– Vatsal Rai

August 2, 2024

Introduction

The real estate market in 2024 stands at a crossroads, shaped by the lingering effects of a global pandemic, shifting work patterns, and evolving lifestyle preferences. As we navigate this new terrain, the industry faces both unprecedented challenges and exciting opportunities. Stakeholders are reevaluating long-held assumptions and embracing innovative strategies to adapt. This comprehensive analysis explores the forces driving change and the trends that will define the real estate market in the coming years. From the booming residential sector to the transforming commercial space, we examine how the real estate market is adapting to meet the needs of a rapidly changing society.

Our journey begins with a broad outlook on the sector, highlighting the remarkable resilience of the housing market despite economic uncertainties. We’ll explore the factors fueling this growth and discuss the implications for both homeowners and aspiring buyers. The spotlight then turns to the emerging hotspots in the real estate market, with a particular focus on the rise of the Sun Belt region. We’ll investigate why these areas are attracting not just retirees but also young professionals, and what this demographic shift means for the future of urban development. One of the most pressing issues facing the industry – the high vacancy rates in office spaces – takes center stage as we explore innovative solutions like adaptive reuse. This section offers insights into how cities are reimagining urban spaces to create vibrant, mixed-use communities.

Finally, we’ll cast our gaze toward the future, offering predictions for the coming quarter and beyond. From potential shifts in mortgage rates to evolving home prices, we’ll provide a roadmap for what lies ahead in this dynamic market. Join us as we unravel the complexities of the 2024 real estate landscape, offering valuable insights for investors, homeowners, and industry professionals alike.

Sector Outlook

The real estate market has distinguished itself as a leading performer among alternative investment options. Housing values reached record highs in the past year due to increased demand and limited supply. By December 2023, the median price of homes sold had risen to $382,600, marking a 4.4% increase compared to the previous year. This upward trajectory in prices has continued for six consecutive months, culminating in a new median home price peak of $389,800 in 2023[1].

Projections indicate that the U.S. real estate market is set to achieve an impressive valuation of approximately $119.80 trillion by 2024[3]. Within this, the residential real estate sector is expected to reach a valuation of $94.39 trillion by 2024[2], suggesting a consistent annual growth rate of 4.99% (CAGR 2024-2028). By 2028, the market volume is anticipated to grow to $114.70 trillion[2].

Globally, China is forecasted to lead the real estate sector, with an estimated value of $135.70 trillion in 2024[3]. The surge in demand within the U.S. residential real estate market can be attributed to factors such as low interest rates and a strong economy, which have collectively driven this remarkable growth.

Home Prices

Due to rising demand and a shrinking supply, single-family home prices have surged by 43% over the past four years[9]. This trend has significant implications for the real estate market. Current homeowners benefit from increased home equity as market values climb, with the average U.S. homeowner experiencing a 9.6% rise in equity last year, amounting to a collective gain of $1.5 trillion[10]. However, these high prices largely exclude first-time buyers from the real estate market.

Fig. 1 – Average prices of single-family dwellings in the US have gone up by 7.6% just since January 2024[9]

Recently, the housing market has shown signs of cooling. Median home prices fell in the first quarter of 2024. As low-rate mortgage holders’ terms end, more properties may become available, potentially continuing this cooling trend. Nevertheless, experts predict that prices will keep rising in the medium term. The National Association of Realtors forecasts a 15 to 25 percent increase in average sale prices over the next five years[9].

