-Shekhar Tripathi

August 30, 2024

Introduction

Demographic trends have always played a crucial role in shaping real estate demand, and as we move further into the 21st century, these shifts are becoming even more pronounced. The interplay between aging populations, urban migration, and changing household dynamics is creating both challenges and opportunities for REIT (Real Estate Investment Trust) investors. Understanding these demographic changes is essential for making informed investment decisions in the real estate sector.

This article explores how key demographic changes influence real estate demand and how REITs can capitalize on these trends. By analyzing current trends, projecting future developments, and evaluating their implications, we aim to provide valuable insights to inform investment strategies in the ever-evolving world of real estate.

The Demographic Landscape: A Snapshot of Change

- The Aging of America

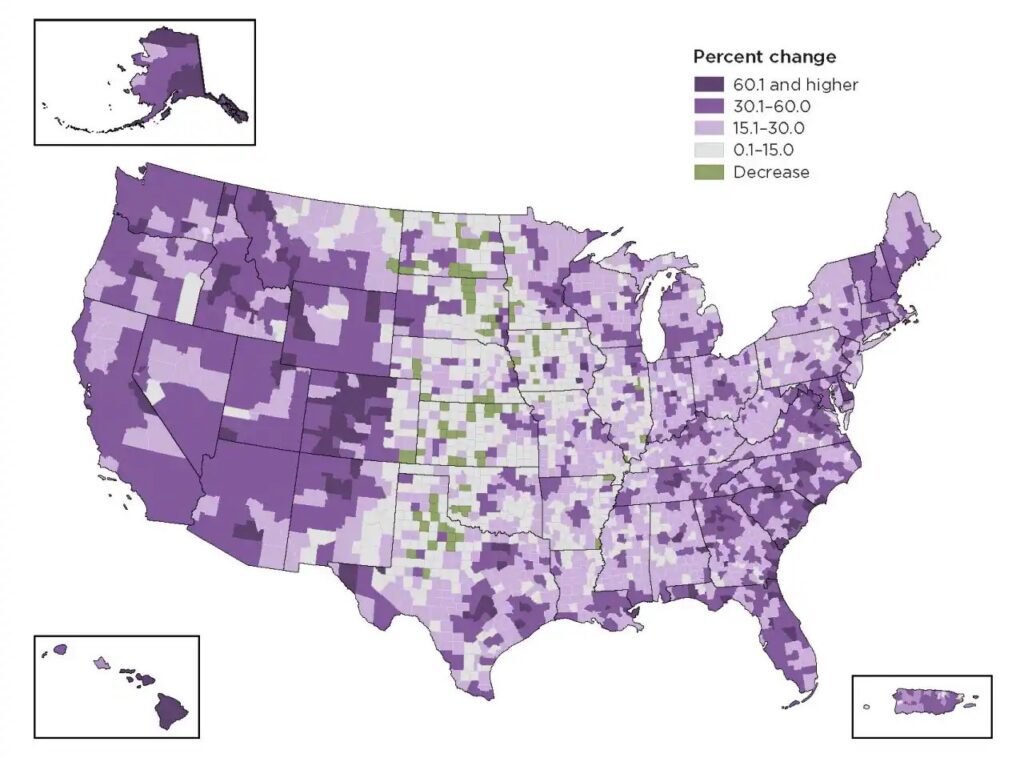

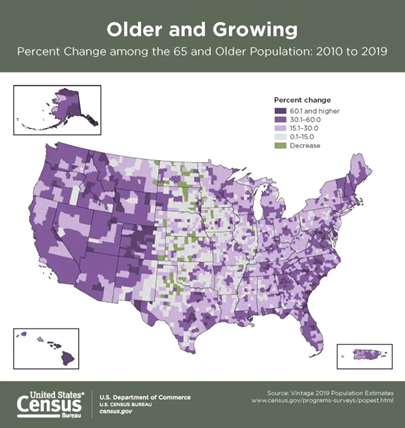

One of the most significant demographic trends shaping the United States is the aging of its population. According to the U.S. Census Bureau, by 2030, all baby boomers will be older than 65, expanding the size of the older population so that one in every five residents will be of retirement age[1]. By 2060, nearly one in four Americans will be 65 years and older, the number of 85-plus will triple, and the country will add a half million centenarians[2].

