crisis and the 2020 COVID-19 pandemic.

Hence, investors can conveniently achieve diversification in real estate investments by opting for one of the top-performing financial vehicles—REITs. These are securities traded on exchanges, akin to standard stocks, and may encompass investments in properties, real estate or property management firms, mortgages, or a blend of these assets. Governed by specific regulations, REITs provide tax perks and investment benefits, including dividend reinvestment plans (DRIPs).[13]

Commodities: Investors can also invest in raw materials like oil, gold, or agricultural products that can provide a hedge against inflation. Commodity prices can be volatile and susceptible to global economic factors. Returns on commodities tend to align more closely with the economic cycle as they are closely linked to raw material prices. Typically, commodity returns peak during periods of economic expansion and hit bottom during economic contractions. This differs from equities and bonds, which may experience price movements that are out of sync with the economic cycle, often with extreme valuations occurring before or after periods of expansion and contraction. Over the past fifty years, this has led to a correlation of 0.05 between a commodity index like the S&P GSCI and the S&P 500, and a correlation of -0.16 with the Bloomberg US Government/Credit Bond Index.[4] As commodities tend to move in the opposite direction of other assets, they can help reduce expected volatility in a portfolio that includes them.

Regulatory and Tax Considerations

It is essential to note that alternative assets are often subject to different regulatory frameworks and tax implications compared to traditional investments. Investors should thoroughly understand the specific rules and regulations governing each alternative asset class before allocating capital. For instance, certain alternative investments, such as hedge funds and private equity, may have stricter accreditation requirements, limiting access to only qualified investors.

Additionally, the tax treatment of these investments can vary, with potential implications for investors’ overall tax liabilities. As an illustration, long-term capital gains are taxed at a maximum rate of 20%, whereas ordinary income faces a maximum tax rate of 37%.[14] Following the enactment of the Tax Cuts and Jobs Act in 2017, investments must be held for a minimum of three years to be eligible for capital gains treatment

Moreover, from a regulatory perspective, hedge funds are confined by Regulation D within the Securities Act of 1933 to soliciting funds solely through private offerings and exclusively from “accredited investors,” who must possess a minimum net worth of $1,000,000 or a minimum income of $200,000 in each of the preceding two years, with a reasonable expectation of maintaining the same income level in the present year.[15] Therefore, it is very important to consider the legal angles of the alternative investment vehicle that investors are going to employ.

Striking the Right Balance

While alternative assets can offer compelling benefits, it is crucial to maintain a well-diversified portfolio approach. Over-concentrating in any single asset class, whether traditional or alternative, can expose investors to excessive risk and potential losses.

Rather than relying solely on alternatives or any single asset class, investors should aim for a balanced and diversified portfolio that aligns with their risk tolerance, investment objectives, and time horizon. For example, as per data from J.P. Morgan private bank clients, investors generally prefer allocations ranging from 15% to 30% of their total portfolio towards alternatives.[17] However, some high net worth investors (HNIs) with substantial assets and a focus on multi-generational planning may allocate 50% or more to alternatives, akin to certain large endowments.[17]

Alternative assets can serve as a complementary component within a broader asset allocation strategy, providing diversification benefits and potentially enhancing overall portfolio performance. Another important factor to consider is the time horizon of investment. It is generally recommended that investors with less than a 15-year investment horizon should generally avoid investments in private real estate, private real asset, and private equity funds.[16]

The outcomes from the classical mean variance analysis reveal that the most favorable risk-return balance is achieved by constructing a portfolio with a minimum allocation of 30% to alternative funds to minimize variance, and frequently 50% to maximize the Sharpe ratio.[18] However, considering the lifecycle of certain alternative investments and the crucial timing of vintages, some experts recommend a strategy for achieving, for instance, a 30% allocation to alternatives in your portfolio.[17] Instead of investing the entire amount at once, investors might contemplate investing approximately 7% to 8% annually.

Conclusion

Alternative investments offer a compelling array of benefits for investors seeking to diversify their portfolios and potentially achieve their financial goals. These non-traditional investments offer unique characteristics that can potentially enhance returns, mitigate overall portfolio risk, and provide a reliable supplement to many investors’ income needs. Their low correlation to traditional assets makes them valuable tools for mitigating risk, while certain alternatives hold the potential for superior returns. However, it is crucial to approach alternative asset allocation with a balanced and informed perspective, recognizing the potential risks and complexities involved. Ultimately, the inclusion of alternative assets in a portfolio should be driven by a thorough understanding of their unique characteristics, alignment with investment objectives, and a commitment to prudent risk management.

