– Vatsal Rai

July 12, 2024

Introduction

The world of investing offers a vast array of options, ranging from the dynamic and potentially high-reward nature of stocks to the tangible allure of real estate. Each choice presents unique opportunities and challenges, vying for an investor’s attention and capital. Amidst this bustling landscape lies a more stable and predictable category: fixed income investments.

Fixed income investments, often overlooked in favor of more glamorous options, provide a cornerstone of reliability in an investment portfolio. These investments typically include government bonds and corporate bonds, treasury bills, and other debt securities. Unlike stocks, which can fluctuate wildly based on market conditions, fixed income investments offer a predetermined return, making them an attractive option for risk-averse investors or those looking to diversify their portfolios with lower-risk assets. This approach is particularly relevant for those interested in income investing, where the focus is on generating steady income through interest payments.

This guide aims to provide a comprehensive understanding of fixed income investments. It will explain the fundamental concepts, such as how these investments generate returns through interest payments and the different types of fixed income securities available. Additionally, it will examine various investment vehicles within this category, detailing their specific features, benefits, and potential drawbacks. By highlighting the role that fixed income investments can play in an overall financial strategy, this primer will help investors appreciate how these assets can offer stability and predictability, balancing the volatility of other investments and contributing to a well-rounded portfolio through effective portfolio management.

What is Fixed Income Investing?

Unlike many investments, fixed-income investments don’t require selling to generate profits. To understand this, let’s consider bonds, one of the most common fixed-income investments.

A bond is essentially a loan you provide to a corporation or government, which pays you interest over time and returns the principal amount at the end of a specified period. This is a core concept in both bond investing and income investing. For instance, if you purchase a 10-year bond with a face value of $5,000 and a 3% interest rate, you will earn $150 annually for 10 years. Interest can be paid at various intervals, such as monthly, quarterly, or semi-annually. By the end of the 10 years, you will have earned $1,500 in interest, and the issuer will return your $5,000 principal.

The periodic interest payments from fixed-income investments are available for you to use as you wish. However, these payments are taxable as income, with various nuances involved. It’s important to note that bonds, like stocks, can be bought and sold on the secondary market, typically through an online brokerage. This market activity can cause their value to fluctuate above or below their initial cost. While selling a fixed-income investment for a profit is possible, most investors focus on the regular interest payments rather than capital gains, which is a key strategy in income investing.

Fixed-income investments also include other instruments like preferred stocks and bank certificates of deposit. Nonetheless, for many investors, corporate bonds and government bonds constitute the majority of their fixed-income portfolio. Effective portfolio management involves balancing these fixed-income securities to ensure a stable and predictable income stream while mitigating risks associated with market fluctuations.

Understanding the Market Dynamics

Fixed income markets react strongly to changes in monetary policy, particularly those made by the Federal Reserve. These adjustments significantly affect bond investing, including corporate bonds and government bonds, impacting bond yields, prices, and overall investment returns. Grasping these dynamics is essential for effective navigation of the fixed income market and portfolio management.

There is an inverse relationship between interest rates and bond prices: when interest rates rise, bond prices fall, and vice versa. This principle is fundamental to bond investing and is crucial for portfolio management strategies.

From 2008 to 2023, the U.S. bond market’s average annual return was only 2.81%, according to the Bloomberg US Aggregate Bond Index. U.S. Treasury bonds, a key component of government bonds, performed even worse, with an average annual return of just 2.35% during this period. This situation worsened in 2022 when the Fed’s aggressive rate hikes led to a significant 13% loss in the bond market. The Federal Reserve plays a crucial role in shaping the fixed income market through its monetary policy tools, primarily the federal funds rate. Changes in the Fed’s policy can greatly impact bond yields and prices, influencing strategies in income investing and bond investing.

Historically, bonds, including corporate bonds and government bonds, have performed well after the Fed pauses rate hikes, often due to subsequent loosening of monetary policy and falling interest rates. Between August 1984 and December 2021, the average total returns of the U.S. bond market following the end of a rate hike cycle were approximately 8% after six months and 13% after one year. Understanding these historical trends is crucial for effective portfolio management and developing successful income investing strategies.

