– Vatsal Rai

Aug 16, 2024

Introduction

The U.S. real estate market, a bellwether of economic health, has seen remarkable transformations over the past century. From the post-war boom to the 2008 financial crisis and the recent pandemic-induced frenzy, understanding the factors driving real estate prices is crucial. This article delves into the history, key drivers, current trends, and future outlook of U.S. real estate prices, drawing on data that offers nuanced insights

Historical Context

The history of US real estate prices is marked by periods of growth, stagnation, and volatility. To understand the current market, it’s crucial to examine these historical trends.

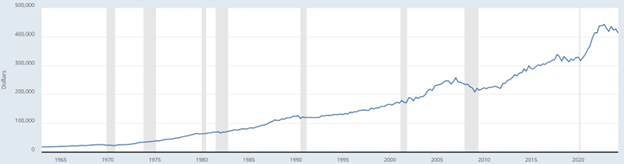

Fig. 1 – Median Sale Price of houses sold[1]

According to the Federal Reserve Bank of St. Louis, the median sales price of houses sold in the United States has shown a general upward trend since the 1960s. In Q1 1963, the median price was $17,800. By Q4 2023, it had risen to $417,700, representing a nominal increase of over 2,200% over six decades.[1]

However, this long-term growth has not been linear. The Case-Shiller Home Price Index, which measures changes in the value of residential real estate nationwide, reveals several significant periods of price fluctuation:

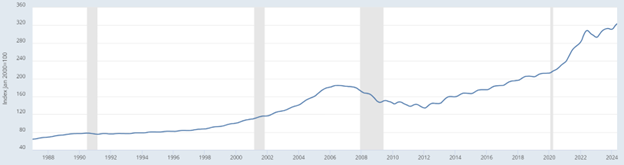

Fig. 2 – S&P CorLogic Case-Shiller Index[2]

1975-1995: Relatively steady growth, with the index rising from 32.96 to 76.66 over 20 years.[2]

1995-2006: Rapid acceleration, often referred to as the “housing bubble,” with the index peaking at 184.62 in July 2006.[2]

2006-2012: The housing market crash, with the index falling to a low of 134.01 in February 2012.[3]

2012-Present: A period of recovery and growth, with the index reaching 305.02 as of December 2023.[2][4]

This historical context sets the stage for understanding current market dynamics and future projections. In the next section, we’ll examine the key drivers that have shaped these trends.

Market Drivers

Several interconnected factors drive US real estate prices. Understanding these can provide insights into both historical trends and future projections.

a) Interest Rates:

The Federal Reserve’s monetary policy significantly impacts mortgage rates, which in turn affect housing affordability and demand. The cost of borrowing money significantly influences real estate prices. Historically low-interest rates following the 2008 crisis and during the pandemic led to a surge in home buying, as cheaper loans made housing more affordable. According to Freddie Mac data, the average 30-year fixed mortgage rate fluctuated from a high of 18.63% in October 1981 to a record low of 2.65% in January 2021.[7] As of February 2024, it stood at around 6.77%.[8] These rate changes have a direct impact on buyers’ purchasing power.

b) Supply and Demand:

The basic economic principle of supply and demand plays a pivotal role. The U.S. has faced a persistent housing shortage since the 1970s, with new home construction failing to keep pace with population growth. Association of Realtors reported that the inventory of existing homes for sale stood at 1.01 million units at the end of December 2023, representing a 3.2-month supply at the current sales pace.[9] This is well below the 6-month supply considered indicative of a balanced market.

c) Demographics:

The aging of the Millennial generation, now the largest cohort in the U.S., has significantly impacted the housing market. Millennials, who delayed homeownership due to student debt and other factors, have entered the market en masse, driving demand in the last decade. According to NAR’s 2023 Home Buyers and Sellers Generational Trends Report, millennials (ages 24-42) made up the largest share of home buyers at 38%.[10]

d) Economic Factors:

Broader economic indicators like GDP growth, unemployment rates, and wage growth all influence housing demand. The U.S. economy’s resilience post-2008 and the fiscal stimulus measures during the pandemic bolstered consumer confidence, contributing to the surge in home buying. The U.S. Bureau of Labor Statistics reported that real average hourly earnings increased by 0.8% from December 2022 to December 2023, affecting consumers’ ability to save for down payments and afford monthly mortgage payments.[11]

e) Construction Costs:

Rising material and labor costs affect new home prices. According to the latest Producer Price Index (PPI) report, growth in the average price level of inputs to residential construction less energy (i.e., building materials) fell from 15% in 2022 to 1.3% in 2023 (not seasonally adjusted). On a monthly basis, building materials prices rose 0.1% in December after increasing 0.1% in November (revised). Monthly price increases averaged 0.2% in 2023, down from 1.5% in 2021 and 0.7% in 2022.[12]

f) Government Policies:

Tax incentives, such as the mortgage interest deduction, and government-backed mortgage programs like those from the FHA, have historically supported housing demand. During the pandemic, the Federal Reserve’s aggressive bond-buying program and the CARES Act, which included mortgage forbearance provisions, helped stabilize the market. Tax policies, zoning laws, and housing regulations can significantly impact local real estate markets. For instance, the Tax Cuts and Jobs Act of 2017 capped the state and local tax (SALT) deduction at $10,000, potentially affecting high-tax states more significantly.[13]

Current Trends

The US real estate market in 2023-2024 has been characterized by several notable trends:

a) Price Growth Moderation:

After the rapid price appreciation seen in 2020-2022, growth has moderated. The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index reported a 5.1% annual gain in November 2023, down from the peak 20.8% increase in March 2022.[14][2]

b) Inventory Constraints:

Despite slowing price growth, inventory remains tight. NAR data shows that total housing inventory at the end of December 2023 was down 11.5% from November 2023 and up by some points from the previous year.[15]

c) Shift in Buyer Preferences:

The COVID-19 pandemic has influenced buyer preferences. NAR’s 2023 Profile of Home Buyers and Sellers revealed that buyers are increasingly prioritizing larger homes and home offices.

d) Rise of Remote Work:

The increase in remote work has allowed some buyers to consider locations further from urban centers. According to a Zillow survey, more than 80% of respondents say they want to work remotely at least occasionally, and 44% want to work from home all the time, influencing their housing choices.[16]

e) Generational Shifts:

As mentioned earlier, millennials continue to dominate the home-buying market. However, Gen Z (ages 18-23) is beginning to enter the market, making up 4% of home buyers in 2023 according to NAR.[17]

Future Predictions

Home listings usually increase during the peak summer buying season, as it’s the most convenient time for families to find new homes before school starts. However, Q3 2024 might break this trend. Since the COVID-19 pandemic, traditional seasonal patterns have shifted. Historically, home sales would rise in the second and third quarters and decline in winter, but recent years have seen peaks in January or February, followed by monthly declines. This trend seems to be continuing in 2024, with sales peaking in February.

Home prices tend to rise during peak season, and with inventory still low, significant price drops are unlikely this quarter. Prices are projected to increase by 5.9 percent year-over-year and 1.5 percent from the previous quarter, based on CoreLogic data.[5] Homes are expected to sell quickly, but with low inventories, sales are predicted to rise by only 5 percent compared to the same quarter last year.

Interestingly, Altos Research notes that about 35% of listed properties have seen price reductions, a higher percentage than usual for this time of year.[6] While this doesn’t necessarily signal a nationwide price drop, it might indicate that prices are starting to stabilize.

As interest rates remain elevated and economic uncertainties persist, the housing market is likely to continue its cooling trend in the near term. However, the impact will vary by region. High-growth areas like the Sun Belt may see more resilience, while expensive markets on the coasts could experience sharper corrections. The growing focus on climate change and sustainability could reshape the housing market. Homes with energy-efficient features and those in climate-resilient areas are expected to command a premium. As Baby Boomers age and Millennials continue to drive demand, the market will see shifts in the types of housing in demand. There could be increased interest in multi-generational homes and smaller, more affordable units that cater to first-time buyers and downsizing retirees.

Conclusion

The U.S. real estate market is a complex and dynamic ecosystem influenced by various economic, demographic, and policy factors. While the market has shown remarkable resilience in the face of challenges, future trends suggest a more cautious environment, with regional variations and shifting buyer preferences. For investors, homeowners, and policymakers, staying informed and understanding the data behind these trends is crucial to navigating the ever-changing real estate landscape. As we look ahead, the market’s future will likely be shaped by how well it adapts to new economic realities, technological advancements, and evolving consumer needs.

