-Shekhar Tripathi

April 10, 2024

Introduction

In the ever-evolving landscape of alternative investments, a notable trend is emerging – an increasing number of high-net-worth individuals (HNWIs) and family offices in the United States are seeking direct partnerships with sponsors through co-investment and GP commitment opportunities. This shift reflects a growing appetite for greater control, transparency, and potential upside in alternative investment strategies.

According to a Family Office Report by Fintrx, 83% of single-family offices worldwide are expected to make direct investments in 2024, a significant increase from 73% in 2023.[1][2] This surge in interest is driven by a confluence of factors, including a desire for enhanced returns, increased access to unique deals, and the ability to leverage the expertise of seasoned investment professionals.

The Pursuit of Higher Returns

One of the primary motivations behind HNWIs and family offices seeking direct partnerships is the potential for higher returns. Traditional investment vehicles, such as mutual funds and hedge funds, often come with substantial fees and layers of management, which can erode overall returns. By co-investing alongside sponsors or committing as a GP, investors can gain exposure to the same investment opportunities while potentially reducing fees and increasing their share of the profits.

A study by MLC Asset Management firm revealed that direct co-investments in private equity have historically outperformed traditional fund investments.[3] This performance advantage has not gone unnoticed by sophisticated investors seeking to maximize their returns in a low-yield environment. Compared to traditional fund investing, co-investments typically carry lower fees and a potentially more predictable risk-return profile, both attractive attributes in times of market dislocation.

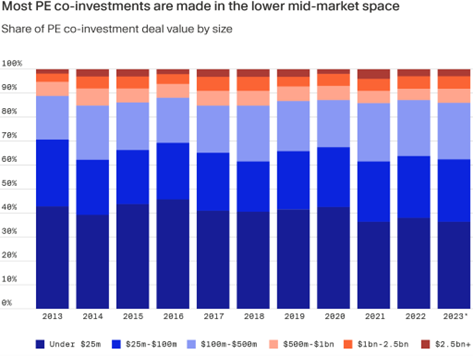

Many general partners (GPs) consider co-investments a way to unlock new capital when fundraising is slow. These deals may also help them strengthen relationships with limited partners (LPs), particularly in the mid-market space. Indeed, 86% of private equity last year’s deals involving co-investors transacted below $500 million, per Pitchbook.[4]

(source: pitchbook.com)

Private lenders from private debt funds have become references for companies, allowing them to bypass traditional banks when seeking to take out loan facilities. Per Oaktree Capital’s Insights Report issued on May 2021, US banks and securities firms were responsible for over 70% of the loan issuance on the primary market for corporate loans in 1994, compared to 10% in 2020.[5]

Believing that rising rates, inflationary pressures, and economic uncertainty offer a few unique advantages for investors, most of the major private equity players have been channeling an increasing share of their assets into the private debt market. Furthermore, there is an estimated $2.72 trillion of global dry powder in private equity, as of September 2023, which points to an optimistic outlook[6]. In its latest five-year private markets outlook, Preqin forecasts that private credit will nearly double in size, reaching $2.8 trillion by the end of 2028, after most investors it surveyed confirmed that they expect to invest even more money in this asset class. Along with Preqin’s survey’s results, some asset managers are optimistic about the outlook of the private credit market, considering that retail investors will get access to those funds, such as Blackrock, which recently predicted that the industry would hit $3 to $5 trillion[7]. This shows the strength and growing appeal of private equity investments.

Access to Unique Opportunities

Another driving force behind the growing interest in direct partnerships is the ability to access unique investment opportunities that may not be available through traditional fund structures. Sponsors often reserve their most compelling deals for co-investment partners or those committing as GPs, providing exclusivity and the potential for outsized returns.

According to a survey by Ernst & Young, 76% of US alternative investment managers expected to increase their co-investment offerings in 2024, recognizing the demand from LPs seeking greater access and transparency.[8] This trend is particularly prevalent in sectors such as real estate, where local expertise and on-the-ground knowledge can create significant advantages for direct investors.

