It is common to see a rush of year-end trading activity to help lock in gains and remove under-performers from portfolios. Although we are now in April, many investors who sold at the end of 2019 may still be looking for opportunities to allocate capital. However, recent unprecedented stock market volatility could drive further demand for alternative investments, which can help investors diversify away from traditional stock market volatility.

Furthermore, some investors may have unexpectedly locked in gains during early 2020, as the stock market sell-off picked up steam. While these sellers may have seen some short-term losses, some likely sold to lock-in their longer-term capital gains.

Unfortunately, investors that sold at the end of 2019 or early 2020 could be liable for capital gains taxes. With proper tax planning, these investors could potentially defer their equity capital gains taxes for up to ten years, if they were to roll their capital gains into opportunity zone funds.

With stock market volatility picking up and investors looking for alternative investments and downside protection, opportunity zone funds could see strong capital inflows in the coming months.

What Are Opportunity Zones?

Opportunity zones were created from the Tax Cuts and Jobs Act of 2017, which provides tax incentives for investing in distressed and lower-income regions.

“Up to 25% of low-income neighborhoods that meet the income qualifications of the program (and up to 5% of non-low-income tracts that meet other income and geographic requirements) in each state, district, or territory can be designated as Opportunity Zones.”

Source: Fundrise

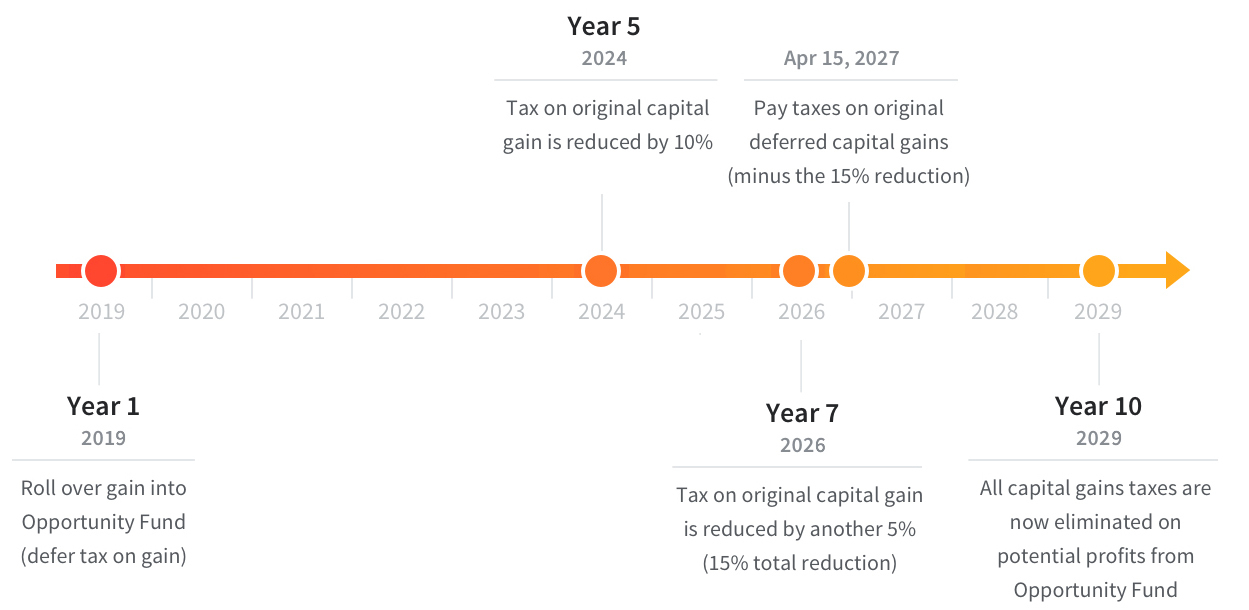

There are currently over 8,700 qualified opportunity zones around the United States and U.S. territories. These qualified locations will be able to retain their opportunity zone designation for ten years.