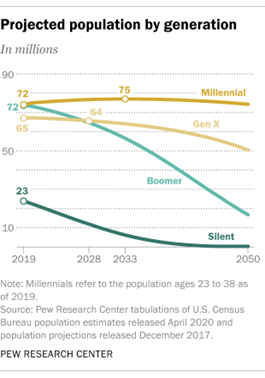

- Millennials Coming of Age

While much attention has been focused on the baby boomer generation, millennials—now the largest living adult generation—are entering their prime home-buying years. Born between 1981 and 1996, millennials numbered 72.1 million in 2019, surpassing baby boomers (71.6 million) as the nation’s largest living adult generation[3].

- The Rise of Gen Z

Generation Z (born between 1997 and 2012) is beginning to enter the workforce and housing market. According to Brookings, Gen Z will comprise 27% of the workforce by 2025[4]. Their preferences and needs will increasingly shape demand in various real estate sectors.

- Changing Household Compositions

The traditional nuclear family is no longer the dominant household type in America. According to the U.S. Census Bureau, single-person households accounted for 28% of all households in 2021, up from 13% in 1960[5]. Additionally, the Pew Research Center reports that multigenerational households have been growing steadily, with 20% of the U.S. population living in such arrangements as of 2016[6].

- Geographic Redistribution

The COVID-19 pandemic accelerated existing trends of population movement. U.S. Census Bureau data shows that between 2020 and 2021, 73% of U.S. counties experienced positive domestic migration overall, with counties in the South and West experiencing the largest gains[7]. This geographic redistribution is reshaping real estate markets across the nation.

Understanding these demographic shifts is crucial for REIT investors looking to position their portfolios for long-term growth and stability. In the following sections, we will explore how these trends are impacting specific sectors of the real estate market and identify the potential opportunities they present for savvy investors.

Demographic Impacts on Real Estate Sectors

- Senior Housing and Healthcare REITs

The aging of America presents a significant opportunity for REITs specializing in senior housing and healthcare facilities. According to the National Investment Center for Seniors Housing & Care (NIC), the occupancy rate for senior housing properties reached 83.2% in Q4 2023, showing a steady recovery from pandemic lows[8]. This shift is creating increased demand for healthcare facilities, senior living communities, and age-restricted housing.

REITs specializing in healthcare real estate, such as medical office buildings, senior housing, and skilled nursing facilities, are well-positioned to benefit from this trend. As the need for healthcare services grows, these REITs can expect stable occupancy rates and increased rental income. For instance, Ventas, a leading healthcare REIT, has focused on expanding its portfolio of senior housing and healthcare properties to capture this growing market demand.

Welltower Inc. (NYSE: WELL), a leading healthcare REIT, reported a 9.1% year-over-year increase in same-store net operating income for its Senior Housing Operating portfolio in Q4 2023[9]. This growth underscores the potential in this sector as demographic trends continue to favor increased demand for senior living facilities.

- Multifamily and Single-Family Rental REITs

Urbanization continues to be a dominant trend globally, with more people moving to cities in search of better job opportunities and amenities. The United Nations estimates that 68% of the world population will live in urban areas by 2050, up from 55% in 2018. This shift is driving demand for multi-family housing, particularly in urban centers.

Multi-family REITs, which invest in apartment buildings and other forms of multi-unit housing, stand to gain from this trend. As urban populations grow, the demand for rental housing is expected to rise, particularly among younger demographics who are more likely to rent rather than own property. REITs such as AvalonBay Communities and Equity Residential have already adapted their strategies to focus on high-demand urban markets, targeting young professionals and families looking for quality rental options.

AvalonBay Communities, Inc. (NYSE: AVB), a leading multifamily REIT, reported a 6.7% increase in same-store residential rental revenue for Q4 2023, reflecting strong demand and rising rents[11].

The trend towards single-family rentals is also gaining momentum. Invitation Homes Inc. (NYSE: INVH), the largest single-family rental REIT in the U.S., saw a 5.3% year-over-year increase in same-store net operating income in Q4 2023[12].

- The Migration to Secondary and Tertiary Markets

While urbanization is a significant trend, there’s also a notable shift toward secondary and tertiary markets, driven by factors such as remote work, affordability, and lifestyle preferences. The COVID-19 pandemic accelerated this trend as many individuals and families sought more space and lower living costs outside of major metropolitan areas.

This migration is boosting demand in smaller cities and suburban areas, which often offer more affordable housing options and a better quality of life. REITs focusing on residential properties in these areas can capitalize on this trend by acquiring assets in markets with strong population growth. For example, American Homes 4 Rent has expanded its portfolio to include single-family homes in suburban markets across the U.S., positioning itself to benefit from this demographic shift.

