– Vatsal Rai

June 28, 2024

Introduction

Real estate investment trusts (REITs) are frequently viewed as a specialized investment option primarily attracting those seeking steady income. Yet, the influence of REITs reaches well beyond the confines of individual investment portfolios. They serve as a vital component in the broader economic landscape, significantly contributing to the economy’s overall health and expansion. By enabling investments in real estate, REITs support the development of new properties and the revitalization of existing ones. This, in turn, stimulates job creation in various sectors, ranging from construction to property management. As a result, REITs are not just passive income-generating assets; they are dynamic players that fuel economic activity and growth, underscoring their importance far beyond their immediate financial returns. The positive impact of real estate investment on economic growth is a key advantage of REITs.

Value Creation: Adding Jobs and Dollars

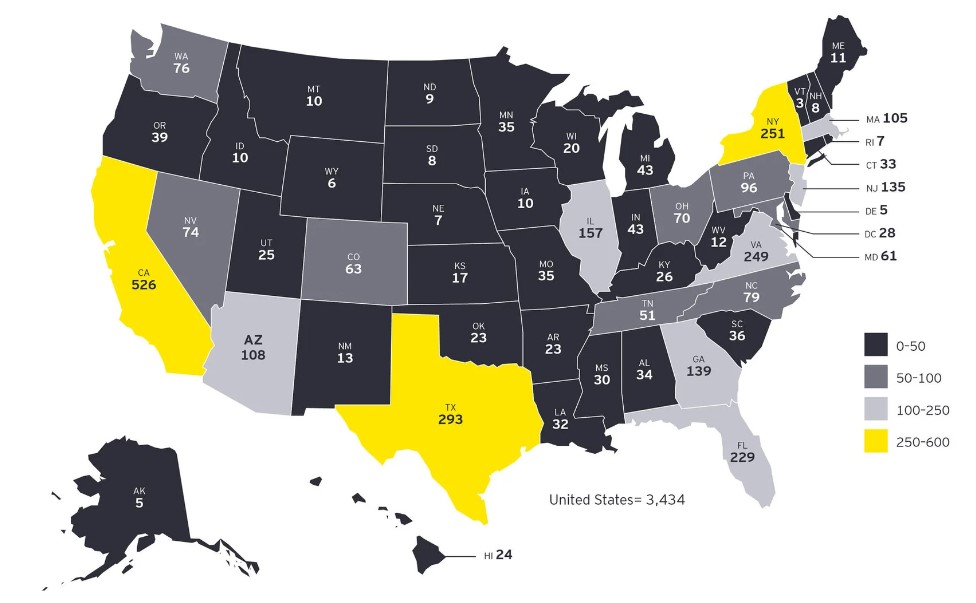

Real estate investment trusts (REITs) play a crucial role in the United States’ economy and local communities, providing a substantial economic footprint. In total, REITs support 3.4 million jobs across the country, resulting in $262.9 billion in labor income.[1] This economic impact encompasses both the direct operations of REITs and the broader economic activities they stimulate, including dividend and interest payments, as well as investments in property improvements and construction.

In 2021, the economic contributions of REITs and their associated businesses were significant, with an estimated 3.2 million full-time equivalent (FTE) jobs attributed to their operations. The combination of REIT activities, such as property management and development, alongside the financial distributions made to investors, significantly bolstered the US labor market. These activities alone contributed $262.9 billion in labor income, underscoring the vital role of REITs in sustaining and growing the workforce.[1]

Fig. 1 – Distribution (in 000s) of 3.4 million FTE jobs supported by REITs in 2022 [1]

REIT returns have shown substantial growth, further enhancing their economic impact. REITs in the US manage a substantial portfolio, owning $4 trillion worth of gross real estate assets. Publicly listed REITs have demonstrated remarkable growth in their equity market capitalization, expanding from $9 billion at the end of 1990 to nearly $1.27 trillion by the end of 2022. This growth, marked by a compound annual rate of approximately 16.8%, highlights the increasing value and influence of REITs in the financial market.[1]

Overall, the extensive footprint of REITs, encompassing millions of jobs and significant labor income, underscores their importance in both local communities and the broader US economy. Their ongoing contributions through direct operations, financial distributions, and substantial investments in real estate underscore their role as key economic drivers.

