-Shekhar Tripathi

March 22, 2024

Introduction

In the dynamic realm of alternative investments, private debt funds have emerged as a compelling opportunity, offering investors the potential for attractive returns and portfolio diversification. These specialized investment vehicles provide debt financing to companies and projects that may not have access to traditional lending sources, such as banks or public markets. However, the private debt landscape is vast and intricate, with a multitude of factors that can significantly impact investment outcomes. This article delves into the critical differentiators that separate one private debt fund from another, equipping investors with the knowledge to make informed decisions and potentially enhance their overall investment strategies.

Understanding Private Debt Funds

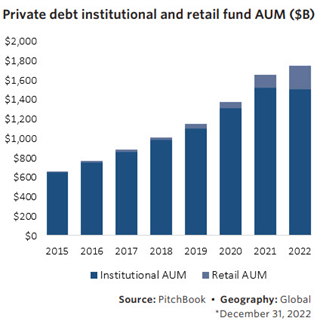

Before exploring the key differentiators, it is essential to understand the fundamental nature of private debt funds. These funds operate as investment vehicles that provide debt financing in the form of loans or similar credit instruments to borrowers outside of traditional lending channels. The private debt market has experienced substantial growth in recent years, driven by factors such as tighter banking regulations, increased demand for alternative sources of capital, and the potential for attractive risk-adjusted returns. According to PitchBook, a leading provider of VC, PE, and M&A data, the global private debt market has been booming during the last fifteen years, going from $280 billion of assets under management (AUM) in 2007 to a staggering $1.75 trillion in assets under management (AUM) as of 2022.[1] This growth trajectory underscores the increasing importance of private debt funds in the alternative investment landscape. It is now fully recognized as one of the primary strategies for alternative investment funds and represents approximately 12% of the global alternatives market.[1]

(source: pitchbook.com)

Private lenders from private debt funds have become references for companies, allowing them to bypass traditional banks when seeking to take out loan facilities. Per Oaktree Capital’s Insights Report issued on May 2021, US banks and securities firms were responsible for over 70% of the loan issuance on the primary market for corporate loans in 1994, compared to 10% in 2020.[2]Believing that rising rates, inflationary pressures, and economic uncertainty offer a few unique advantages for investors, most of the major private equity players have been channelling an increasing share of their assets into the private debt market. Furthermore, there is an estimated $2.72 trillion of global dry powder in private equity, as of September 2023, which points to an optimistic outlook.[3] In its latest five-year private markets outlook, Preqin forecasts that private credit will nearly double in size reaching $2.8 trillion by the end of 2028, after most investors it surveyed confirmed that they expect to invest even more money in this asset class. Along with Preqin’s survey’s results, some asset managers are optimistic about the outlook of the private credit market considering that retail investors will get access to those funds, such as Blackrock, which recently predicted that the industry would hit $3 to $5 trillion.[4]

Types of Private Debt Funds

According to Preqin[12], the majority of institutional investors allocating capital to private debt focus on commitments to unlisted private debt funds. These unlisted private debt funds differ according to strategy, for example, direct lending or fund of funds. They also differ depending on the type of debt provided, such as senior debt or mezzanine debt.

- Direct Lending: Non-bank lenders extending loans to small and medium enterprises (SMEs).

- A direct lending fund issues loans directly to companies.

- The type of debt issued, such as senior or subordinated, depends on the fund’s strategy.

- Distressed Debt: Buying the debt of companies that are in bankruptcy or likely to enter bankruptcy.

- A distressed debt fund is similar to direct lending but only targets distressed opportunities.

- The debt issued tends to be senior, and therefore high in the capital structure, due to the substantial threat of liquidation.

- Debt may be bought at a significant discount, with the goal being that the value of the company improves after the debt investment.

- Mezzanine: A hybrid of equity and debt finance.

- A mezzanine fund only issues mezzanine debt to companies.