- The Growing Influence of Millennials and Generation Z

The preferences of millennials (born 1981-1996) and Gen Z (born 1997-2012) are becoming the dominant demographic groups in the housing market, with their preferences and behaviors significantly shaping real estate demand. Unlike previous generations, these younger cohorts tend to prioritize experiences over ownership and are more likely to rent rather than buy, especially in their early careers.

Millennials and Gen Z are also driving demand for properties that offer modern amenities, technological integration, and proximity to urban centers or transit hubs. REITs that invest in properties catering to these preferences—such as smart apartments with high-speed internet, co-living spaces, and environmentally sustainable buildings—can attract a younger tenant base. Companies like UDR, Inc., a multi-family REIT, have tailored their properties to include these features, aligning with the lifestyle preferences of younger renters.

- Industrial and Logistics REITs

Demographic shifts also impact the demand for retail and industrial real estate. The rise of e-commerce, accelerated by the COVID-19 pandemic and embraced by younger generations, has created robust demand for industrial and logistics real estate. According to CBRE, the U.S. industrial market absorbed 141.8 million square feet in Q4 2023, bringing the total for the year to 513.8 million square feet[13].

Prologis, Inc. (NYSE: PLD), the global leader in logistics real estate, reported 97.8% occupancy in its properties as of Q4 2023, highlighting the strong demand in this sector[14].

Industrial REITs, like Prologis and Duke Realty, are capitalizing on this demand by expanding their portfolios in strategic locations close to major transportation hubs.

- Data Center REITs

The digital nature of Gen Z and the increasing reliance on technology across all generations is driving demand for data centers. According to Gartner, end-user spending on global data center infrastructure is projected to reach $226 billion in 2024, up 8.3% from 2023[15].

Digital Realty Trust, Inc. (NYSE: DLR), a leading global provider of data center solutions, reported a 10% year-over-year increase in total operating revenue for Q4 2023[16].

- Retail REITs: Adapting to Change

While e-commerce has posed challenges for traditional retail, demographic shifts are creating new opportunities in this sector. According to CBRE, the U.S. retail market saw positive net absorption of 24.8 million square feet in Q4 2023, marking the 11th consecutive quarter of positive absorption[17].

Simon Property Group, Inc. (NYSE: SPG), the largest retail REIT, has been adapting its properties to include more mixed-use developments and experiential offerings. In Q4 2023, the company reported a 7.9% increase in funds from operations (FFO) per share compared to the previous year[18].

Investment Strategies for Capitalizing on Demographic Trends

- Diversification Across Sectors: Given the varied impact of demographic shifts on different real estate sectors, investors should consider diversifying their REIT portfolios to capture opportunities across multiple segments.

- Focus on High-Growth Markets: REITs with properties in markets experiencing population growth, particularly in the South and West, may be well-positioned for long-term appreciation.

- Emphasis on Quality and Adaptability: Invest in REITs that demonstrate the ability to adapt their properties to changing demographic needs, such as those incorporating smart home technologies or flexible spaces.

- Long-Term Perspective: Demographic shifts occur gradually. Investors should adopt a long-term view, aligning their investment horizon with the pace of these changes.

- Regular Portfolio Review: As demographic trends evolve, regularly reassess your REIT portfolio to ensure it remains aligned with changing population dynamics and market conditions.

Potential Risks and Challenges

- Overconcentration: While demographic trends can provide tailwinds for certain sectors, overexposure to any single trend can increase portfolio risk.

- Economic Factors: Economic cycles and interest rate fluctuations can impact REIT performance, potentially offsetting demographic tailwinds in the short term.

- Policy Changes: Government policies related to housing, healthcare, and immigration can significantly influence demographic trends and their impact on real estate.

- Technological Disruption: Rapid technological changes could alter how different generations interact with real estate, potentially disrupting established trends.

- Generational Preference Shifts: As generations age, their preferences and needs may evolve in unexpected ways, requiring investors to stay vigilant and adaptable.

Conclusion

Demographic shifts are reshaping the real estate landscape, creating both challenges and opportunities for REIT investors. By understanding these trends and their implications, high-net-worth individuals can position their portfolios to capitalize on the evolving demands of a changing population.

As with any investment strategy, thorough due diligence, regular portfolio review, and a long-term perspective are crucial. By aligning investments with demographic tailwinds while remaining mindful of potential risks, investors can leverage REITs as a powerful tool for wealth preservation and growth in the face of societal change.

