– Vatsal Rai

August 8, 2024

Introduction

The housing market has once again entered an election year. With the US presidential election set for November 2024, homeowners, investors, and economists are keen to anticipate its impact. There is a sense of unease among many. A recent survey by Investopedia revealed that over 61% of investors are concerned about how the 2024 US presidential election might affect their portfolios.[3] But is this concern justified? Do elections indeed pose a significant threat to the housing market? Let’s delve into how real estate markets typically behave during an election year.

Overall market performance

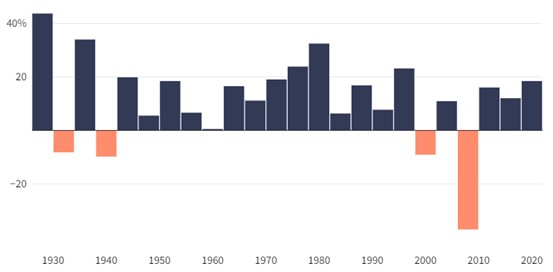

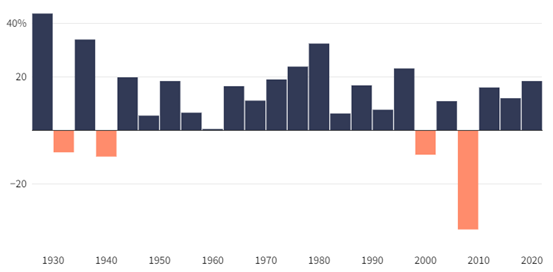

Fig. 1 – S&P recorded positive performance in 83% of the last 24 election years[3]

Although past performance doesn’t guarantee future results, studying market behavior during previous election years can be reassuring for anxious investors. Historical patterns reveal that the stock market often rises in presidential election years. Specifically, the S&P 500 has shown positive returns in 20 out of 24 election years since 1928, translating to an impressive 83.3% of the time.[3]

Data from First Trust illustrates that the average return for these election years stands at 11.58%, which significantly surpasses the S&P 500’s average return of 9.81% for all years since 1928.[3] This trend suggests that election years may provide a favorable backdrop for market performance, potentially easing investor concerns.

What History Shows Us?

Although the common belief is that presidential elections negatively impact the housing market, recent data suggests otherwise. An analysis by Bankrate of the S&P CoreLogic Case-Shiller Home Price Index reveals that during the nine elections since 1987, home price appreciation exceeded that of the 28 non-election years. On average, home prices increased by 4.84 percent in election years since 1987, compared to a 4.44 percent rise in non-election years, based on Case-Shiller data.[1] This could suggest that presidential elections benefit the housing market, but the situation is more complex.

For example, 2008 was the worst year for the housing market in recent memory, with home values plummeting by 12 percent, unrelated to the Obama-McCain election battle. The decline was due to the economic timing, as the housing bubble from 2004 to 2007 burst and the global economy crashed. Conversely, 2004 was one of the best years for home prices, with a 13.4 percent increase, primarily driven by the inflating housing bubble, not George W. Bush’s re-election.[1]

In 2015, buyer demand stayed consistent leading up to the May election, then surged in the following month, showing an 18% increase compared to the previous year.[5] Similarly, in 2019, demand remained steady in the months before the December election, with a 13% annual increase that month. This was followed by a 14% annual rise in buyer demand in January 2020.[5]

The highest home value appreciation since 1987 occurred in 2021, with a 18.9 percent surge, attributed to record-low mortgage rates and the COVID-19 housing boom, rather than being Joe Biden’s first year in office.[1] Historically, the housing market shows little difference in performance between presidential election years and other years.

What happens with Prices, Mortgages?

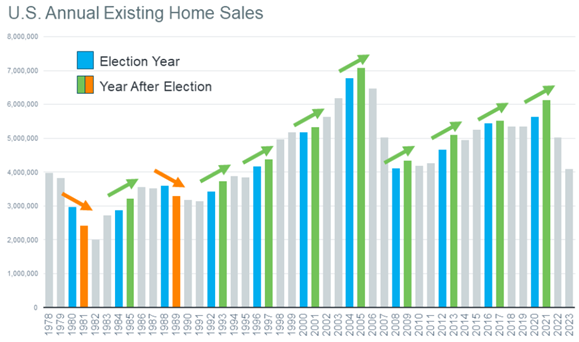

During November of Presidential election years, there’s often a slight dip in home sales. This occurs mainly because some people feel uncertain and hesitant about making significant decisions during such a pivotal time. However, this slowdown is temporary. Historically, home sales recover in December and continue to climb the following year.

Data from the Department of Housing and Urban Development (HUD) and the National Association of Realtors (NAR) indicates that home sales have increased the year following nine of the last eleven Presidential elections.

Fig. 2 – Home Sales went up after 9 of the last 11 presidential elections[2]

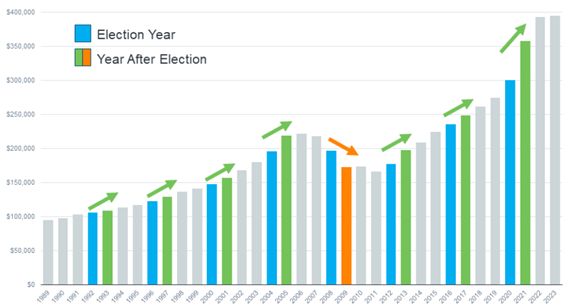

Fig. 3 – US Annual Median Home Sale price[2]

Home prices tend to be quite stable, typically increasing year-over-year regardless of elections. Recent NAR data reveals that in seven of the last eight Presidential elections, home prices rose the subsequent year. The only instance of a decline, highlighted in orange, occurred during the housing market crash, an anomaly in an otherwise consistent trend. Today’s market conditions differ significantly from those of that period. The green bars in the data indicate years where prices increased after the election.