Common Fixed Income Instruments

The fixed income market offers a broad spectrum of options, each with its unique balance of risk and reward:

Bonds: Bonds are the cornerstone of fixed income securities and a key element of bond investing. They function as loans you extend to an issuer, which could be a government entity (such as government bonds, including Treasury bonds) or a corporation (corporate bonds). Bonds have different credit ratings, indicating the issuer’s likelihood of default. Bonds with higher credit ratings tend to offer lower yields, reflecting their lower risk, while bonds with lower ratings offer higher yields to compensate for their higher risk of default. Corporate bonds carry greater risks and rewards compared to municipal and Treasury bonds. They make up around 19% of the U.S. fixed-income market and are an essential consideration in portfolio management.

Certificates of Deposit (CDs): CDs are time deposits issued by banks, offering a fixed interest rate for a set period. Generally, the longer the term of the CD, the higher the interest rate it pays. However, the trade-off is that your funds are locked in for the term’s duration, and early withdrawal can result in penalties.

Money Market Accounts: These are interest-bearing accounts similar to checking accounts but typically offer slightly higher yields. The downside is that they often come with restrictions on check-writing and may have lower liquidity compared to traditional savings accounts, making them a less flexible option.

Bond Mutual Funds and ETFs: These investment vehicles gather funds from numerous investors to buy a diverse portfolio of bonds, crucial for diversified bond investing. This diversification helps spread risk across various issuers and maturities, reducing the impact of any single bond’s performance. Bond mutual funds and ETFs vary in their risk and return profiles depending on the specific bonds they hold, offering options to suit different investment strategies and risk tolerances.

Municipal Bonds: State and local governments issue municipal bonds, akin to the federal government’s government bonds, but with an added advantage: federal tax exemption. Typically, the interest from municipal bonds is exempt from both federal and state taxes, though this can differ by state. However, they generally offer lower yields compared to other bonds and are often advised for investors in high tax brackets. Municipal bonds are considered low risk, as municipalities can impose new taxes to repay bondholders. From 1970 to 2022, the five-year default rate for municipal bonds was a mere 0.08%. These bonds are a stable option for income investing and are an integral part of strategic portfolio management.

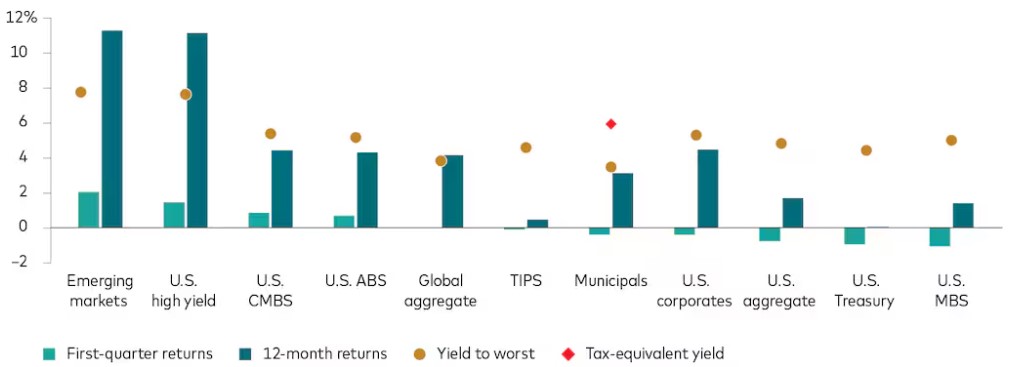

The chart above showcases the performance metrics across different fixed income sectors. This comparison reveals how various sectors, such as government bonds, corporate bonds, and municipal bonds, are performing relative to one another. By observing these performance trends, we can identify which sectors are gaining or losing value, offering insights into broader economic or market conditions. This information is crucial for investors, helping them make informed decisions about resource allocation to optimize returns and manage risks effectively.

Market on the Upside

Fixed income investing has recently regained attention due to rising interest rates. This might feel new, as it’s been a while since rates have been high enough to make such investments appealing. Despite this, fixed income assets have always been among the most critical asset classes due to their vast size and impact. Fixed income markets, including government bonds and corporate bonds, are even more vital to economies than stock markets. While stock market downturns can unsettle investors, disruptions in debt markets can lead to widespread panic and systemic economic issues, highlighting their fundamental importance.

For nearly four decades, interest rates have been declining, dropping from 15% to nearly zero, where they remained until about two years ago. This prolonged period of low rates made fixed-income investments less attractive. However, the recent surge in inflation has caused interest rates to rise sharply, making fixed-income securities more appealing and relevant once again.

