– Vatsal Rai

July 01, 2024

Introduction

Real Estate Investment Trusts (REITs) have gained significant traction as a favored investment vehicle, providing investors with the opportunity to access the real estate market without the complexities and responsibilities of direct property ownership. These investment instruments enable individuals to benefit from the potential income and economic growth associated with real estate, while enjoying the liquidity and diversification that come with publicly traded securities. However, a critical aspect of investing in REITs involves understanding their relationship with interest rates, as this factor can significantly influence stock market performance.

A common belief is that rising interest rates are detrimental to REITs, potentially leading to decreased returns and reduced investor interest. This perspective stems from the idea that higher interest rates increase borrowing costs for REITs and make alternative income-generating investments, such as bonds, more attractive. Nonetheless, the impact of interest rates on REITs is far from straightforward and warrants a deeper examination. In reality, the relationship between interest rates and REITs is multifaceted and depends on various factors, including the broader economic environment, the specific type of REIT, and the underlying real estate assets. For instance, while higher interest rates may pose challenges, they can also be indicative of a robust economy, which can drive demand for real estate and, consequently, benefit REITs. Additionally, some REITs, particularly those focused on sectors like healthcare or residential properties, may exhibit different sensitivities to interest rate changes compared to others.

This article aims to shed light on the intricacies of how interest rates impact REITs, providing valuable insights for investors seeking to navigate this dynamic landscape. By examining the interplay between economic conditions, interest rates, and the diverse range of REITs available, investors can make more informed decisions and better position themselves to achieve their investment objectives.

Identifying the Correlation

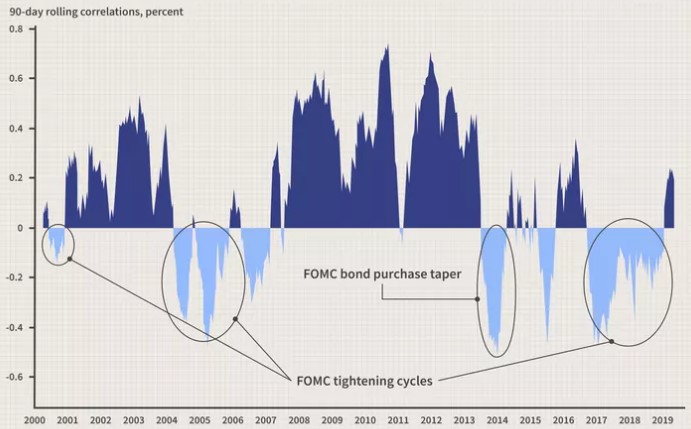

During periods of economic growth, Real Estate Investment Trusts (REITs) generally experience an increase in their prices, which often occurs alongside rising interest rates. This pattern is largely due to the fact that a flourishing economy enhances the value of real estate assets, thereby boosting the value of REITs. As the economy expands, the demand for financing grows, leading to higher interest rates. Conversely, in a slowing economy where the Federal Reserve tightens monetary policy, this relationship reverses. In such scenarios, REIT prices may decline even as interest rates rise. This dynamic is depicted in a chart that illustrates the correlation between REIT total returns and the yields on 10-year Treasury bonds from 2000 to 2019. Throughout most of this period, REIT returns and interest rates showed a positive correlation, typically moving in the same direction. For example, between 2001-2004 and 2008-2013, both REIT returns and interest rates increased. However, there were also times of negative correlation, particularly after 2004, 2013, and 2016. These inversions are often linked to the Federal Reserve’s monetary tightening policies, which usually followed periods of monetary stimulus implemented in response to economic recessions. During such times, despite rising interest rates, REIT values declined.