Increased Control and Transparency

By forging direct partnerships with sponsors, HNWIs and family offices gain greater control over their investments and increased transparency into the underlying assets and decision-making processes. This level of involvement aligns with the growing trend of family offices seeking to assert more influence over their investment portfolios and ensure alignment with their specific goals and risk profiles.

A report by UBS highlighted that 41% of family offices planned to increase their direct investments in 2022, citing a desire for greater control and transparency as key drivers.[9] This hands-on approach allows investors to actively participate in the due diligence process, evaluate risks more effectively, and potentially influence strategic decisions related to their investments.

Leveraging Expertise and Industry Connections

By partnering directly with sponsors, HNWIs and family offices gain access to the deep industry knowledge, operational expertise, and extensive networks of seasoned investment professionals. This symbiotic relationship allows investors to leverage the sponsor’s capabilities while contributing their own capital and insights.

The report by UBS on family offices found that 67% of family offices cite access to specialized expertise as a key factor when considering direct investments.[9] This expertise can be particularly valuable in sectors with complex operational requirements, such as real estate, infrastructure, or energy, where sponsors often have specialized teams and long-standing relationships with industry players.

Furthermore, sponsors with strong track records and established networks can provide investors with a pipeline of proprietary deal flow, potentially leading to investment opportunities that may not be accessible through traditional fund structures.

Tax Efficiency and Estate Planning Advantages

Direct partnerships can also offer tax efficiency and estate planning benefits for HNWIs and family offices. Co-investments and GP commitments may qualify for various tax incentives and preferential treatment, depending on the specific structure and jurisdiction.

For instance, in the United States, certain co-investment vehicles may be structured as partnerships, allowing investors to benefit from pass-through taxation and potentially defer or reduce their tax liabilities. Additionally, some alternative investment strategies, such as real estate or energy investments, may qualify for specialized tax treatments like depreciation deductions or tax credits.

From an estate planning perspective, direct investments can offer greater flexibility in terms of asset distribution and succession planning. Family offices can potentially structure their investments in a way that facilitates the transfer of assets to future generations while minimizing tax implications.

Regulatory Considerations

While direct partnerships offer numerous advantages, they also come with increased regulatory scrutiny and compliance requirements. Investment sponsors must adhere to stringent regulations governing the solicitation and management of co-investment capital, particularly when dealing with individual investors.

In the United States, the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) have implemented rules and guidelines surrounding the marketing and offering of co-investment opportunities. Sponsors must ensure compliance with various disclosure requirements, investor accreditation standards, and anti-money laundering regulations.

Additionally, HNWIs and family offices participating in direct partnerships may be subject to heightened due diligence and reporting obligations, depending on the specific investment structure and their level of involvement in the management of the assets.

Alignment of Interests and Shared Upside

One of the key advantages of direct partnerships is the alignment of interests between sponsors and investors. By co-investing alongside sponsors or committing as a GP, HNWIs and family offices effectively become partners in the success of the investment strategy, fostering a shared incentive for strong performance.

According to a report by RBC Wealth Management, alignment of interests is a critical factor influencing family offices’ decisions to pursue direct investments.[10] When sponsors and investors share in the upside potential, there is a heightened motivation to maximize returns and carefully manage risks.

This alignment also extends to the governance and decision-making processes. As co-investment partners or GPs, HNWIs and family offices often have a more active role in shaping the investment strategy, overseeing operations, and influencing key decisions. This level of involvement can be particularly valuable in sectors with complex operational dynamics or where local knowledge and relationships are crucial.

Diversification and Risk Management

While direct partnerships can provide enhanced returns and control, they also offer diversification benefits and risk management opportunities for HNWIs and family offices. By co-investing across multiple strategies, asset classes, and geographies, investors can effectively mitigate concentration risks and create a more resilient portfolio.