Top Real Estate Markets

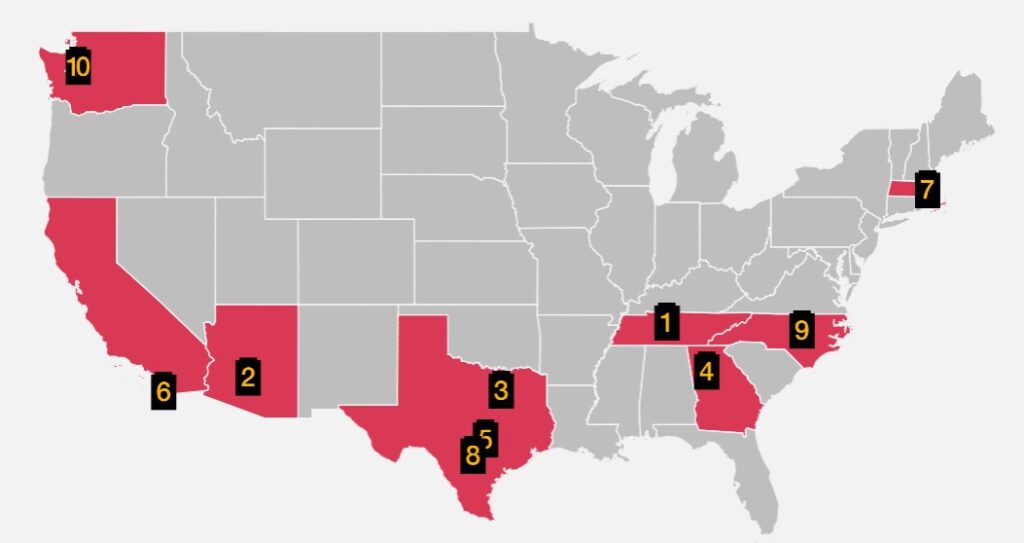

In the immediate aftermath of the pandemic, the real estate market experienced significant changes, but surprisingly, preferences have remained relatively stable over the past two years. According to a report by PwC, the most promising opportunities are found in the “smile” markets, which are located in an arc across the southern third of the United States. These regions have seen an increase in Sun Belt markets among the Top 10, reflecting a shift in real estate market dynamics. In contrast, the number of Top 10 markets in colder climates of the Northeast and Midwest has remained limited to just one city, Boston. Notably, three markets that were in the Top 10 in 2023—Tampa/St. Petersburg, Miami, and Charlotte—have dropped out of the top tier this year, although they still remain within the Top 20[4]. This trend underscores the growing preference for warmer climates and the enduring appeal of Sun Belt regions.

Fig. 2 – 2024 US Markets to Watch: Overall Real Estate Prospect Rank[4]

A notable trend in the real estate market is the migration from big cities to the Sun Belt. The pandemic has highlighted the Sun Belt’s growing appeal, which is expected to continue. The Sun Belt, spanning from California to North Carolina and including 18 southern states, has seen about 80% of the nation’s population growth[9]. One estimate indicates that the Sun Belt now houses approximately 50% of the national population (335 million), with projections to increase to 55% by 2040[9]. The region attracts not only retirees but also younger professionals due to lower taxes and more affordable housing and rent. Even the largest Sun Belt cities offer more space compared to major U.S. metros like New York.

Fig. 3 – The Sun Belt is looking to see increased growth over the next 10 years[9]

The influx of people and rising population have strengthened real estate markets in the Sun Belt. Growth extends beyond single-family homes to multifamily housing and commercial real estate. Dallas and Tampa, major Sun Belt metro areas, rank among the top ten U.S. cities for real estate investment potential. Other rapidly growing cities, such as Austin, are also in the Sun Belt. Conversely, major metropolitan areas like New York, Philadelphia, and San Francisco are experiencing fluctuating real estate demand. In San Francisco, about one in five homeowners are now selling their properties at a loss.

Addressing the Office Vacancy Problem

Last year, the real estate market’s strategy was straightforward: navigate current risks and prepare for a phase of sustained growth and improved returns. However, this year’s Emerging Trends in Real Estate report reveals a sobering reality for industry leaders. They no longer anticipate a swift return to pre-pandemic conditions. Instead, they’ve come to terms with the fact that many people may not return to the office, or at least not as frequently. This shift has significant implications for the commercial real estate market, particularly for office spaces.

Additionally, there is a reluctant acceptance within the industry that interest rates will remain high for at least the next year, if not longer. This acknowledgment of prolonged high-interest rates further complicates the landscape, forcing industry leaders to adapt their strategies and expectations for the foreseeable future. The combination of reduced office occupancy and sustained high interest rates presents a challenging environment, requiring innovative approaches and flexibility to navigate the evolving market dynamics.

Fig. 4 – Direct Office Vacancy Rates[4]

A promising solution to the problem of vacant office spaces is the concept of ‘adaptive reuse,’ which involves converting these spaces into residential units. Cities like New York, Chicago, and Cleveland are actively adopting this strategy, providing incentives to encourage such transformations. Research conducted by RentCafe highlights the success of this approach. In 2021, there was a record 43 percent increase in office-to-residential conversions across the United States, leading to the creation of 11,090 new apartments[6]. This trend reflects a growing recognition of the potential to revitalize underutilized office buildings, address housing shortages, and breathe new life into urban centers. By repurposing vacant offices, cities can optimize existing infrastructure, stimulate economic growth, and create vibrant, mixed-use communities that meet the evolving needs of their residents. Check out our latest article here to know more about adaptive reuse in the real estate market[5].

Q3 2024 Predictions

Home listings usually increase during the peak summer buying season, as it’s the most convenient time for families to find new homes before school starts. However, Q3 2024 might break this trend. Since the COVID-19 pandemic, traditional seasonal patterns have shifted. Historically, home sales would rise in the second and third quarters and decline in winter, but recent years have seen peaks in January or February, followed by monthly declines. This trend seems to be continuing in 2024, with sales peaking in February.