References

[1] “Median Sales Price of Houses Sold for the United States.” 2019. Stlouisfed.org. 2019. https://fred.stlouisfed.org/series/MSPUS.

[2] “S&P/Case-Shiller U.S. National Home Price Index.” 2019. Stlouisfed.org. 2019. https://fred.stlouisfed.org/series/CSUSHPINSA.

[3] Schaefer, Steve. 2012. “Case-Shiller Shows U.S. Home Prices Hit Fresh Lows in February.” Forbes, April 24, 2012. https://www.forbes.com/sites/steveschaefer/2012/04/24/case-shiller-shows-u-s-home-prices-hit-fresh-lows-in-february/.

[4] Hepp, Selma. 2024. “US CoreLogic S&P Case-Shiller Index Continues to Strengthen, with Annual Gain of 5.5% in December.” CoreLogic®. February 27, 2024. https://www.corelogic.com/intelligence/us-corelogic-case-shiller-index-continues-strengthen-with-annual-gain-december/.

[5] Martin, Erik J. n.d. “Housing Market Trends Q2 2024: What to Expect.” Bankrate. https://www.bankrate.com/real-estate/housing-trends/#mortgage-rate.

[6] Simonsen, Mike. n.d. “As More Homes Take a Price Cut, Will List Prices Drop?” Blog.altosresearch.com. Accessed July 31, 2024. https://blog.altosresearch.com/as-more-homes-take-a-price-cut-will-list-prices-drop.

[7] Erika Giovanetti 2024 | “Historical Mortgage Rates: See Averages and Trends by Decade”. USNews https://money.usnews.com/loans/mortgages/articles/historical-mortgage-rates

[8] Bahney, Anna. 2024. “Mortgage Rates Rise for the Second Week, Reaching 6.77%.” CNN. CNN. February 15, 2024. https://edition.cnn.com/2024/02/15/economy/mortgage-rates-february-15/index.html.

[9] “Monthly Indicators Greater Hartford Association of REALTORS®.” 2024. https://www.gharonline.com/clientuploads/PDFs/SmartMLS_MI_2024_02.pdf.

[10] “2024 Home Buyers and Sellers Generational Trends Report National Association of REALTORS® Research Group.” n.d. https://www.nar.realtor/sites/default/files/documents/2024-home-buyers-and-sellers-generational-trends-04-03-2024.pdf.

[11] “Real Earnings News Release – 2023 M12 Results.” 2023. Bureau of Labor Statistics. 2023. https://www.bls.gov/news.release/archives/realer_01112024.htm#:~:text=Real%20average%20hourly%20earnings%20increased.

[12] “Building Materials Price Growth Plummets in 2023.” 2024. Www.nahb.org. January 16, 2024. https://www.nahb.org/blog/2024/01/building-materials-prices-plummet-in-2023.

[13] “State and Local Tax (SALT) Deduction: Overview & FAQs.” 2024. @Thomsonreuters. 2024. https://tax.thomsonreuters.com/en/glossary/salt-deduction.

[14] Hepp, Selma. 2024. “US CoreLogic S&P Case-Shiller Index Suggests Pivot Ahead, up by 5.1% Annually in November.” CoreLogic®. January 30, 2024. https://www.corelogic.com/intelligence/us-corelogic-case-shiller-index-up-annually-in-november-2023/.

[15] “U.S. Economic, Housing and Mortgage Market Outlook – February 2024.” n.d. Www.freddiemac.com. https://www.freddiemac.com/research/forecast/20240226-us-economy-defied-expectations.

[16] Tobey, David. 2021. “Remote Work Will Fuel Housing Demand for Years to Come.” Zillowgroup.com. September 16, 2021. https://www.zillowgroup.com/news/remote-work-will-fuel-housing-demand-for-years-to-come/.

[17] J.P. Morgan Chase. 2023. “Appealing to Gen Z Homebuyers | Chase.” Chase.com. J.P. Morgan Chase. 2023. https://www.chase.com/personal/mortgage/b2b/real-estate/agents/appealing-to-gen-z-homebuyers#:~:text=According%20to%20the%20National%20Association.