-Shekhar Tripathi

September 20, 2024

Introduction

The United States is grappling with a housing affordability crisis that has been exacerbated by the rapid increase in property prices, limited supply, and stagnant wages. The issue, which primarily affects low- and middle-income families, is causing millions of households to spend a disproportionate amount of their income on housing. Real Estate Investment Trusts (REITs) specializing in affordable housing are stepping in to mitigate the crisis by investing in properties that cater to these underserved communities. This article explores the root causes of the housing crisis, the pivotal role that affordable housing REITs play, and how they offer both financial and social returns for investors.

Source: NAREIT

Understanding the Affordable Housing Crisis

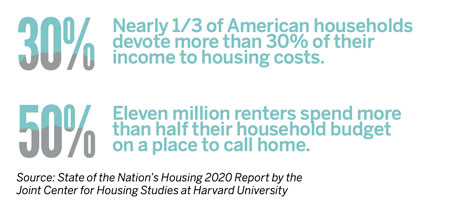

The United States faces a severe shortage of affordable housing. According to the National Low Income Housing Coalition, there is a gap of over 7.3 million affordable homes for the country’s lowest-income renters(1). This shortage is driven by various factors, including skyrocketing real estate prices, the increasing cost of construction, and the loss of affordable housing units due to market conversions. For example, between 1990 and 2016, the country lost over 2.5 million affordable rental units, especially those priced under $800 per month(2). The economic burden has reached a critical point, with more than 30% of U.S. households spending over 30% of their income on housing, which classifies them as cost-burdened(3).

This issue is particularly pressing in urban centers where demand for housing far exceeds supply. Cities like New York, San Francisco, and Los Angeles have seen a boom in the development of luxury housing, while affordable units have dwindled. The high cost of land and construction has made it economically unfeasible for developers to build new affordable housing units without subsidies or incentives. Even existing affordable housing is at risk, as investors seek to convert lower-income properties into higher-end developments to maximize returns.

- Economic Pressures

In cities across the country, rising demand has pushed rents higher, making it difficult for low- and middle-income families to find housing that fits their budget. In 2021, rental prices in urban areas rose by an average of 17%, far outpacing wage growth, which increased by only 4% in the same period(4). This gap is particularly problematic for essential workers, such as teachers, nurses, and service employees, who are increasingly being priced out of the cities where they work.

● Impact on the Workforce

The housing crisis has far-reaching effects on the economy, particularly on workforce stability. Many workers must move further away from job centers, resulting in longer commutes, higher transportation costs, and reduced quality of life. Businesses are also feeling the strain as they struggle to attract and retain employees who can afford to live near their workplaces.

The Role of Affordable Housing REITs: A Critical Solution

Affordable housing Real Estate Investment Trusts (REITs) have emerged as an essential part of the solution to the housing crisis, leveraging the financial power of real estate to both generate returns and address a critical social issue. Affordable housing REITs invest in, develop, and manage properties that are specifically designed to serve low- and middle-income families. These REITs partner with governments, nonprofits, and private developers to provide housing at below-market rents, filling a gap that traditional market-rate housing developers cannot.

- How Affordable Housing REITs Work

Affordable housing REITs operate by investing in multi-family properties, single-family homes, and mixed-use developments where a substantial portion of units are designated as affordable. These properties are often financed through a mix of public and private funding, including subsidies such as Low-Income Housing Tax Credits (LIHTCs), tax-exempt bonds, and government-backed loans. These financing tools make it financially feasible for REITs to develop and maintain affordable units while still delivering returns to investors.

● Key Players in the Market

The most prominent affordable housing REITs include Community Development Trust (CDT), Housing Partnership Equity Trust (HPET), and Reven Housing REIT. These REITs operate with a dual mission—providing returns to investors while focusing on the social goal of creating or preserving affordable housing units. CDT, for instance, has created or preserved over 47,000 affordable housing units, providing homes for more than 120,000 residents across the U.S.(5). Similarly, HPET partners with nonprofit developers to acquire and rehabilitate affordable housing projects, ensuring long-term affordability for residents.

● Mission-Driven Investment

These REITs often follow a “double bottom-line” investment strategy, which means they aim to deliver both financial returns and social outcomes. HPET, for example, acquires properties that provide affordable housing to low- and moderate-income families, prioritizing communities with pressing needs for workforce housing(6). The REIT ensures that these properties remain affordable for decades by utilizing government programs like LIHTCs and Section 8 vouchers.

- Financial Performance of Affordable Housing REITs

One of the main reasons affordable housing REITs are attractive to investors is their ability to deliver stable, long-term returns. Affordable housing tends to have lower vacancy rates compared to luxury or market-rate housing, as demand far outstrips supply. Even during economic downturns, the need for affordable housing remains consistent, making these REITs relatively recession-proof.

- Steady Cash Flow

Many affordable housing REITs receive consistent cash flow from long-term government contracts, subsidies, and rental assistance programs. Section 8 vouchers, for example, guarantee that a portion of the rent is paid directly to the property owner, ensuring a steady income stream. This makes affordable housing investments less volatile compared to other types of real estate assets.