Mortgage rates might see a slight decline, especially if inflation cools and the Federal Reserve decides on rate cuts. Despite initial hopes that the average 30-year fixed mortgage rate could drop below 6 percent by the end of 2024, recent trends suggest this may not happen until the latter half of 2025[7]. Rates for 30-year fixed mortgages are expected to stay between 7.0 and 7.5 percent through Q3, with 15-year fixed-rate mortgages averaging between 6.25 and 6.75 percent[7].

Home prices tend to rise during peak season, and with inventory still low, significant price drops are unlikely this quarter. Prices are projected to increase by 5.9 percent year-over-year and 1.5 percent from the previous quarter, based on CoreLogic data[7]. Homes are expected to sell quickly, but with low inventories, sales are predicted to rise by only 5 percent compared to the same quarter last year.

Interestingly, Altos Research notes that about 35% of listed properties have seen price reductions, a higher percentage than usual for this time of year[8]. While this doesn’t necessarily signal a nationwide price drop, it might indicate that prices in the real estate market are starting to stabilize.

Conclusion

As we look to the future of the real estate market in 2024 and beyond, it’s clear that the industry is in a state of profound transformation. The trends and challenges discussed in this analysis paint a picture of a sector that is both resilient and adaptable, continuously evolving to meet the changing needs of society.

The residential real estate market, while facing affordability challenges, continues to demonstrate strength and potential for growth. The shifting preferences towards Sun Belt regions reflect a broader change in how people view work, lifestyle, and community. This migration is not just reshaping individual cities but entire regions, promising to redefine the American urban landscape in the coming decades.

Meanwhile, the commercial real estate market, particularly office spaces, is at a critical juncture. The adaptive reuse strategies being employed in cities across the nation represent more than just a solution to vacancy rates; they symbolize a reimagining of urban spaces and a move towards more flexible, mixed-use environments.

As we navigate through these changes, it’s evident that the real estate market will play a crucial role in shaping our post-pandemic world. The ability to adapt to new work patterns, changing demographic preferences, and evolving urban needs will be key to success in this new era. While challenges remain, particularly in terms of affordability and market stability, the industry’s demonstrated resilience and innovative spirit provide reasons for optimism. As we move forward, the real estate market will undoubtedly continue to be a dynamic and vital component of our economy and society, offering opportunities for growth, investment, and community development in equal measure.

References

[1] “Real Estate Notes: Are These the Holy Grail of Passive Income in Today’s Real Estate Market?” 2024. Yahoo Finance. April 5, 2024. https://finance.yahoo.com/news/real-estate-notes-holy-grail-193011496.html.

[2] “Residential Real Estate – US | Statista Market Forecast.” n.d. Statista. https://www.statista.com/outlook/fmo/real-estate/residential-real-estate/united-states.

[3] “Real Estate – United States | Statista Market Forecast.” n.d. Statista. https://www.statista.com/outlook/fmo/real-estate/united-states.

[4] PwC. 2024. “Emerging Trends in Real Estate 2022.” PwC. 2024. https://www.pwc.com/us/en/industries/financial-services/asset-wealth-management/real-estate/emerging-trends-in-real-estate.html.

[5] sortis-kristina. 2024. “Adaptive Reuse: Converting Empty Offices into Residential Spaces.” Sortis Capital. July 25, 2024. https://sortis.com/blog/adaptive-reuse-converting-empty-offices-into-residential-spaces/.

[6] Sisson, Patrick. 2022. “Getting Creative with Vacant Office Space: Storage, Gym, Film Set.” The New York Times, December 27, 2022, sec. Business. https://www.nytimes.com/2022/12/27/business/office-space-glut-reuse.html.

[7] Martin, Erik J. n.d. “Housing Market Trends Q2 2024: What to Expect.” Bankrate. https://www.bankrate.com/real-estate/housing-trends/#mortgage-rate.

[8] Simonsen, Mike. n.d. “As More Homes Take a Price Cut, Will List Prices Drop?” Blog.altosresearch.com. Accessed July 31, 2024. https://blog.altosresearch.com/as-more-homes-take-a-price-cut-will-list-prices-drop.

[9] Howarth, Josh. 2021. “7 Key Real Estate Trends for 2022-2024.” Exploding Topics. February 2, 2021. https://explodingtopics.com/blog/real-estate-trends.

[10] Team, Economy. 2024. “Homeowner Equity Insights – Q1 2024.” CoreLogic®. June 7, 2024. https://www.corelogic.com/intelligence/homeowner-equity-insights-q1-2024/.