Global stock markets continue to face turmoil, as the COVID19 outbreak continues to spread. The virus has likely dealt a significant blow to the global economy, as factories & manufacturing, retail, restaurants, and other amenities close. The long-term impact remains to be seen, but experts are increasingly warning the public to remain vigilant and exercise good healthy habits.

However, it is not all bad news in the markets. Some industries have even seen stronger business conditions, as a result of the recent market turmoil. A surge in online purchasing has triggered growth in e-commerce. According to the Wall Street Journal, “Amazon to hire 100,000 warehouse and delivery works amid Coronavirus shutdowns and will raise pay by $2 an hour for warehouse and delivery employees through April.”

With even the 30-year Treasury now yielding below 1%, retirees are forced to turn to other assets to find necessary income sources. This had led to a great increase in demand for alternate assets, which can help produce income without exposure to the stock market volatility.

One such company that is sitting perfectly to benefit from this phenomenon is Sortis Holdings, Inc. (OTC Pink: SOHI).

Sortis: An Overview

Sortis Holdings is a Portland, Oregon-based alternate investment firm with a primary focus on real estate including managed funds with positions in both debt and equity. Tracing its roots as a bank holding company, Sortis has since transformed into a diversified alternate investment firm that offers fund management, lending, development, advisory & real estate brokerage services. The Sortis team has a strong line-up of former bankers as well as seasoned real estate professionals giving them a great bench to draw from.

Source: Sortis Holdings

Source: Sortis Holdings

As an example, real estate experience, Sortis developer affiliate Third and Pine LLC are in the final phase as the developer of 300Pine (www.300pine.com) in Seattle, which was the conversion of the downtown Seattle Macy’s to 700,000 SF of space for Amazon. Third and Pine LLC is managed by Sortis Executive Chairman Paul Brenneke, who is also the Sortis Opportunity Zone Fund Manager.

This shows that Sortis is well-diversified and has the competency to participate in all levels of the real estate capital stack from debt to equity. Not only is this valuable for investor clients, but it shows the company can generate cash flow by offering diverse and comprehensive services.

Sortis Family of Funds

Currently, Sortis manages three active funds: Sortis Income Fund, Sortis Opportunity Zone Fund, and the Sortis Growth Fund. The company is also planning to launch a new real estate fund in Q2 of 2020 for the acquisition of real estate and distressed debt that will focus on opportunities created by the current market dislocation.

Sortis Income Fund

The Sortis Income Fund (SIF) is the company’s flagship fund, which has a three-year track record averaging annual returns of 11% net to its investors. The income fund is a $100 million real estate loan fund, which is focused on generating high-yield and fixed income returns to its investors that are distributed every quarter. The fund is un-leveraged and holds real estate collateralized first lien positions. It is the ultimate defensive position in a volatile market as the underwriting is collateral focused on 65% average LTV in the portfolio.

Source: Sortis Holdings

Source: Sortis Holdings

SIF’s investment strategy is to acquire senior loans that are collateralized by real estate, many of them originated by SORFI the captive lender at Sortis. Sortis looks to take advantage of inefficiency in the marketplace with its speed to closing and the ability to understand complex deals. SIF only works with short-term maturities (6-24 months) and experienced real estate operators (not borrowers!). SIF focuses on opportunities in the Western United States, with a focus on the Pacific Northwest.

The Sortis Income fund is available on Charles Schwab, TD Ameritrade, Fidelity, and most self-directed IRA platforms.

Sortis Opportunity Zone Fund

Sortis’s Opportunity Zone Fund is a $100 million fund that focuses on real estate development and investing in opportunity zones, primarily in the Western United States. Opportunity zones are a relatively new investment, which was created through the Tax Cuts and Jobs Act in December 2017.

Opportunity zone investing has very strong incentives and tax savings, which makes them ideal investments for long-term-minded investors. “An investor who has realized a capital gain by selling an asset like stocks or real estate can receive special tax benefits if they reinvest that gain into an Opportunity Fund within 180 days. There are three primary advantages to rolling over a capital gain into an Opportunity Zone Fund:”

- Ability to defer capital gains payments until December 31, 2026

- Reduced benefit drops to 10% after five years

- After ten years, investors are eligible to pay zero taxes on capital gains that were earned from opportunity zone investments

The opportunity zone fund is structured as a diversified multi-asset fund, which provides quality opportunities across different assets and locations. “Sortis is both a developer through its’ affiliated developer and an allocator of capital to third-party developers,” according to the company. This gives fund investors a chance to effectively play both roles on the best available projects.

Sortis Growth Fund

The Sortis Growth Fund (SGF) is a unique take on consumer-oriented private equity. The goal of the $10 million fund is to help existing consumer brands accelerate their growth.

According to the company, “The Sortis Growth Fund I is on a mission to accelerate emerging consumer brands in the next phase of growth by providing an infusion of capital and a digital strategy to generate demand and revenue.”