- Risk Mitigation

While affordable housing REITs may not offer the same explosive growth potential as luxury or office REITs, they provide a unique risk mitigation strategy. The high demand for affordable housing and the scarcity of available units mean that occupancy rates remain high, even during economic downturns. As of 2023, affordable housing REITs maintained occupancy rates above 95%, a stark contrast to the volatility seen in other sectors such as retail and hospitality(7).

3. The Use of Public-Private Partnerships

Public-private partnerships (PPPs) are a crucial component of how affordable housing REITs operate. These partnerships allow REITs to access government funding, such as federal tax credits or state housing programs, which can subsidize the development and management of affordable housing projects. In exchange, REITs commit to keeping rents below market rates for a set number of years, typically 30 to 50 years, depending on the financing structure.

For instance, the Low-Income Housing Tax Credit (LIHTC) program is the largest federal subsidy for affordable rental housing, financing approximately 90% of all affordable housing developments in the U.S. since its inception(8). REITs that use LIHTCs can attract private capital while keeping rents affordable for low-income families, creating a win-win for both investors and tenants.

Challenges, Opportunities, and the Future of Affordable Housing REITs

While affordable housing REITs are increasingly recognized as a solution to the housing crisis, they face a range of challenges that must be navigated carefully. These obstacles include regulatory complexities, the high cost of development, and competition for government subsidies. However, the long-term outlook for affordable housing REITs remains optimistic as demand for affordable housing continues to grow, and as more investors recognize the potential for steady returns coupled with social impact.

Challenges Faced by Affordable Housing REITs

- Rising Construction and Land Costs

One of the biggest barriers to affordable housing development is the increasing cost of land and construction materials. Developers often struggle to find economically feasible ways to build affordable housing in high-demand areas without significant government subsidies. As land prices rise, particularly in major cities, it becomes more challenging to keep rental units affordable without pricing out lower-income tenants(9). This trend also discourages the private sector from entering the affordable housing market, further exacerbating the shortage of affordable homes.

- Regulatory Hurdles and Zoning Laws

The regulatory environment surrounding affordable housing is complex and varies significantly from state to state. Zoning laws, in particular, can make it difficult to develop affordable housing projects in urban centers where it is needed most. In some cases, developers must navigate multiple layers of approvals and permits, which can slow down or even derail projects entirely. These hurdles not only increase the time and cost of development but also contribute to the ongoing housing shortage(10). In response, some REITs have begun to advocate for more flexible zoning laws that encourage the development of affordable housing.

- Competition for Subsidies

Affordable housing REITs often rely on federal programs like the Low-Income Housing Tax Credit (LIHTC) to make their developments financially viable. However, competition for these subsidies is fierce, and there is often more demand for tax credits than there is supply. As a result, not all projects that apply for subsidies receive them, which can delay construction or make certain developments infeasible. Securing these tax credits is critical for REITs to maintain affordable rents and generate returns for their investors.

Emerging Opportunities for Affordable Housing REITs

Despite these challenges, there are several emerging opportunities that are driving the growth of affordable housing REITs. These include the growing demand for affordable rental units, increased government support, and the integration of new technologies to reduce costs and improve sustainability.

- Growing Demand for Affordable Rental Units

The demand for affordable housing continues to outpace supply, particularly in urban centers where populations are growing, and wages have not kept pace with housing costs. According to a report from the National Low Income Housing Coalition, there is currently a nationwide shortage of more than 7 million affordable homes for extremely low-income renters (1). This persistent demand ensures that affordable housing REITs will have a steady pipeline of tenants, which in turn creates stable, long-term cash flows for investors.

- Increased Government Funding and Support

The federal government is taking steps to address the affordable housing crisis through various funding programs and initiatives. For example, the Biden administration has announced plans to invest $5.5 billion in grants aimed at supporting affordable housing development over the next decade (6). This influx of government support is expected to help REITs finance new projects and acquire existing properties, further expanding the affordable housing market. In addition, state and local governments are introducing new incentives and programs to encourage affordable housing development, including tax abatements, low-interest loans, and fast-tracking permitting processes.

- Technological Innovation and Cost Reduction

Advances in construction technology and modular building techniques have the potential to lower the cost of developing affordable housing. Modular construction, for instance, can reduce construction time and costs by as much as 20% compared to traditional building methods(11). REITs that invest in these new technologies can pass on savings to tenants through lower rents while maintaining profitability. Additionally, the integration of energy-efficient systems and green building certifications can reduce operational costs for affordable housing REITs, making their properties more sustainable and appealing to environmentally conscious investors.

The Future of Affordable Housing REITs: Outlook and Trends

The future of affordable housing REITs looks bright as demographic trends, economic pressures, and government policies continue to support the need for more affordable homes. Here are some key trends that will shape the future of affordable housing REITs:

- Public-Private Partnerships (PPPs)

Public-private partnerships are expected to play a crucial role in the development of affordable housing in the coming years. These partnerships allow REITs to collaborate with government agencies and nonprofit organizations to access subsidies, tax incentives, and other financial tools that make affordable housing projects feasible. For instance, the Community Development Trust (CDT) works closely with local governments to secure funding for affordable housing developments, ensuring that rents remain low for tenants while providing returns for investors (5).