Over the past decade, in pursuit of higher returns, investors have increasingly taken on greater risks by over-allocating to equities and moving towards lower-quality debt. This search for yield often meant sacrificing quality for potential gains. However, with central banks raising interest rates recently, there has been a significant and rapid shift in fixed-income yields. Notably, high-quality bonds, such as government bonds, are now offering much better returns. For the first time since 2007, more than 80% of the fixed-income market is yielding over 4%. This shift represents a substantial change in the investment landscape, providing new opportunities for investors seeking stable and reliable returns through income investing and bond investing.

The chart displays the market capitalization weights of assets with an average annual yield exceeding 4%. These assets are part of a select group that accounts for approximately 70% of the Bloomberg Multiverse Bond Index, a comprehensive measure of fixed-income securities.

To elaborate, the Bloomberg Multiverse Bond Index is a widely recognized benchmark that includes a diverse range of bonds from various global markets. By focusing on assets within this index that offer yields above 4%, the chart highlights those securities that potentially provide higher returns to investors. The market capitalization weights indicate the proportionate value of each asset within the selected universe, offering insight into their relative significance and performance in the fixed income market. This information can be crucial for investors seeking to optimize their portfolios through effective portfolio management by targeting bonds with favorable yield characteristics.

Benefits of Fixed Income Instruments

Fixed income investments are essential components of a diversified portfolio, offering multiple benefits that enhance stability and performance. Here’s a detailed look at how they contribute:

Income Generation: Fixed income investments, such as government bonds, corporate bonds, and certificates of deposit (CDs), provide a reliable and predictable stream of income. This steady cash flow is particularly beneficial for retirees who rely on their investments to cover living expenses without depleting their principal. Additionally, investors who seek regular income to meet financial obligations, such as mortgage payments or education costs, find fixed income investments advantageous. The interest payments from these investments can be scheduled, typically on a semi-annual or annual basis, ensuring a consistent income stream that helps in budgeting and financial planning. This approach aligns well with income investing strategies.

Volatility Reduction: One of the significant advantages of fixed income investments is their lower volatility compared to equities. Stocks can experience significant price swings due to market sentiment, economic data releases, or geopolitical events. In contrast, fixed income investments usually exhibit more stable price behavior. This stability stems from the predictable nature of their interest payments and the fixed terms associated with their maturity. By including fixed income securities in your portfolio, you can reduce its overall volatility, providing a cushion against the sharp fluctuations often seen in the stock market. This characteristic makes them an excellent choice for risk-averse investors or those looking to balance a more aggressive investment strategy with a safer, more stable component. Effective portfolio management incorporates these low-volatility assets to stabilize overall portfolio performance.

Capital Preservation: Fixed income investments are often seen as safer havens for preserving capital. Unlike equities, which can suffer from substantial price declines and potentially result in the loss of your principal, many fixed income securities, especially high-quality bonds, offer the return of principal upon maturity. This feature makes them particularly appealing during periods of economic uncertainty or market downturns. For instance, government bonds or highly-rated corporate bonds are less likely to default, providing assurance that your invested capital will be returned. This capital preservation aspect is crucial for investors nearing retirement or those with a low risk tolerance, as it ensures that a portion of their portfolio remains intact regardless of market conditions.

Enhancing Portfolio Diversification: In addition to income generation, volatility reduction, and capital preservation, fixed income investments play a vital role in enhancing overall portfolio diversification. Diversification involves spreading investments across different asset classes to reduce risk. Fixed income securities often have low or negative correlations with equities, meaning they may perform well when stock markets are underperforming. By integrating a mix of asset classes, including fixed income, into your portfolio, you can achieve a more balanced risk-return profile. This diversification helps in mitigating the impact of adverse market movements on your overall portfolio, providing a more stable investment experience over time. This strategy is a key component of robust portfolio management.

Inflation Protection: Certain types of fixed income investments, such as Treasury Inflation-Protected Securities (TIPS), offer protection against inflation. Inflation erodes the purchasing power of money, and traditional fixed income securities can suffer as a result. However, TIPS are designed to increase their principal value with inflation, as measured by the Consumer Price Index (CPI). This adjustment ensures that your investment maintains its real value over time, preserving your purchasing power and providing an additional layer of financial security.