“During the salad days, every scalable business has a moment most ripe for acceleration. You hate to miss it, and you can’t always predict it, but you can harness it,” says Adam Shearer, founder of the Pacific Northwest’s premier Shopify Plus D2C studio, WLCR.io. “The ecosystem we’re creating with Sortis allows us to intervene at the most opportune time by creating a confluence of the merchant, the money and the moment.”

Source: Sortis Holdings

Source: Sortis Holdings

Through its partnership with the world-renowned web design company, WLCR, Sortis can help consumer brands and startups with building a mobile-centric website that is not only user-friendly but also helps drive demand using a direct-to-consumer (D2C) model.

“This is an unprecedented time in the market where a robust e-commerce strategy has gone from a want to a necessity to survive,” said Butch Bannon SGF Manager and Principal. “We are seeing an unprecedented amount of deals because our captive digital team combined with capital makes us totally unique in the consumer private equity space.”

SOHI: Recent News

January 2020:

29th – Sortis Holdings formally announces the launch of its $10 million growth fund. The fund will be open to accredited investors and maintains a target return on invested capital of 20%.

“Sortis has developed a unique platform that aggregates highly experienced operators, advisors, and investors with a world-class e-commerce agency, providing promising consumer brands with critical support and structure as they focus on achieving the next level,” said Butch Bannon, fund manager, and principal. “With access to our network, resources, means, and expertise, Sortis Growth Fund portfolio companies can tap into their growth potential more efficiently and effectively.”

23rd – Sortis announced that its Sortis Income Fund has closed out 2019 with its 12th consecutive quarter of strong returns. For the fourth quarter of 2019, the SIF reported a net annualized return of 10.2%. For full-year 2019, net annualized returns came in at 10.7%. In 2017, the SIF returned 12.2% and 11.1% in 2018.

“While our focus will always be on principal protection for our investors, we’re pleased to deliver the 12th consecutive quarter of annualized yields above 10%,” said Jef Baker, Sortis Income Fund managing director. “Investor interest in the fund, which more than tripled in size in 2019, continues to grow. The fact that the fund is un-leveraged, combined with the high quality of the loans in the portfolio, is very appealing to investors.”

August 2019:

29th – The company announced that it has closed on a $59.8 million opportunity zone project for Tukwila Village Phase II, a planned mixed-income 55+ multifamily development located in Tukwila, Washington. Sortis’s $100 million Opportunity Zone Fund worked with project sponsor Bryan Park, a senior living developer that has developed, owned and operated over 5,000 senior living apartments in Washington. Once completed, the project will be operated and run by Sustainable Housing for Ageless Generations (SHAG), a non-profit organization.

Tukwila Project Rendering Source: Sortis Holdings

Tukwila Project Rendering Source: Sortis Holdings

“By 2050, the population of individuals who are 65 and older in the U.S. is projected to double, yet rising rents and lack of supply have reduced the availability of affordable, high-quality housing in desirable locations for this population,” said Paul Brenneke, Sortis founder. “We believe delivering a high-quality project with attractive investment returns while simultaneously providing an affordable housing option to low-income seniors is a win-win.”

26th – Sortis announced that its Income Fund is now available on the Charles Schwab Advisor Center platform. This makes the fund available to registered investment advisors (RIAs) and broker-dealers through the Schwab platform.

“Schwab’s Advisor Center now enables investment professionals to access the Sortis Income Fund, which just posted its 10th consecutive quarter of exceeding target returns,” said Baker. “At Sortis, we continue to generate significant-high-quality loan deal flow. Matching that deal flow with an expanding investor base through the Schwab platform is a perfect fit.”

January 2019:

2nd – The Revitalization of 300 Pine, a redevelopment of the flagship downtown Seattle Macy’s for Starwood Capital Group led by Sortis Holdings’ affiliate Third & Pine LLC, has been named the National Association of Industrial and Office Properties’ (NAIOP) Top Redevelopment/ Revitalization Project of The Year for 2018.

300 Pine is a full block located between Third and Fourth Avenue and Pine and Olive streets in downtown Seattle that began life as a Bon Marche department store in 1928. In 2004, it was converted to Macy’s flagship Seattle store. The project to rehabilitate the eight-story 800,000 square foot building is in its final phase of construction and was leased to Amazon, who currently occupies 500,000 square feet of office space.

300 Pine Source: Sortis Holdings

300 Pine Source: Sortis Holdings

“The eight-story building of approximately 800,000 square feet was fully rehabilitated including a seismic retrofit, a new six-elevator core, new mechanical and electrical systems, the addition of two 4,000 square foot clerestories, and a spectacular 20,000 square foot rooftop deck amenity. A new ground floor office lobby that includes a Victrola Café was built at the Third Avenue and Pine Street corner to access the office space on floors three through eight. Through creative solutions such as these, the result is the formation of a next-generation workplace while preserving and enhancing an iconic building at a prime location in Seattle’s downtown core.”