The key to success lies in staying informed about demographic trends, understanding their nuanced impacts on various real estate sectors, and maintaining a diversified, adaptable investment approach. As the American population continues to evolve, so too will the opportunities in the real estate market. Savvy investors who can anticipate and respond to these shifts stand to benefit significantly in the years to come.

Sortis REIT: The Sortis Advantage

One compelling option for Private REIT investors is the Sortis REIT (S-REIT). Sortis REIT stands out for several key reasons. It’s tailored for Accredited Investors, requiring a minimum investment of $25,000. Investors enjoy quarterly distributions, providing a steady income stream. Redemption is possible after 6 months, with caps of 2% quarterly and 5% annually, subject to fund availability and advisor discretion. The REIT’s impressive maximum offering is set at $1 billion, showcasing its scale and potential. Management charges are transparent at 1.25% of Net Asset Value (NAV), with a profit-sharing mechanism ensuring further transparency.

Sortis REIT focuses on acquiring stabilized or readily stabilized real estate assets, prioritizing off-market transactions. Deal sizes range from $2 million to $20 million to stay competitive. Supported by Sortis Holdings, Inc., they enhance acquisitions through curated retail experiences. Asset classes include multifamily, hotel, retail, office, light industrial, and life science properties.

The REIT’s approach, led by individuals with proven investment management expertise, identifies opportunities for strong risk-adjusted returns. Focused on the Western States, they capitalize on localized expertise. As a boutique-sized fund, Sortis REIT maintains flexibility in the market, avoiding forced investments. Their diverse relationships facilitate unique access to deals, and staff members’ personal investments align their interests with investors. Learn more about Sortis REIT here.

References:

[1] U.S. Census Bureau. (2018). Older People Projected to Outnumber Children for First Time in U.S. History.

https://www.census.gov/newsroom/press-releases/2018/cb18-41-population-projections.html

[2] U.S. Census Bureau. (2020). 65 and Older Population Grows Rapidly as Baby Boomers Age.

https://www.census.gov/newsroom/press-releases/2020/65-older-population-grows.html

[3] Pew Research Center. (2020). Millennials overtake Baby Boomers as America’s largest generation.

[4] Brookings. (2020). Now more than ever, businesses must prioritize Gen Z. https://www.brookings.edu/articles/now-more-than-ever-businesses-must-prioritize-gen-z/

[5] U.S. Census Bureau. (2021). America’s Families and Living Arrangements: 2021.

https://www.census.gov/data/tables/2021/demo/families/cps-2021.html

[6] Pew Research Center. (2018). A record 64 million Americans live in multigenerational households.

[7] U.S. Census Bureau. (2022). New Census Data Show Faster Population Growth in South and West.

https://www.census.gov/library/stories/2022/03/population-shifts-in-south-and-west-2020-census.html

[8] National Investment Center for Seniors Housing & Care. (2024). NIC MAP Vision Executive Summary – 4Q2023.

[9] Welltower Inc. (2024). Welltower Reports Fourth Quarter 2023 Results.

http://welltower.com/investors

[10] National Multifamily Housing Council. (2023). U.S. Needs to Build 4.3 Million New Apartments by 2035 to Meet Demand.

[11] AvalonBay Communities, Inc. (2024). AvalonBay Communities, Inc. Announces Fourth Quarter 2023 Operating Results.

https://www.avaloncommunities.com/investors

[12] Invitation Homes Inc. (2024). Invitation Homes Reports Fourth Quarter 2023 and Full Year 2023 Results.

https://www.invitationhomes.com/investors

[13] CBRE. (2024). U.S. Industrial & Logistics Figures Q4 2023.

https://www.cbre.com/insights/

[14] Prologis, Inc. (2024). Prologis Reports Fourth Quarter 2023 Earnings Results.

https://www.prologis.com/investors

[15] Gartner. (2023). Gartner Forecasts Worldwide Data Center Infrastructure Spending to Grow 8.3% in 2024.

https://www.gartner.com/en/newsroom/press-releases/

[16] Digital Realty Trust, Inc. (2024). Digital Realty Reports Fourth Quarter 2023 Results.

https://investor.digitalrealty.com/

[17] CBRE. (2024). U.S. Retail Figures Q4 2023.

https://www.cbre.com/insights/

[18] Simon Property Group, Inc. (2024). Simon Property Group Reports Fourth Quarter and Full Year 2023 Results.