- Debt issued has conversion rights to equity with embedded equity options if the borrower defaults.

- Fund of Funds: A private pool of institutional investor capital that invests in several private debt funds.

- A private debt fund of funds invests in a variety of third-party debt funds depending on the fund strategy.

- Provides greater portfolio diversification for institutional investors.

- Special Situations: A loan based on a ‘special situation,’ referring to something other than underlying company fundamentals.

- A special situations fund focuses on companies whose value may be impacted by a certain event, including company spin-offs, mergers & acquisitions, or tender offers.

- This can include both debt and equity investments.

- Venture Debt: A loan provided to a start-up or early-stage company.

- Provides loans to act as growth capital for equipment financing, or as accounts receivable finance.

Critical Differentiators

- The Loan-to-Value (LTV) Ratio: A Measure of Risk

One of the most critical differentiators among private debt funds is the loan-to-value (LTV) ratio, a metric used to assess the risk associated with a loan. The LTV ratio is calculated by dividing the loan amount by the value of the underlying collateral or asset. A lower LTV ratio generally indicates a lower risk profile, as there is a greater cushion of collateral value to cover potential losses in the event of default.

(source: commloan.com)

For example, a private debt fund focused on real estate lending may target LTV ratios of 60% or lower, providing a significant margin of safety in case property values decline. According to a report by Nuveen, a financial planning firm, real estate debt funds typically target LTV ratios ranging from 50% to 65%, with some funds accepting higher ratios for more opportunistic investments.[5]

In contrast, a fund specializing in distressed debt or special situations may be willing to accept higher LTV ratios in exchange for potentially higher returns, as these investments often involve greater risk. A study by Robert Newstead from Gaurdrail Finance found that distressed debt funds, on average, targeted LTV ratios between 65% and 85%, reflecting their willingness to take on more risk in pursuit of higher potential returns.[6]

- Collateral: A Crucial Consideration

The type of collateral securing a loan is another critical differentiator among private debt funds. Collateral can take many forms, including real estate, equipment, intellectual property, or other tangible or intangible assets. The quality and liquidity of the collateral play a significant role in determining the risk profile of the investment and the potential recovery in the event of a default.

For instance, a private debt fund focused on asset-based lending may prioritize loans secured by high-quality, liquid collateral, such as accounts receivable or inventory. According to a report by the International Finance Corporation (IFC), asset-based lending funds typically accept collateral with loan-to-value ratios ranging from 50% to 85%, depending on the liquidity and quality of the underlying assets.

On the other hand, a fund specializing in project finance may accept collateral in the form of long-term contracts, concessions, or other less liquid assets, reflecting the unique nature of the underlying investment. A study by Preqin found that project finance funds often accept collateral with lower liquidity, such as power purchase agreements or infrastructure concessions, as these assets are integral to the viability of the project.

The quality and liquidity of collateral can have a substantial impact on a fund’s ability to recover its investment in the event of a default or restructuring. Funds that prioritize high-quality, liquid collateral may sacrifice potential returns but benefit from a lower risk profile and potentially smoother exit strategies.

- Workout Capabilities: Maximizing Value in Distressed Situations

Another key differentiator among private debt funds is their ability to execute successful workouts in distressed situations. A workout refers to the process of restructuring or renegotiating the terms of a loan to maximize the recovery value for investors. Funds with strong workout capabilities can often generate superior returns by navigating complex restructurings, negotiating with other creditors, and implementing operational improvements.

Funds with experienced teams and a track record of successful workouts can be particularly appealing to investors, as they demonstrate the ability to create value even in challenging situations. These funds may have specialized expertise in specific industries or asset classes, enabling them to identify and capitalize on opportunities that others might overlook. According to a report by the Alternative Investment Management Association (AIMA), funds with robust workout capabilities often employ dedicated restructuring teams with diverse skill sets, including legal, operational, and industry-specific expertise.[6] These teams can negotiate more favorable terms, implement operational improvements, and potentially unlock additional value through asset sales or strategic partnerships.