Customization and Flexibility: Fixed income investments offer a range of options that can be tailored to meet individual financial goals and risk appetites. Investors can choose from government bonds, municipal bonds, corporate bonds, and other instruments, each with varying levels of risk and return. This flexibility allows for the creation of a customized fixed income portfolio that aligns with specific investment objectives, such as maximizing income, enhancing capital preservation, or achieving a particular investment horizon.

This chart showcases the performance of 11 different fixed-income asset classes over a decade. Selecting any asset class demonstrates the flexibility available. The chart highlights the significance of diversification, as the performance of each category fluctuates yearly. A top performer one year might lag the next. Diversification can help lessen market risk but doesn’t eliminate it or guarantee profit or protection against loss in a declining market. Nevertheless, spreading investments across various fixed-income categories may help reduce losses.

Conclusion

Fixed income investments have long been a cornerstone of balanced portfolios, offering stability, predictable income, and risk mitigation. As we’ve explored in this primer, these assets play a crucial role in financial strategies, particularly in today’s evolving economic landscape.

The recent upswing in interest rates has breathed new life into fixed income markets, making them increasingly attractive to investors. After decades of declining rates, we’re witnessing a shift that has propelled yields to levels unseen in years. This resurgence offers investors fresh opportunities to generate steady income while preserving capital, a combination that’s especially appealing in uncertain economic times. However, the fixed income market is not without its complexities. The inverse relationship between interest rates and bond prices, the varying risk profiles of different instruments such as corporate bonds and government bonds, and the impact of economic policies all contribute to a dynamic environment that requires careful navigation. Investors must remain vigilant, continuously assessing market conditions and adjusting their strategies accordingly.

Diversification remains a key principle in bond investing. As we’ve seen, different sectors and instruments can perform variably year over year. By spreading investments across various fixed income categories – from government bonds and corporate bonds to municipal securities and bond funds – investors can potentially mitigate risks and optimize returns. Effective portfolio management involves balancing these diverse assets to achieve a stable and predictable income stream while minimizing exposure to market volatility.

Looking ahead, fixed income investments are likely to maintain their significance in portfolio construction. Their ability to provide stable income, reduce overall portfolio volatility, and offer a hedge against economic uncertainties makes them indispensable, especially as global economic conditions remain unpredictable.

For individual investors, the key lies in understanding personal financial goals, risk tolerance, and investment horizon. Whether seeking to generate regular income, preserve capital, or balance riskier investments, fixed income securities offer a range of options to meet diverse needs. As we move forward, staying informed about market trends, economic indicators, and policy changes will be crucial for successful income investing. While past performance doesn’t guarantee future results, the historical resilience and adaptability of fixed income markets suggest they will continue to play a vital role in investment strategies.

In conclusion, fixed income investing, with its blend of stability and income generation, remains a powerful tool in the investor’s arsenal. By leveraging the knowledge gained from this primer and staying attuned to market dynamics, investors can harness the potential of fixed income securities to build robust, balanced portfolios suited to navigate the complexities of today’s financial landscape.

References

[1] “Fixed-Income Investments for a Diversified Portfolio.” n.d. NerdWallet. https://www.nerdwallet.com/article/investing/fixed-income-investments.

[2] “Fixed-Income Investing: Seizing a Lucrative Opportunity.” n.d. Wharton Executive Education. Accessed July 9, 2024. https://executiveeducation.wharton.upenn.edu/thought-leadership/wharton-at-work/2024/02/fixed-income-investing/.

[3] “Fixed Income Investing | IShares.” n.d. BlackRock. Accessed July 9, 2024. https://www.blackrock.com/se/individual/etfs-and-indexing/fixed-income/why-indexing#portfolio-construction.

[4] published, Adam Lampe. 2024. “Are Bonds Back? A Fresh Look at Fixed Income in 2024.” Kiplinger.com. March 29, 2024. https://www.kiplinger.com/investing/are-bonds-back-a-fresh-look-at-fixed-income.

[5] “Investing Concepts.” 2014. https://www.thriventfunds.com/content/dam/thrivent/mcs/site-media/insights/market-update/quilt-charts-asset-class-sector-and-fixed-income-performance-past-10-years/33094K-Fixed-Income.pdf.

[6] “Active Fixed Income Perspectives Q2 2024: Data Dependent.” n.d. Advisors.vanguard.com. https://advisors.vanguard.com/insights/article/series/active-fixed-income-perspectives#trying-to-find-a-landing.