- Impact Investing

As more investors seek to align their portfolios with their values, impact investing is becoming a major force in real estate. Affordable housing REITs are uniquely positioned to attract impact investors who want to achieve both financial returns and social good. By providing stable housing for low- and middle-income families, these REITs offer investors a chance to contribute to positive social change while earning steady returns. This trend is expected to grow as socially responsible investing continues to gain momentum.

- Sustainability in Affordable Housing

As sustainability becomes a priority for both investors and tenants, affordable housing REITs are increasingly focusing on green building practices. The use of energy-efficient systems, sustainable materials, and environmentally friendly construction techniques not only reduces the environmental impact of affordable housing developments but also lowers operating costs. REITs that integrate sustainability into their business models will be well-positioned to attract environmentally conscious investors and tenants alike.

Conclusion: A Resilient and Growing Sector

The affordable housing crisis presents both challenges and opportunities, and affordable housing REITs are uniquely positioned to fill the gap. While they face obstacles such as rising construction costs, regulatory hurdles, and competition for subsidies, the demand for affordable housing continues to grow, providing a resilient market for these REITs. The combination of steady occupancy rates, government support, and technological innovation ensures that affordable housing REITs will remain an attractive option for investors seeking both financial returns and social impact.

As more investors recognize the potential for long-term, stable returns in this space, affordable housing REITs will continue to grow, expanding their role in addressing one of the most pressing issues facing the housing market today.

Sortis REIT: The Sortis Advantage

One compelling option for Private REIT investors is the Sortis REIT (S-REIT). Sortis REIT stands out for several key reasons. It’s tailored for Accredited Investors, requiring a minimum investment of $25,000. Investors enjoy quarterly distributions, providing a steady income stream. Redemption is possible after 6 months, with caps of 2% quarterly and 5% annually, subject to fund availability and advisor discretion. The REIT’s impressive maximum offering is set at $1 billion, showcasing its scale and potential. Management charges are transparent at 1.25% of Net Asset Value (NAV), with a profit-sharing mechanism ensuring further transparency.

Sortis REIT focuses on acquiring stabilized or readily stabilized real estate assets, prioritizing off-market transactions. Deal sizes range from $2 million to $20 million to stay competitive. Supported by Sortis Holdings, Inc., they enhance acquisitions through curated retail experiences. Asset classes include multifamily, hotel, retail, office, light industrial, and life science properties.

The REIT’s approach, led by individuals with proven investment management expertise, identifies opportunities for strong risk-adjusted returns. Focused on the Western States, they capitalize on localized expertise. As a boutique-sized fund, Sortis REIT maintains flexibility in the market, avoiding forced investments. Their diverse relationships facilitate unique access to deals, and staff members’ personal investments align their interests with investors. Learn more about Sortis REIT here.

References:

- Joint Center for Housing Studies, Harvard University. (2024). America’s Rental Housing 2024 Report.

https://www.jchs.harvard.edu/americas-rental-housing-2024 - Nareit. (2019). Social Purpose REITs Tackle Affordable Housing Challenges.

https://www.reit.com/news/reit-magazine/may-june-2019/social-purpose-reits-tackle-affordable-housing-challenges - Nareit. (2021). REITs Are Helping to Bridge the Affordable Housing Gap.

https://www.reit.com/news/reit-magazine/march-april-2021/reits-are-helping-bridge-gap - Nuveen. (2024). 2024 U.S. Affordable Housing Impact Report.

https://www.nuveen.com/en-us/insights/real-estate/2024-us-affordable-housing-impact-reportrt - Community Development Trust. (2023). Affordable Housing and Public-Private Partnerships.

https://cdt.biz/affordable-housing/ - U.S. Department of Housing and Urban Development (HUD). (2024). Biden-Harris Administration Announces $5.5 Billion in Grants for Affordable Housing.

https://www.hud.gov/press/press_releases_media_advisories/hud_no_24_103 - Nareit. (2024). Occupancy Rates for Affordable Housing REITs Remain Strong Despite Market Volatility.

https://www.reit.com/news/blog/market-commentary/reit-prowess-occupancy-rates-showcase-reit-asset-selection-and - National Low Income Housing Coalition. (2023). The Gap: A Shortage of Affordable Rental Homes.

https://nlihc.org/gap - McKinsey & Company. (2022). Rising Land Costs and Their Impact on Affordable Housing.

https://www.mckinsey.com/~/media/mckinsey/featured%20insights/urbanization - National Association of Housing and Redevelopment Officials (NAHRO). (2023). Rethinking Zoning to Increase Affordable Housing

https://www.nahro.org/journal_article/rethinking-zoning-to-increase-affordable-housing/ - Modular Building Institute. (2023). How Modular Construction Is Reducing Costs in Affordable Housing Development.

https://www.modular.org/modular-advantage/