- Property Type and Industry Focus

For private debt funds focused on real estate or specific industries, the property type and industry focus can be a critical differentiator. Different property types, such as multifamily residential, office, retail, or industrial, carry unique risk profiles, market dynamics, and operational considerations. Similarly, funds that concentrate on particular industries, such as healthcare, energy, or technology, may have specialized knowledge and expertise that can inform their investment decisions and risk management strategies.

- Real Estate Private Debt Funds:

A report by McKinsey & Co. highlights that the real estate private debt market has experienced significant growth, with assets under management increasing 15.4 percent year-over-year in 2022, outpacing the annualized average since 2016 by nearly five percentage points.[7] Within this market, funds often specialize in specific property types, each with its own dynamics and considerations.

For example, a private debt fund specializing in multifamily residential properties may have a deep understanding of local housing markets, rental trends, and property management best practices, enabling them to better evaluate and mitigate risks associated with these investments. According to a study by Ellie Perlman of Blue Lake Capital, the multifamily sector has experienced strong performance, with an average annual return of 10.5% over the past two decades.[8]

In contrast, a fund focused on office or retail properties may need to navigate challenges such as changing workplace trends, e-commerce disruption, and evolving consumer behaviors. These funds may prioritize investments in prime locations, high-quality tenants, and properties with strong long-term leases to mitigate risk.

b. Industry-Specific Private Debt Funds:

Private debt funds that concentrate on specific industries, such as healthcare, energy, or technology, can leverage deep sector expertise to identify attractive investment opportunities and manage risks more effectively.

For instance, a healthcare-focused fund may have a comprehensive understanding of regulatory landscapes, reimbursement models, and emerging trends in the industry. This knowledge can inform their due diligence processes, enabling them to better assess the viability of potential borrowers and the risks associated with specific investments.

According to a report by Russel Investments, the healthcare private debt market has experienced significant growth, driven by factors such as aging populations, increasing healthcare expenditures, and the need for capital investment in healthcare facilities and technologies.[9]

Similarly, energy-focused private debt funds may have specialized expertise in evaluating energy projects, assessing resource availability, and navigating complex regulatory environments. With the ongoing energy transition and the increasing focus on renewable energy sources, these funds may prioritize investments in sustainable energy projects or companies involved in the development and deployment of clean technologies.

5. Regulatory and Tax Considerations

As with any alternative investment, it is essential to consider the regulatory and tax implications of investing in private debt funds. These funds are often subject to different rules and regulations compared to traditional investments, and investors should thoroughly understand the specific requirements and restrictions.

- Regulatory Landscape:

Private debt funds are typically structured as limited partnerships or similar vehicles and may fall under various regulatory frameworks depending on their investment strategies, investor base, and geographic focus. In the United States, for example, many private debt funds are subject to regulation by the Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940 or the Investment Company Act of 1940.

Additionally, funds focused on specific asset classes or industries may face additional regulatory oversight. For instance, private debt funds investing in real estate may need to comply with real estate-specific regulations, such as the Real Estate Settlement Procedures Act (RESPA) or the Truth in Lending Act (TILA).

b. Investor Accreditation:

Private debt funds often have specific accreditation requirements for investors, limiting access to only qualified individuals or institutions. In the United States, these funds typically rely on exemptions from registration under Regulation D of the Securities Act of 1933, which restricts them from soliciting funds from non-accredited investors .According to the SEC, an accredited investor must meet certain income or net worth thresholds, such as having an individual income of at least $200,000 or a net worth of at least $1 million, excluding the value of their primary residence.[10] These requirements aim to ensure that investors in private debt funds have the financial sophistication and risk tolerance to participate in these types of investments.

c. Tax Implications:

The tax treatment of investments in private debt funds can vary depending on the fund’s structure, investment strategies, and the investor’s individual circumstances. In general, investors in private debt funds may be subject to different tax rates on ordinary income, capital gains, and other types of investment income.