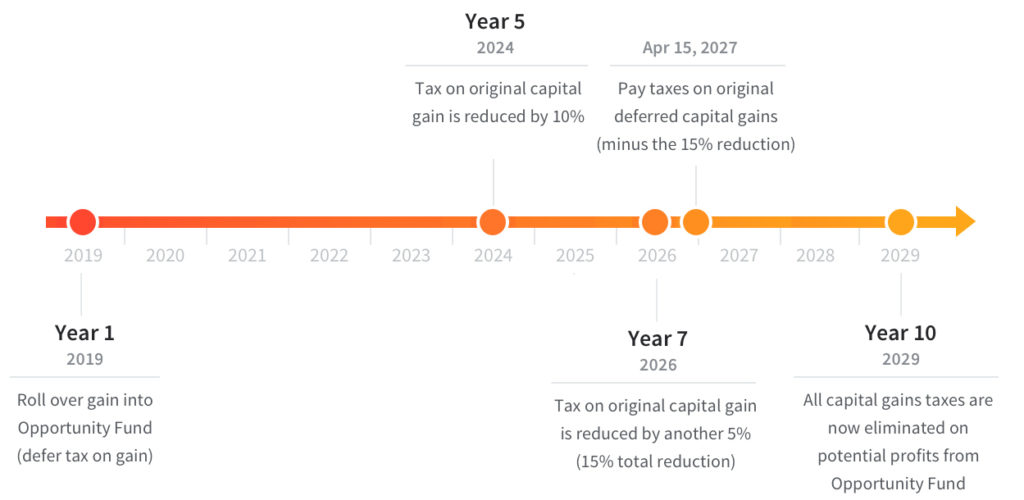

Investors can take advantage of opportunities and the tax-benefits, by rolling over capital gains within 180 days into an approved opportunity zone fund. This allows the investor to defer their capital gains tax exposure.

If that same investor holds that opportunity zone investment for at least five years before December 31, 2026, they can reduce their deferred capital gain principle liability by 10%. Once the opportunity zone investment is held for at least ten years, the investor will pay no capital gains taxes from returns directly tied to the opportunity zone. However, the investor would have to pay the capital gains from the initial equity position that was rolled into the opportunity zone fund ten years earlier.

NES Financial: Economic Uncertainty Could Be A Major Driver For Opportunity Zone Investing

Some experts believe that the recent market sell-off could drive demand for opportunity zone investing, thanks to its tax-friendly features and recession-resistant components.

Executive Vice President of NES Financial, Reid Thomas, is one such expert that believes demand is coming later this year for opportunity zone investing.

“The market has been going up for so many years,” Thomas says. “I presume people are selling at a gain, or a significant portion of it is being sold at a gain.”

Number of Opportunity Zones in Each U.S. State/Territory; Source: Economic Innovation Group

Number of Opportunity Zones in Each U.S. State/Territory; Source: Economic Innovation Group

As noted above, this could create unexpected taxable events, including a large one-time capital gains tax payment. However, Thomas notes that these investors still have 180 days from the day they sold to roll their funds over into an opportunity zone fund to manage their tax exposure.

Thomas does note that opportunity zones are not risk-free opportunities, as up and coming areas are not always sure bets. However, he believes the tax deferral components of opportunity zone investing are enough for “opportunity zones to make sense.”

“Given that there are 8,700 Opportunity Zones, there is a potential for a wide range of alternatives that provide different levels of safety,” Thomas says. “The types of asset classes that are well suited for Opportunity Zones [or up and coming areas] tend to provide downside protection risk.”

Sortis Holdings, Inc. (OTC Pink: SOHI) Provides Strong Exposure to Opportunity Zones

Portland, Oregon-based alternative investment firm, Sortis Holdings, is one such company that could benefit from a potential surge in demand for opportunity zone funds.

Among its current investment fund offerings is its $100 million Sortis Opportunity Zone Fund, which primarily focuses on opportunities across the Western United States. The opportunity zone fund is structured as a diversified multi-asset fund, which provides quality opportunities across different assets and locations.

Source: Sortis Holdings

Source: Sortis Holdings

A key Sortis advantage is the company’s hybrid allocator-developer model, which allows the Sortis to diversify projects, partners, developments, and construction components. “Sortis is both a developer through its’ affiliated developer and an allocator of capital to third-party developers,” according to the company. This gives fund investors a chance to effectively play both roles on the best available projects.