SOHI: Share Structure and Financials

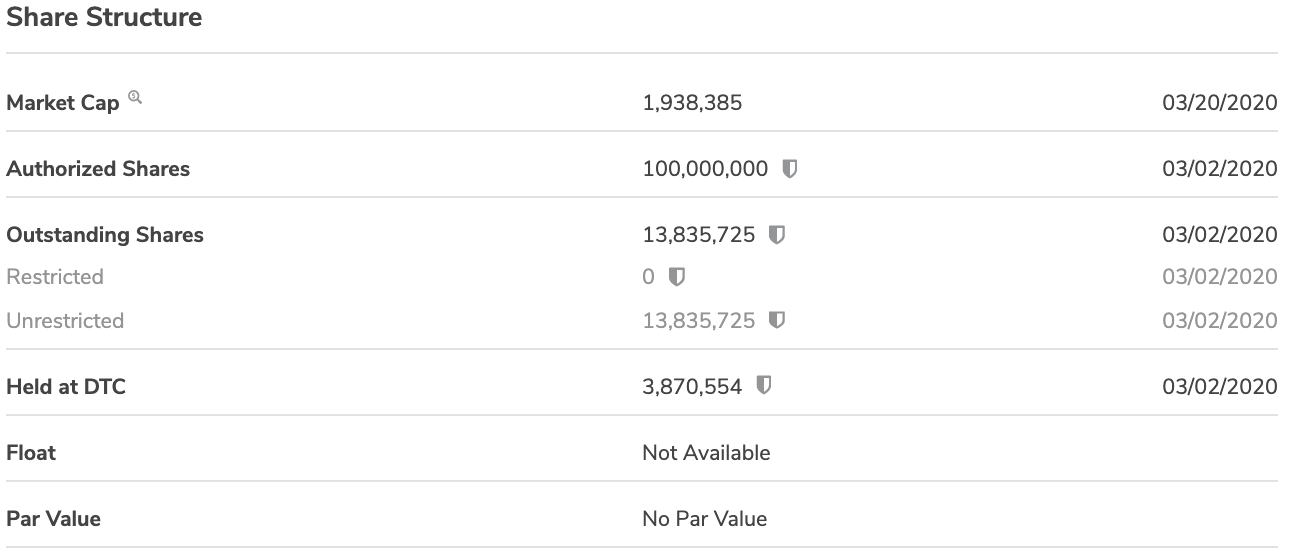

As of March 2020, Sortis Holdings maintains a market cap of $1.94 million. Turning to its share structure, Sortis has 100 million authorized shares, and 10.62 million shares outstanding.

With a tight share structure, Sortis Holdings is compelling for investors and traders that search for “low float” opportunities.

During the third quarter of 2019, Sortis Holdings reported total revenue of nearly $1.5 million and a profit of $557,000.

SOHI Share Structure; Source: OTC Markets

SOHI Share Structure; Source: OTC Markets

Interestingly enough, Sortis generated almost as much revenue during Q3 2019 as its entire current market cap. This highlights the undervalued nature of the company and the potential opportunity that is presenting itself to investors.

Overall, Sortis Holdings has an impressive business, but its stock has yet to be discovered by investors. With real estate increasingly coming into focus with the recent stock market and bond yield declines, Sortis sits in a perfect position to offer a viable alternative for income investors. Sortis’s flagship fund is available on Fidelity, Charles Schwab and more, which provides strong support and validation for the company. In the end, Sortis Holdings has an exciting story that is just beginning to unfold.

Disclaimer:

Spotlight Growth is compensated, either directly or via a third party, to provide investor relations services for its clients. Spotlight Growth creates exposure for companies through a customized marketing strategy, including design of promotional material, the drafting and editing of press releases and media placement.

All information on featured companies is provided by the companies profiled, or is available from public sources. Spotlight Growth and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever and we are not qualified to give financial advice. The information contained herein is based on external sources that Spotlight Growth believes to be reliable, but its accuracy is not guaranteed. Spotlight Growth may create reports and content that has been compensated by a company or third-parties, or for purposes of self-marketing. Spotlight Growth was compensated ten thousand dollars for the creation and dissemination of this content.

This material does not represent an investment solicitation. Certain statements contained herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may include, without limitation, statements with respect to the Company’s plans and objectives, projections, expectations and intentions. These forward-looking statements are based on current expectations, estimates and projections about the Company’s industry, management’s beliefs and certain assumptions made by management.

The above communication, the attachments and external Internet links provided are intended for informational purposes only and are not to be interpreted by the recipient as a solicitation to participate in securities offerings. Investments referenced may not be suitable for all investors and may not be permissible in certain jurisdictions.