For example, in the United States, income from interest payments on loans may be treated as ordinary income and taxed at the investor’s marginal tax rate. However, certain types of income, such as gains from the sale of distressed debt or equity positions acquired through a workout process, may be treated as capital gains and potentially taxed at lower rates. [11]

It is crucial for investors to consult with tax professionals to understand the specific tax implications of investing in private debt funds and to ensure compliance with all relevant tax laws and regulations.

Conclusion & The Sortis Income Fund

Navigating the world of private debt funds requires a deep understanding of the critical differentiators that separate one fund from another. By carefully evaluating factors such as loan-to-value ratios, collateral quality, workout capabilities, property type or industry focus, and regulatory considerations, investors can make informed decisions and potentially enhance their overall investment outcomes. As the private debt market continues to evolve and grow, staying informed about these key differentiators will become increasingly important for those seeking to capitalize on the opportunities within this alternative asset class.

One compelling option for investors is the Sortis Income Fund (SIF), an evergreen, unleveraged private credit fund focused on senior secured loans backed by commercial real estate collateral in the Western United States. With over 7 years of successful operations, SIF has demonstrated a strong track record of preserving principal and generating attractive risk-adjusted returns with over 28 consecutive profitable quarters, distributing over $40 million to investors to date. By leveraging the team’s extensive experience of over 30+ years in real estate investment, development, and asset management, SIF employs a disciplined underwriting approach and tailored loan structuring to meet the specific needs of borrowers while prioritizing downside protection for investors.Additionally, Sortis offers the Sortis Edge platform, providing access to a diverse range of alternative investment opportunities beyond private credit. With a focus on identifying emerging trends and capitalizing on market inefficiencies, Sortis Edge allows investors to diversify their portfolios across a spectrum of alternative asset classes, further enhancing their potential for risk-adjusted returns. Learn more about Sortis here.

References:

[1] PitchBook. (2023). Investors Continue to Flock to Private Debt https://pitchbook.com/newsletter/investors-continue-to-flock-to-private-debt

[2] Oaktree Insights. (2021). Direct Lending: Benefits, Risks and Opportunities.

[3] S&P Global Market Intelligence. (2023). Private Credit Boom Continues

[4] Bloomberg. (2023). BlackRock Says Private Debt Will Double to $3.5 Trillion by 2028.

[5] Nuveen. (2024). U.S. Commercial Real Estate Debt: Discovering beneficial routes of exposure https://www.nuveen.com/global/insights/alternatives/high-yield-debt

[6] Robert Newstead. (2024). Understanding Loan-to-Value (LTV) Ratios

https://www.linkedin.com/pulse/understanding-loan-to-value-ltv-ratios-robert-newstead-afjpe

[7] McKinsey & Co. (2022). Private market Rallies to New Heights. https://www.mckinsey.com/~/media/mckinsey/industries/privateequity/2022/mckinseys-private-markets-annual-review-private-markets-rally-to-new-heights-vf.pdf

[8] Blue Lake Capital. (2023). Why Ultra High Net Worth Investors Remain Confident in Multifamily Investments. https://www.linkedin.com/pulse/why-ultra-high-net-worth-investors-remain-confident-ellie-perlman

[9] Russell Investments. (2021). Why Hospitals and Healthcare Systems Should Consider Private Credit.

https://russellinvestments.com/us/blog/private-credit-hospitals-healthcare-systems

[10] U.S. Securities and Exchange Commission. (2023). Accredited Investors. https://www.investor.gov/introduction-investing/investing-basics/glossary/accredited-investors

[11] Lexology. (2022). Taxation of Credit Funds in USA

https://www.lexology.com/library/detail.aspx?g=5c14b61e-dba7-4659-b0b6-496d7070495f

[12] Preqin. (2022). Private Debt

https://www.preqin.com/academy/lesson-4-asset-class-101s/private-debt