Fig.1 – Correlation between REIT total returns and 10-year treasury yields[3]

Rising interest rates often coincide with factors that strengthen the fundamentals of Real Estate Investment Trusts (REITs). One major factor is economic growth, which tends to accompany higher interest rates. When the economy is expanding, businesses and consumers are more inclined to invest in and use real estate, leading to higher demand and increased occupancy rates. This surge in demand supports the growth of REIT earnings, cash flow, and dividends. In a robust economy, higher interest rates reflect greater economic activity, which benefits the real estate market and, consequently, REITs. As a result, REITs can thrive in an environment of rising interest rates, provided the economic fundamentals remain strong.

REIT Performance During Sustained Periods of Rising Interest Rates

When the 10-year bond yield is on the rise, several factors often align to benefit REIT (Real Estate Investment Trust) fundamentals. Typically, a rise in long bond yields is linked with heightened economic activity and inflation, both of which tend to positively impact REITs. Economic expansion usually leads to greater demand for real estate investments, driven by rising employment rates. As more people find jobs, businesses expand, leading to higher occupancy rates in commercial properties. This increased demand for space allows landlords to raise rents, as growing firms are willing to pay more to secure the necessary office or retail space. Consequently, these higher rents translate into improved cash flows for REITs. Additionally, as REITs collect more rent, they can distribute larger dividends to their investors, thereby enhancing their overall valuations. Thus, the environment of rising bond yields can foster a favorable climate for REITs, bolstering their financial performance and market appeal.[5]

Fig.2 – REIT Performance During Sustained Periods of Rising Interest Rates[5]

REIT Stock Market Performance and Interest Rate Environment

REIT share prices, like the broader stock market, often respond to changes in interest rate outlooks. These changes include both short-term rates set by the Federal Reserve and long-term rates influenced by market forces.

Historically, there has generally been a positive correlation between rising interest rates and REIT returns over extended periods. This correlation exists because rising rates typically reflect improvements in underlying economic fundamentals. Market interest rates tend to increase when macroeconomic conditions are strengthening, which often drives positive REIT investment performance. Strengthening macroeconomic conditions usually lead to higher occupancy rates, robust rent growth, increased funds from operations (FFO) and net operating income (NOI), rising property values, and higher dividend payments to investors.

Fig. 3 – REIT Total Returns & Rate Changes[1]

The figure above[1] demonstrates the relationship between the four-quarter change in the 10-year Treasury yield and the four-quarter total return on the FTSE Nareit All Equity REIT Index. From Q1 1992 to Q4 2022, REITs posted positive total returns in 82% of months with rising Treasury yields, showcasing the strong link between improving economic conditions and REIT performance.[1]

Real Estate Investment Trusts (REITs) have often surpassed the performance of broad equity indexes during numerous periods marked by rising interest rates. The accompanying figure below demonstrates the relationship between the four-quarter change in the 10-year Treasury yield and the difference in four-quarter total returns between the FTSE Nareit All Equity REIT Index and the S&P 500. This data highlights that REITs outperformed the S&P 500 in more than half of the instances when Treasury yields increased from Q1 1992 to Q4 2022. This trend indicates that REITs can be a resilient investment option even in fluctuating interest rate environments.[1]

Fig. 4 – REIT vs S&P 500 Total Returns & Rate Changes[1]

Explaining the Relation

Determining why Real Estate Investment Trusts (REITs) have generally performed well in rising interest rate environments would require a much more detailed study. However, it is evident that rising interest rates are linked with factors that positively influence REIT fundamentals. For instance, rising interest rates often accompany economic growth and increased inflation, both of which can be beneficial for real estate investments. When the economy grows healthily, there is typically a higher demand for real estate, leading to higher occupancy rates. This, in turn, supports the growth of REIT earnings, cash flow, and dividends. Additionally, during periods of inflation, real estate owners usually have the capacity to raise rents. Historically, this has allowed REIT dividend growth to outpace the rate of inflation. As shown in the below figure, the income component of REIT returns has surpassed inflation, as measured by the Consumer Price Index (CPI), in 14 out of the past 15 years. This correlation between rising interest rates, economic growth, and inflation demonstrates why Real Estate Investment Trusts have generally thrived in such environments.