References

[1] “Stock-Bond Correlation Hits Multi-Decade High.” n.d. FS Investments. Accessed March 12, 2024. https://fsinvestments.com/fs-insights/chart-of-the-week-2024-1-5-stock-bond-correlation/.

[2] Hall, Tim. 2023. “Alternative Investments: Asset Correlation.” Percent. March 6, 2023. https://percent.com/blog/alt-investments-correlation/.

[3] “Why Private Equity Is Targeting Individual Investors.” 2023. Bain. February 27, 2023. https://www.bain.com/insights/why-private-equity-is-targeting-individual-investors-global-private-equity-report-2023/#:~:text=Not%20only%20are%20private%20equity.

[4] “Stocks, Bonds, Cash, Commodities: Rethinking the Typical Core Portfolio | Parametric Portfolio Associates.” n.d. Parametric. Accessed March 12, 2024. https://www.parametricportfolio.com/blog/rethinking-the-typical-core-portfolio#:~:text=Commodities%20have%20historically%20provided%20a.

[5] Barber, Felix, and Michael Goold. 2014. “The Strategic Secret of Private Equity.” Harvard Business Review. August 2014. https://hbr.org/2007/09/the-strategic-secret-of-private-equity.

[6] “Private Equity Investments.” n.d. Www.cfainstitute.org. https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/private-equity-investments.

[7] “Investing in Hedge Funds.” 2023. Mercer.com. 2023. https://www.mercer.com/insights/investments/alternative-investments/investing-in-hedge-funds/.

[8] Gilchrist, Karen. 2024. “World’s Largest Hedge Funds Record Bumper Year of Profits, Research Shows.” CNBC. January 23, 2024. https://www.cnbc.com/2024/01/23/worlds-largest-hedge-funds-record-bumper-year-of-profits.html.

[9] “Top Alternative Investments Trends for 2023 – Yieldstreet.” n.d. Www.yieldstreet.com. https://www.yieldstreet.com/top-alternative-investments-trends/.

[10] “Is Artwork a Wise Investment?” n.d. Www.rbcwealthmanagement.com. https://www.rbcwealthmanagement.com/en-us/insights/is-artwork-a-wise-investment#:~:text=Over%20the%20past%2020%20years.

[11] Stevens, Pippa. 2019. “Buy a Monet instead of a Treasury? Art Has Shown Long-Term Returns That Rival Bonds.” CNBC. December 7, 2019. https://www.cnbc.com/2019/12/07/art-has-shown-long-term-returns-that-rival-bonds.html.

[12] “What Is Real Estate Return on Investment (ROI)? – Forbes Advisor.” n.d. Www.forbes.com. https://www.forbes.com/advisor/investing/roi-on-real-estate-investment/.

[13] “The Average Annual Return for a Long Term Investment in the Real Estate Sector.” 2019. Investopedia. 2019. https://www.investopedia.com/ask/answers/060415/what-average-annual-return-typical-long-term-investment-real-estate-sector.asp.

[14] Investopedia. 2022. “How Private Equity and Hedge Funds Are Taxed,” June 10, 2022. https://www.investopedia.com/articles/investing/072215/how-private-equity-and-hedge-funds-are-taxed.asp.

[15] “Hedge Fund Investing & Regulation.” n.d. Rpc.cfainstitute.org. Accessed March 12, 2024. https://rpc.cfainstitute.org/en/policy/positions/hedge-funds#:~:text=Specifically%2C%20hedge%20funds%20are%20restricted.

[16] “Asset Allocation to Alternative Investments.” n.d. CFA Institute. https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/asset-allocation-alternative-investments.

[17] “Private Markets: 4 Steps to Help You Optimize Your Allocation to Alternatives | J.P. Morgan Private Bank U.S.” n.d. Privatebank.jpmorgan.com. Accessed March 12, 2024. https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/private-markets-4-steps-to-help-you-optimize-your-allocation-to-alternatives.

[18] ManagementSeptember 2003, Dexia Asset. n.d. “How Much Should Be Allocated to Alternatives?” IPE. https://www.ipe.com/how-much-should-be-allocated-to-alternatives/16232.article#:~:text=A%20new%20study%20carried%20out.