Confirmation of Sortis’s opportunity zone and real estate expertise can be seen throughout its recent press releases and announcements.

In August 2019, Sortis announced that it had closed on a $59.8 million opportunity zone project for its $100 million fund. The project was Tukwila Village Phase II, which is an affordable multifamily development located in the suburban Seattle market.

The second phase of a two-phase project is comprised of 204 apartment units for adults 55 and older and will provide approximately 8,300 square feet of commercial & retail space with parking. The first building was recently completed and the second building will be complete in late 2020.

Sortis’s leadership operates a more thoughtful approach to its fund management. Rather than programmatically investing in a single asset class, the Sortis management team focuses on market trends and the current economic environment to inform their investment strategy.

Source: Sortis Holdings

Source: Sortis Holdings

For example, with a global pandemic ongoing, it is fair to say that building a new hotel during this period is very impractical. However, with the pandemic driving demand for vaccines and therapeutics to treat the emerging virus, common sense would suggest that focusing on life sciences/healthcare-based real estate projects is a more pragmatic approach given the current climate.

Another good potential example of a successful strategy in this environment would be to acquire and re-purpose big-box retail locations. With Sears, J.C. Penny’s, Macy’s, and just about every other legacy brick-and-mortar retailer closing stores at the fastest rate in decades, many of these locations sit idle. This presents an opportunity for these dormant buildings often in great locations to be acquired at a steep discount and re-purposed.

“We pride ourselves on providing wealth-building private investments through both lending and direct real estate investments,” said Paul Brenneke, Sortis founder. “The Sortis Opportunity Zone Fund will allow accredited investors to take advantage of our unique investment strategies while postponing, reducing and eliminating expensive capital gains tax they would otherwise have to pay.”

Overall, there is currently capital on the sidelines from 2019 year-end sellers and from early, which likely created capital gains events, as investors rush to lock-in their long-term returns from previous years. With a potential tax liability on the horizon, investors could utilize opportunity zones to help defer capital gains, while also maintain countercyclical exposure for downside protection. This means that year-end sellers have until June 2020 to roll their capital gains into an opportunity zone fund to qualify for deferment.

Sortis Holdings is one such investment firm that offers an opportunity zone fund, which has a track record of success. Management’s practicality and focus on market trends helps the company capitalize on the current market, rather than just indiscriminately building and developing real estate that may be currently out-of-demand. Sortis’s real estate expertise puts it at the forefront of the coming opportunity zone boom.

Disclaimer:

Spotlight Growth is compensated, either directly or via a third party, to provide investor relations services for its clients. Spotlight Growth creates exposure for companies through a customized marketing strategy, including design of promotional material, the drafting and editing of press releases and media placement.

All information on featured companies is provided by the companies profiled, or is available from public sources. Spotlight Growth and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. The information contained herein is based on external sources that Spotlight Growth believes to be reliable, but its accuracy is not guaranteed. Spotlight Growth may create reports and content that has been compensated by a company or third-parties, or for purposes of self-marketing. Spotlight Growth was compensated ten thousand dollars for the creation and dissemination of this content.

This material does not represent an investment solicitation. Certain statements contained herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may include, without limitation, statements with respect to the Company’s plans and objectives, projections, expectations and intentions. These forward-looking statements are based on current expectations, estimates and projections about the Company’s industry, management’s beliefs and certain assumptions made by management.

The above communication, the attachments and external Internet links provided are intended for informational purposes only and are not to be interpreted by the recipient as a solicitation to participate in securities offerings. Investments referenced may not be suitable for all investors and may not be permissible in certain jurisdictions.

Spotlight Growth and its affiliates, officers, directors, and employees may have bought or sold or may buy or sell shares in the companies discussed herein, which may be acquired prior, during or after the publication of these marketing materials. Spotlight Growth, its affiliates, officers, directors, and employees may sell the stock of said companies at any time and may profit in the event those shares rise in value. For more information on our disclosures, please visit: http://spotlightgrowth.com/index.php/disclosures/