Fig. 5 – REIT Income has outpaced inflation[2]

REITs as a Potential Inflation Buffer

Even as the Federal Reserve and other central banks raise rates to combat rising prices, we believe inflation is likely to remain higher than it was during the previous economic cycle. Listed real estate possesses distinct characteristics that can help cushion the impact of inflation and support stock market performance. For instance, sectors with shorter lease durations, such as self-storage, can promptly adjust rents as conditions change. In scenarios of slow economic growth or even recession, longer inflation-linked rental contracts offer the potential for relatively strong and steady income growth.

Moreover, while inflation can hurt company profits when costs rise faster than revenues, REITs typically enjoy operating margins of around 60%, which helps mitigate the impact of higher costs. Additionally, increased costs for land, materials, and labor can reduce the profitability of new developments. This raises economic barriers to new supply and diminishes potential competition for existing properties.

Fig 6 – Returns during varying periods of inflation[4]

Traditional asset allocations may offer less protection against a prolonged period of higher inflation compared to real estate assets. Historically, real estate has performed well during periods of elevated inflation, providing a more reliable safeguard against prolonged inflationary pressures as explained by the above figure.

Conclusion

The relationship between Real Estate Investment Trusts and interest rates is more nuanced and complex than commonly perceived. While conventional wisdom suggests that rising interest rates negatively impact REITs, our analysis reveals a more intricate dynamic. Historical data demonstrates that REITs have often performed well during periods of rising interest rates, frequently outpacing broader equity indexes and showing strong stock market performance. This trend is often linked to underlying economic growth, which supports the real estate market and, consequently, REITs.

This counterintuitive performance can be attributed to several factors. First, rising interest rates often coincide with economic growth, which typically leads to increased demand for real estate, higher occupancy rates, and stronger rent growth. These fundamental improvements can offset the potential negative effects of higher borrowing costs for REITs. Second, REITs have shown resilience in inflationary environments, with their income component frequently outpacing inflation over the past decade and a half.

The diverse nature of the REIT market also plays a crucial role in their performance during varying interest rate environments. Different REIT sectors may respond differently to rate changes, with some benefiting from shorter lease durations that allow for quicker rent adjustments, while others gain from longer inflation-linked contracts providing stable income growth.

Investors should consider Real Estate Investment Trusts as a potential buffer against inflation, particularly in a landscape where inflation may remain higher than in previous economic cycles. The unique characteristics of real estate investments, such as the ability to adjust rents and high operating margins, can provide a degree of protection against inflationary pressures.

In conclusion, while interest rates remain an important factor to consider when investing in Real Estate Investment Trusts, they should not be viewed in isolation. The broader economic context, specific REIT sectors, and underlying real estate fundamentals all play crucial roles in determining REIT and stock market performance. As with any investment, a comprehensive understanding of these various factors is essential for making informed decisions in the dynamic world of REIT investing.

References

[1] “REITs and Interest Rates.” n.d. Www.reit.com. https://www.reit.com/investing/reits-and-interest-rates.

[2] Orzano, Michael, and John Welling. 2017. “RESEARCH Real Estate CONTRIBUTORS the Impact of Rising Interest Rates on REITs.” https://www.spglobal.com/spdji/en/documents/research/the-impact-of-rising-interest-rates-on-reits.pdf.

[3] “Are REITs Beneficial during a High-Interest Era?” n.d. Investopedia. https://www.investopedia.com/articles/investing/091615/are-reits-beneficial-during-highinterest-era.asp

[4] “Rising rents matter more to REITs than rising rates” n.d. Cohen & Steershttps://www.cohenandsteers.com/insights/rising-rents-matter-more-to-reits-than-rising-rates/

[5] “Starlight Capital – Impact of Rising Interest Rates on REITs.” n.d. Starlight Capital. https://starlightcapital.com/en/insights/impact-of-rising-interest-rates-on-reits.