A study by Campden Wealth highlighted that 62% of family offices cite portfolio diversification as a key driver for pursuing direct investments.[10] Additionally, the ability to conduct thorough due diligence and actively monitor investments can enable investors to better understand and manage risks associated with specific opportunities.

Furthermore, direct partnerships often involve a longer investment horizon, aligning with the patient capital approach favored by many family offices. This extended time frame can potentially smooth out market volatility and allow for the realization of long-term value-creation strategies.

Challenges and Considerations

Despite the compelling advantages, pursuing direct partnerships also presents several challenges and considerations for HNWIs and family offices. One significant hurdle is the substantial capital commitment often required for co-investment or GP opportunities, which may be beyond the means of some individual investors.

Additionally, direct partnerships demand a significant time commitment and resources for conducting thorough due diligence, monitoring investments, and potentially participating in governance and decision-making processes. HNWIs and family offices without dedicated investment teams may find it challenging to allocate the necessary resources effectively.

Furthermore, investor must carefully evaluate the track record, reputation, and alignment of interests with potential sponsors before committing capital. Thorough due diligence is essential to mitigate the risks associated with direct partnerships and ensure a fruitful collaboration.

Conclusion & The Sortis Income Fund

Direct co-investments offer HNWIs and family offices a unique opportunity to participate actively in the investment process, potentially leading to higher returns and greater control over their investment portfolios. However, these opportunities come with their own set of challenges, requiring investors to be well-prepared, informed, and strategic in their approach.

By adhering to best practices in due diligence, employing effective risk management strategies, and leveraging technology, HNWIs and family offices can navigate the complexities of direct co-investments and GP partnerships successfully. The evolving landscape of these investment opportunities promises both rewards and risks, but with the right strategies, investors can position themselves to capitalize on the benefits while mitigating potential downsides.

One compelling option for investors is the Sortis Income Fund (SIF), an evergreen, unleveraged private credit fund focused on senior secured loans backed by commercial real estate collateral in the Western United States. With over 7 years of successful operations, SIF has demonstrated a strong track record of preserving principal and generating attractive risk-adjusted returns with over 28 consecutive profitable quarters, distributing over $40 million to investors to date. By leveraging the team’s extensive experience of over 30+ years in real estate investment, development, and asset management, SIF employs a disciplined underwriting approach and tailored loan structuring to meet the specific needs of borrowers while prioritizing downside protection for investors.

Additionally, Sortis offers the Sortis Edge platform, providing access to a diverse range of alternative investment opportunities beyond private credit. With a focus on identifying emerging trends and capitalizing on market inefficiencies, Sortis Edge allows investors to diversify their portfolios across a spectrum of alternative asset classes, further enhancing their potential for risk-adjusted returns. Learn more about Sortis here.

References:

[1] Fintrx. (2024). The Rise of Family Offices Co-Investing

[2] Institutional Investor. (2023). Direct Lending: Benefits, Risks and Opportunities.

[3] MLC Asset management. (2024). Co-Investments: Jewel in The Private Equity

[4] Pitchbook. (2023). Smaller GPs offer LPs co-investments to build trust https://pitchbook.com/news/articles/butterfly-equity-lower-middle-market-GP-coinvestments-limited-partners-fundraising

[5] Oak Tree Capital. (2023). Direct Lending: Benefits, Risk and Opportunities

[6] S&P Global. (2023). Private Credit Boom Continues

[7] Bloomberg. (2023). BlackRock Says Private Debt Will Double to $3.5 Trillion by 2028.

[8] Ernst & Young. (2024). The Future of Family Offices: A Look Ahead to 2024

https://www.ey.com/en_lu/wealth-asset-management/the-future-of-family-offices–a-look-ahead-to-2024

[9] UBS. (2022). Global Family Office Report 2022

[10] Campden Wealth. (2023). The North America Family Office Report 2023 https://www.rbcwealthmanagement.com/assets/wp-content/uploads/documents/campaign/the-north-america-family-office-report-2023.pdf