Liquidity for Real Estate: Democratizing Investment

Historically, investing in real estate has been synonymous with substantial initial financial commitments, making it a challenging arena for small-scale investors to penetrate. Real Estate Investment Trusts (REITs) have revolutionized this landscape by aggregating capital from numerous investors. This collective pooling of funds enables individuals to enter the real estate market with relatively modest investments. Consequently, REITs have democratized real estate investment, significantly expanding the range of participants and unlocking a vast reservoir of capital for the industry. This expanded participation and market capitalization foster economic development.

The influx of this capital has a profound impact on the real estate sector. REITs are continuously on the lookout for new investment opportunities across a diverse array of property types, including office buildings, warehouses, residential complexes, and healthcare facilities. These investments drive a surge in development and construction activities, creating numerous construction jobs and boosting the demand for building materials. The ripple effects of these activities stimulate a wide range of related industries, fostering economic growth and development. This cycle of investment and construction not only enhances the built environment but also contributes to broader economic vitality.

Benefits within High Interest Rates

During periods of economic growth, Real Estate Investment Trusts (REITs) typically see an increase in their prices alongside rising interest rates. This trend can be attributed to the fact that an expanding economy boosts the value of real estate assets, which in turn enhances the value of REITs. As the economy grows, the demand for financing escalates, leading to higher interest rates. Conversely, in a slowing economy where the Federal Reserve is tightening monetary policy, this relationship reverses, and REIT prices may decline even as interest rates rise. This dynamic is illustrated in a chart showing the correlation between REIT total returns and the yields on 10-year Treasury bonds from 2000 to 2019.

Fig.2 – Correlation between REIT total returns and 10-year treasury yields [3]

Over most of this period, REIT returns and interest rates displayed a positive correlation, generally moving in tandem. Notably, between 2001-2004 and 2008-2013, both REIT returns and interest rates increased. However, there were also periods of negative correlation, particularly following the years 2004, 2013, and 2016. These inversions can be linked to the Federal Reserve’s monetary tightening policies, which often followed periods of monetary stimulus enacted in response to economic recessions. During these times, despite rising interest rates, REIT values declined.[3]

Rising interest rates often coincide with factors that enhance the fundamentals of Real Estate Investment Trusts (REITs). One significant factor is economic growth, which tends to accompany higher interest rates. When the economy is expanding, businesses and consumers are more likely to invest in and utilize real estate, leading to higher demand and increased occupancy rates. This uptick in demand supports the growth of REIT earnings, cash flow, and dividends.

Furthermore, periods of rising inflation often occur alongside rising interest rates. During inflationary times, real estate owners usually have the ability to increase rents, which can bolster their revenue streams. This capacity to adjust rents in response to inflation means that REITs can maintain or even grow their income despite the eroding purchasing power of money. Historically, REIT returns and dividend growth have outpaced inflation, providing investors with a reliable income stream that keeps up with or exceeds the cost of living increases.

Fig. 3 – REIT Income has outpaced Inflation [6]

The data presented in the above figure illustrates this point clearly: over the past 15 years, the income component of REIT returns has surpassed inflation, as measured by the Consumer Price Index (CPI), in 14 of those years.[6] This trend underscores the resilience and attractiveness of REITs as an investment, particularly in environments characterized by rising interest rates and inflation. It highlights how the real estate sector can not only endure but thrive under such conditions, making REITs a valuable component of an investment portfolio seeking both growth and income. This analysis suggests that REIT returns may not be heavily dependent on interest rate fluctuations. Other factors, such as the overall health of the economy, real estate market conditions, and individual REIT management strategies, play significant roles in determining REIT returns. Therefore, investors should consider a broader range of factors beyond interest rates when evaluating REIT investments.

Stability in Economic Downturns

REITs provide a distinct advantage when it comes to portfolio diversification. Unlike investing in the stocks of individual companies, where the performance is heavily dependent on the success of those specific businesses, REITs invest in a diverse array of real estate assets. This broad investment spread helps reduce risk and offers investors a more reliable income stream, making REITs an appealing choice for those looking to stabilize their portfolios and looking for stability.

Over the last two decades, REITs have shown a moderate performance correlation with the broader equity market, standing at 0.56 correlation, and minimal correlation with investment-grade bonds, at 0.16 correlation.[2] This means that the performance of REITs does not necessarily mirror the fluctuations of the stock market. For instance, if the stock market experiences a decline, REITs might not be affected to the same extent, or at all. This characteristic makes REITs an effective hedge against volatility in other parts of an investor’s portfolio, helping to balance overall investment risk.