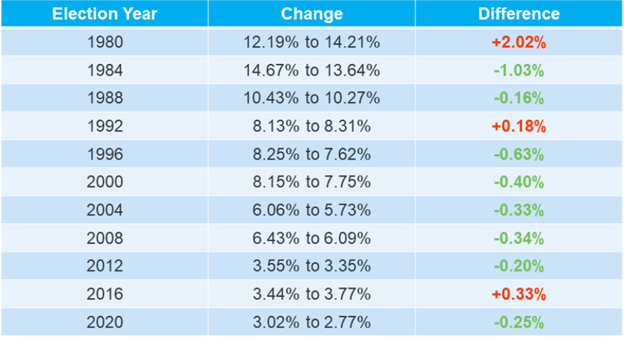

Mortgage rates play a crucial role in determining your monthly mortgage payment when purchasing a home. Freddie Mac’s data reveals that in eight out of the last eleven Presidential election years, mortgage rates dropped from July to November. Most projections anticipate a slight decline in mortgage rates for the rest of the year. If these predictions hold true, this year will follow the pattern of falling rates seen in most past election years. For potential homebuyers, this trend could be advantageous, as lower rates can lead to reduced monthly payments.

Fig. 4 – Mortgage rates have decreased in the lead up to 8 of the last 11 elections[2]

How to Navigate the market?

Navigating the housing market during presidential election years can be challenging, but there are effective strategies for homebuyers and sellers:

- Stay Updated: Keep abreast of election-related developments and their potential effects on the economy and housing market.[4] Pay attention to trends in interest rates, housing inventory, and local market conditions.

- Consult Professionals: Collaborate with experienced real estate agents, mortgage lenders, and financial advisors. Their insights and tailored guidance can help you make informed decisions in an uncertain market.

- Prioritize Long-Term Goals: Focus on your long-term housing and financial objectives when making real estate decisions. Although election years may bring short-term market fluctuations, it’s crucial to maintain your broader goals and financial health.

Presidential election years can create uncertainty and volatility in the housing market, affecting buyer and seller behaviors and market dynamics. By understanding typical trends and implementing proactive strategies, you can effectively navigate the housing market during an election year. Whether buying, selling, or investing in real estate, staying informed and working with knowledgeable professionals are vital to achieving your housing goals amid market fluctuations.

Conclusion

The relationship between presidential elections and the real estate market is complex and often misunderstood. While conventional wisdom might suggest that election years bring uncertainty and volatility to the housing market, historical data paints a more nuanced picture. Rather than causing significant disruptions, elections appear to have a relatively minor and temporary impact on real estate trends.

Analysis of past election years reveals that the housing market generally maintains its stability and even shows signs of growth during these periods. Home prices have consistently appreciated, and sales have typically increased in the year following most elections. This resilience suggests that the fundamental factors driving the housing market – such as supply and demand, interest rates, and broader economic conditions – tend to exert a stronger influence than political events.

However, it’s important to recognize that each election year is unique, and market behavior can be influenced by a myriad of factors beyond just the political climate. Economic cycles, global events, and shifts in housing policy can all play significant roles in shaping market outcomes. As such, while historical trends can provide valuable insights, they should not be viewed as definitive predictors of future market performance.

For those navigating the real estate market during an election year, the key lies in maintaining a balanced perspective. Rather than making decisions based solely on short-term political considerations, it’s crucial to focus on long-term housing goals and personal financial circumstances. Staying informed about market conditions, consulting with real estate professionals, and remaining adaptable to changing circumstances can help buyers, sellers, and investors make sound decisions regardless of the political landscape.

Ultimately, while presidential elections may introduce a degree of uncertainty into the real estate market, they do not fundamentally alter its long-term trajectory. By understanding the historical context and approaching the market with a well-informed, strategic mindset, individuals can successfully navigate the housing landscape during election years and beyond.

References

[1] Ostrowski, Jeff. 2024. “What Happens to the Housing Market in an Election Year?” Bankrate. Bankrate.com. May 24, 2024. https://www.bankrate.com/real-estate/election-year-housing-market/.

[2] “Do Elections Impact the Housing Market?” 2020. Keeping Current Matters. 2020. https://www.keepingcurrentmatters.com/2024/06/17/do-elections-impact-the-housing-market.

[3] “Investors’ Election Year Worries Could Be Overblown, Experts Say.” n.d. Investopedia. https://www.investopedia.com/investors-election-year-worries-could-be-overblown-experts-say-8410521.

[4] NMB. 2024. “Navigating the Housing Market during a Presidential Election Year: What To.” Nationwide Mortgage Bankers. March 27, 2024. https://nmbnow.com/navigating-the-housing-market-during-a-presidential-election-year-what-to-expect/.

[5] “Will the General Election Affect the Housing Market in 2024? – Oakwood Property Solicitors.” 2024. Oakwood Property Solicitors – Residential & Commercial Property Services. June 27, 2024. https://www.oakwoodpropertysolicitors.co.uk/will-the-general-election-affect-the-housing-market-in-2024