Over the decade surrounding the dot-com peak in March 2000, U.S. Real Estate Investment Trusts (REITs) outperformed the S&P 500, achieving an annualized return of 13.8 percent compared to the S&P 500’s 11 percent. This outperformance was notable not just for the higher returns, but also for the reduced volatility. Specifically, REITs’ annualized returns came with a standard deviation that was over 2 percent lower than that of the S&P 500, indicating significantly less fluctuation and risk.[7]

Fig. 4 – US REITs performance in the 10-year period near Dotcom Bubble [7]

The implications of this data are multifaceted. First, it highlights the resilience and stability of REITs during a period marked by substantial market turbulence, particularly the dot-com bubble burst. The lower standard deviation of REITs suggests that they experienced fewer extreme ups and downs, making them a less risky investment compared to the broader equity market.

Additionally, this historical performance underscores the potential of REITs as an effective tool for portfolio diversification. The lower correlation of REITs with other equities means that they can reduce overall portfolio risk while still providing competitive returns. This characteristic is particularly valuable for investors seeking to mitigate risk without sacrificing potential gains.

While past performance is not a guarantee of future results, the data from this period suggests that REITs can offer not only comparable or superior returns but also a smoother investment experience with less volatility. This combination of steady performance and reduced risk makes REITs an attractive option for those looking to diversify their investment portfolios and achieve more stable long-term growth. By investing in a mix of commercial, residential, industrial, and other types of properties, REITs spread their exposure across different segments of the real estate market. This strategy not only enhances diversification but also taps into various revenue streams from different sectors. As a result, REITs can provide a buffer against sector-specific downturns and contribute to a more resilient investment portfolio.

Delivering Access to New Economy

The growth and evolution of the Real Estate Investment Trust (REIT) sector have introduced a crucial new aspect to portfolio diversification. Traditionally, institutional investors focused on property sectors such as Retail, Office, Residential, and Industrial (RORI). In 2000, these sectors made up over 75% of the market capitalization of equity REITs. However, the last decade has seen a significant shift with the introduction and rapid expansion of new property types. Nowadays, these emerging sectors contribute to half of the total market capitalization.[4]

The saying, “real estate houses the economy,” now extends to the technology-driven economy as well. Modern internet communications and e-commerce heavily rely on tech-related real estate. REITs play a vital role in owning and developing the infrastructure that underpins the tech economy. For example, the Infrastructure sector includes REITs that own cell towers essential for transmitting voice and data messages. Similarly, Data Center REITs provide the necessary facilities to house servers, facilitating data communications, data storage, and maintaining internet websites. Together, these tech-related sectors account for 23% of the market capitalization of all equity REITs. Additionally, other new and emerging sectors contribute another 10% to the total market capitalization.[4]

In the Industrial sector of the REIT industry, there has been a notable shift from traditional warehouse and flex space to logistics space, which has become the dominant form of industrial real estate. These logistics facilities are crucial for the rapid delivery of goods purchased through e-commerce, underscoring the evolving demands of the market.

Fig. 5 – REIT sectors over time [4]

The increased diversity within REIT property sectors offers enhanced diversification benefits for investors. By including both traditional property types and newer REIT property types in their portfolios, investors can achieve better risk management and potentially higher returns. Notably, the Infrastructure, Industrial, and Data Center REITs have delivered impressive annualized total returns of nearly 20% since 2014, highlighting their strong performance and significant contribution to overall investment returns.[4]

REIT Sector Returns & Correlations

Investing in a diverse range of Real Estate Investment Trust (REIT) property sectors can significantly enhance an investor’s portfolio diversification. Traditional REIT property types, known as RORI (Retail, Office, Residential, and Industrial), have been staples in the market for years. However, the inclusion of newer REIT property types, such as Infrastructure, Industrial, and Data Center REITs, can offer additional benefits. Since 2016, these newer REIT sectors have delivered impressive annualized total returns exceeding 20%.[5]

One of the key advantages of incorporating a variety of REIT sectors into an investment portfolio is the potential for reduced risk through diversification. Different REIT sectors often do not exhibit synchronized movement in their returns. This is particularly true for the newer property types, which tend to have lower correlations with traditional property types. For instance, the average correlation between traditional RORI property types is around 76%, which provides some degree of diversification but not substantial risk reduction.[5]

In contrast, tech-related REIT sectors, such as Infrastructure and Data Centers, exhibit a much lower average correlation of 44% with other property types.[5] This significant difference in correlation means that these newer REIT types can offer substantial diversification benefits. By spreading investments across these sectors, investors can better mitigate risks and potentially enhance overall portfolio performance.

The remaining REIT property types, which fall between the traditional and tech-related categories, have an average correlation of 56%.[5] This mid-range correlation still offers more diversification than the traditional sectors alone but not as much as the newer, tech-related REITs. Overall, the inclusion of a broader array of REIT sectors can help investors achieve a more balanced and resilient investment portfolio, capable of weathering various market conditions while optimizing returns.

Conclusion

Real Estate Investment Trusts (REITs) have established themselves as a vital component of the modern economic landscape, extending far beyond their traditional role as income-generating assets for individual investors. Their impact on the broader economy is substantial, driving job creation, urban development, and economic growth across various sectors.

REITs have democratized real estate investment, making it accessible to a wider range of investors and unlocking significant capital for the industry. This influx of funds has fueled construction and revitalization projects, stimulating local economies and creating a ripple effect of economic activity. The ability of REITs to provide liquidity to the real estate market has transformed the property investment landscape, enabling more diverse participation and fostering further economic expansion.

In the face of changing economic conditions, including periods of high interest rates and inflation, REITs have demonstrated remarkable resilience and adaptability. Their capacity to adjust rents and deliver consistent income that often outpaces inflation makes them an attractive investment option in various economic climates. This adaptability, coupled with their potential for capital appreciation, positions REITs as a valuable component of a well-diversified investment portfolio.

The evolution of the REIT sector to include new economy properties, such as data centers and cell towers, has further enhanced their relevance in the modern, technology-driven economy. This diversification across traditional and emerging sectors not only reflects the changing nature of our economy but also provides investors with access to a wide range of property types, enhancing risk management and return potential.

REITs offer significant portfolio diversification benefits, with their performance showing moderate correlation to broader equity markets and minimal correlation to bonds. This characteristic makes them an effective tool for managing overall portfolio risk while maintaining the potential for attractive returns.

As REITs continue to evolve and adapt to new economic realities, they remain a crucial component of the economic machinery, driving growth, providing stable returns, and offering investors a unique blend of income, growth potential, and portfolio diversification. Their role in shaping the built environment and supporting technological infrastructure positions them at the forefront of economic development, underscoring their importance in the modern investment landscape and the broader economy.

In conclusion, REITs have proven to be more than just an investment vehicle; they are a dynamic force shaping our economic landscape, fostering growth, and providing investors with a versatile tool for portfolio management. As the economy continues to evolve, REITs are likely to play an increasingly important role in driving innovation, supporting new industries, and contributing to overall economic vitality.

References

[1] |authorurl:https://www.ey.com/en_us/people/ey, authorfirstname:EY|authorlastname:Americas|authorjobtitle:Multidisciplinary professional services organization. n.d. “REIT Economic Contributions to US Economy.” Www.ey.com. https://www.ey.com/en_us/insights/real-estate-hospitality-construction/reit-economic-contributions-to-us-economy.

[2] Buller, Steven, Sam Wald, and Andy Rubin. n.d. “Leadership Series REIT Stocks: An Underutilized Portfolio Diversifier AUTHORS.” Accessed May 21, 2024. https://www.reit.com/sites/default/files/media/PDFs/Research/REITStocksAnUnderutilizedPortfolioDiversifier_Fidelity.PDF.

[3] “Are REITs Beneficial during a High-Interest Era?” n.d. Investopedia. https://www.investopedia.com/articles/investing/091615/are-reits-beneficial-during-highinterest-era.asp.

[4] “How REITs Deliver Access to the New Economy.” n.d. Www.reit.com. Accessed June 28, 2024. https://www.reit.com/data-research/research/nareit-research/how-reits-deliver-access-new-economy.

[5] “How REITs Deliver Access to the New Economy.” 2020. https://www.lseg.com/content/dam/ftse-russell/en_us/documents/research/how-reits-deliver-access-new-economy.pdf.

[6] Orzano, Michael, and John Welling. 2017. “RESEARCH Real Estate CONTRIBUTORS the Impact of Rising Interest Rates on REITs.” https://www.spglobal.com/spdji/en/documents/research/the-impact-of-rising-interest-rates-on-reits.pdf.

[7] client. n.d. “REITs: A Diversification Trilogy.” Www.ft.com. https://www.ft.com/partnercontent/janus-henderson/reits-a-diversification-trilogy.html.